ICT Supplemental Session 01 - Mastering High Probability Scalping

Summary

TLDRIn this instructional video, the speaker delves into high-probability scalping techniques for trading the British Pound (GBP/USD) and Euro (EUR/USD). Utilizing daily and hourly charts, they illustrate how to identify swing points and reversal patterns, emphasizing the importance of targeting buy stops above key resistance levels. By employing Fibonacci retracement levels and focusing on specific timeframes during the New York trading session, the speaker provides actionable strategies for anticipating market movements. The overall message reinforces the significance of understanding market liquidity and using technical analysis to optimize trading outcomes.

Takeaways

- 😀 Mastering high probability scalping involves not just hindsight but practical execution of strategies in real market conditions.

- 📈 Understanding swing points and reversal patterns on higher timeframes (like daily and hourly charts) is crucial for effective trading.

- 🔍 The concept of daily bias may not always favor specific trades; instead, focus on identifying support and resistance levels.

- 💡 Clean and precise levels of support and resistance attract retail traders, creating opportunities for institutional players to exploit buy stops.

- 🚀 Price often retraces to attack buy stops above old highs, indicating potential reversal or continuation points.

- 🎯 Setting target levels around 10-20 pips above significant price levels can enhance the probability of successful trades.

- ⏰ The New York ICT Kill Zone, occurring between 7:00 AM and 9:00 AM, is a critical time for anticipating market swings and scalping opportunities.

- 📊 Using Fibonacci retracement levels can help identify optimal entry points for trades, particularly after significant price movements.

- 🔄 Analyzing multiple timeframes (15-minute, 5-minute, 1-minute) can provide a detailed view for precise trade entries and exits.

- 🤔 The liquidity around old highs and lows remains a reliable trading strategy, emphasizing the importance of double tops and bottoms.

Q & A

What is the primary focus of the video regarding trading strategies?

-The video emphasizes high probability scalping strategies, specifically for trading currency pairs like the British Pound USD (cable) and the Eurodollar.

How does the speaker suggest identifying reversal patterns in trading?

-The speaker recommends using swing points on the daily chart to identify reversal patterns, and then refining the analysis using the hourly chart to confirm these levels.

What is meant by 'old support' and 'old resistance' in the context of this trading strategy?

-Old support refers to previous price levels where the market has bounced back up, while old resistance is where the market has previously faced downward pressure. These levels are critical for determining potential future price movements.

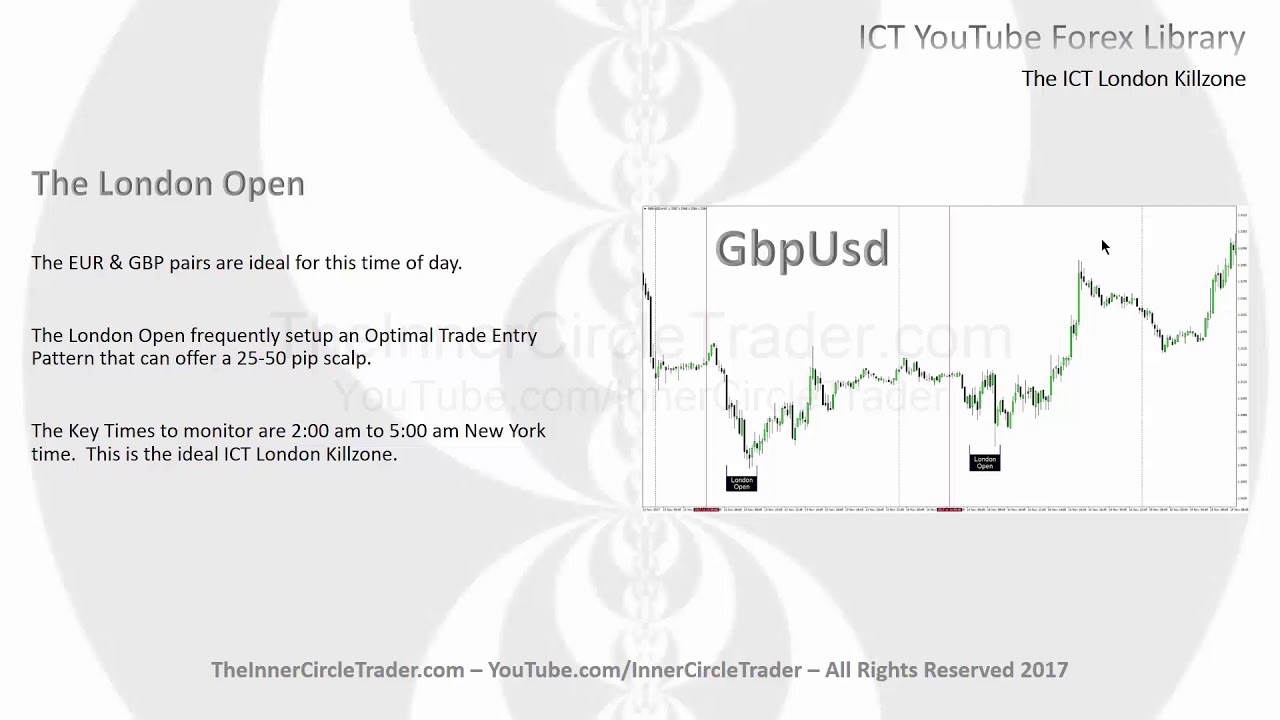

What is the significance of the New York ICT kill zone mentioned in the video?

-The New York ICT kill zone refers to a specific time window (7:00 AM to 9:00 AM New York time) during which traders should look for significant price movements, often driven by market structure from the London session.

How does the speaker utilize Fibonacci retracement levels in trading?

-Fibonacci retracement levels are used to identify potential reversal points in the market. The speaker discusses using these levels to determine optimal trade entries and exits.

What is the purpose of targeting buy stops in the trading strategy?

-Targeting buy stops involves placing orders just above previous highs to capitalize on market movements that trigger these orders, allowing traders to profit from price spikes.

How does the speaker suggest managing trade execution and exit strategies?

-The speaker emphasizes the importance of having a well-documented reason for each trade and an exit strategy before entering the market to avoid emotional decision-making.

What role do institutional levels play in the speaker's trading approach?

-Institutional levels serve as key price points that traders anticipate price will reach or react to. These levels are significant for planning entry and exit points.

Why does the speaker consider double tops and double bottoms important?

-Double tops and bottoms indicate areas of market liquidity where many orders are concentrated, making them crucial for identifying potential reversal points in price action.

What can traders learn about market behavior from this video?

-Traders can learn to identify key price levels, understand market manipulation, and apply technical analysis techniques such as Fibonacci retracements and price action patterns to improve their trading strategies.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade Now5.0 / 5 (0 votes)