SMC Swing Trading Strategy - 40-60% WIN RATE

Summary

TLDRIn this informative video, the presenter breaks down a swing trading strategy using the GBP/USD pair on the daily time frame, emphasizing the benefits of patience and discipline over day trading. The analysis highlights key price movements, retracements, and the effective use of the Fibonacci tool to identify entry points. By showcasing the potential profitability of swing trading, the presenter argues that it can be less stressful and time-consuming, allowing traders to enjoy a better lifestyle. Viewers are encouraged to consider this approach as a viable alternative to high-frequency trading methods, ultimately promoting a more balanced trading experience.

Takeaways

- 😀 Swing trading can be more profitable and less stressful than day trading, especially for those who prefer a more passive approach.

- 📈 Analyzing price action on higher time frames, like the daily chart for GBP/USD, allows traders to identify bullish trends and potential entry points effectively.

- 🔄 The Fibonacci retracement tool is a valuable resource for determining optimal entry points during retracements in trending markets.

- 💡 Traders should focus on setting limit orders and monitoring multiple currency pairs to maximize trading opportunities without the need for constant screen time.

- 📊 A risk-reward ratio of 2.45 is achievable with swing trading, leading to significant profits even with a relatively small percentage of capital at risk.

- 🧘♂️ Swing trading reduces the mental strain associated with frequent trading decisions and allows for better psychological management of trades.

- 🌍 The convenience of swing trading allows for lifestyle flexibility, enabling traders to manage their positions remotely without being tied to a desk.

- 🚀 Successful trading requires patience and discipline; avoiding micromanagement is crucial to prevent analysis paralysis.

- 🤝 Prop trading firms provide access to larger capital without the need for personal investment, enhancing trading potential for swing traders.

- 🔄 As traders gain experience and capital, they often transition from day trading to swing trading for better overall returns and reduced screen time.

Q & A

What is the main trading strategy discussed in the video?

-The video focuses on swing trading as a passive trading strategy, emphasizing its potential for profitability compared to day trading.

Why does the presenter prefer swing trading over day trading?

-The presenter prefers swing trading because it requires less mental effort, takes less time, and generally has a higher win rate than day trading.

What specific currency pair is analyzed in this video?

-The video analyzes the GBP/USD currency pair on the daily time frame.

How does the presenter use the Fibonacci tool in trading?

-The presenter uses the Fibonacci tool to identify retracement levels and set entry points for trades, particularly favoring the 71% retracement level.

What does the presenter mean by 'imbalance' in the context of trading?

-Imbalance refers to areas on the chart that tend to pull price towards them. The presenter looks for these areas near his Fibonacci retracement levels to increase the likelihood of successful trades.

What is the expected drawdown mentioned during the trade analysis?

-The presenter notes that there was a drawdown of over 50% on the position, which was expected due to the imbalance being below the entry point.

What are the potential gains from swing trading, according to the presenter?

-The presenter calculates that with a risk of 1% on a $100,000 account, a 2.45 risk-reward ratio could yield a return of about $25,000, highlighting the substantial profits possible with swing trading.

How does the presenter suggest managing emotions in swing trading?

-He emphasizes the importance of patience and discipline, advising against micromanagement of trades to avoid analysis paralysis and emotional stress.

What lifestyle benefits does the presenter associate with swing trading?

-Swing trading allows the presenter to have more free time, travel, and spend time with family, as it requires less constant screen time compared to day trading.

What is the significance of liquidity in swing trading compared to day trading?

-In swing trading, liquidity is less of a focus except when anticipating reversals, while day trading requires constant attention to liquidity fluctuations throughout the trading session.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Trading Strategy had 100% Win Rate in 2024 - What’s the Secret?

EASIEST ICT FX Strategy for Prop Firms (GET FUNDED WITH THIS)

COMO TRAÇAR o seu CANAL DE ABERTURA no GAP? | FOREX | FIMATHE

ICT Supplemental Session 01 - Mastering High Probability Scalping

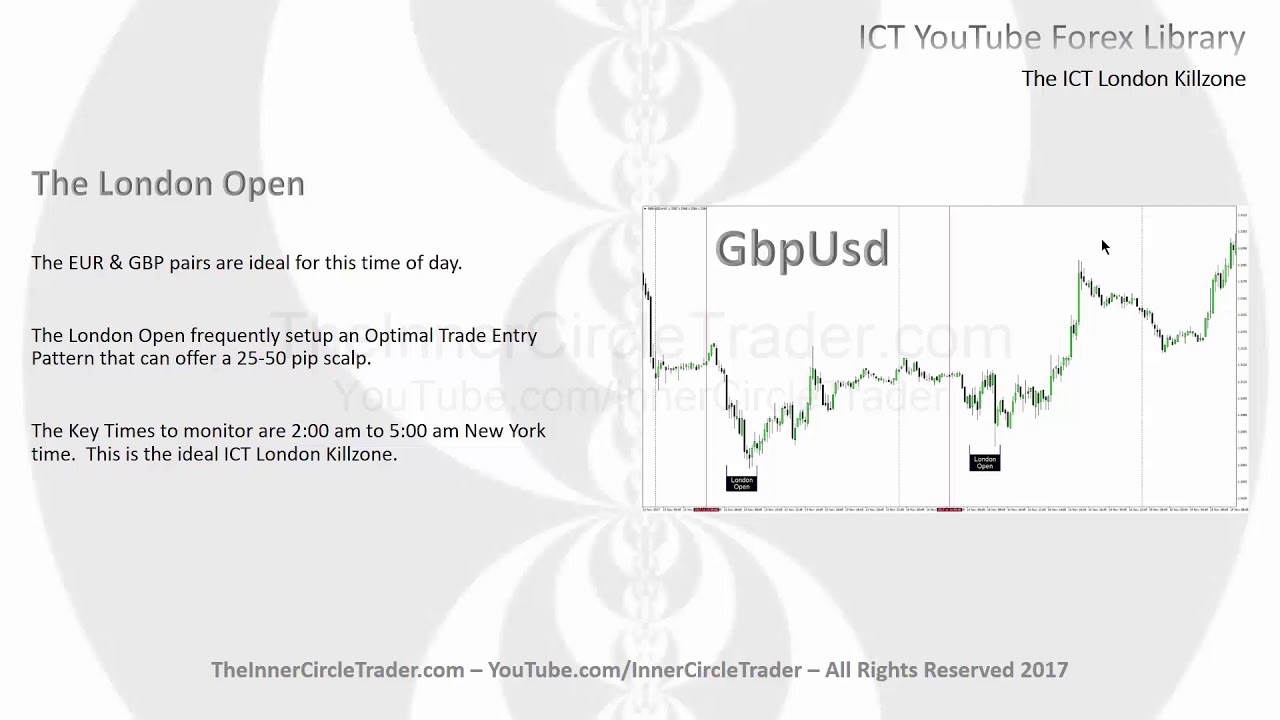

ICT Forex - The ICT London Killzone

Counter Trend-line Break Trading Strategy for Beginners to Advance | Day in the Life

5.0 / 5 (0 votes)