Baumol-Tobin model explained: transaction money demand (Excel)

Summary

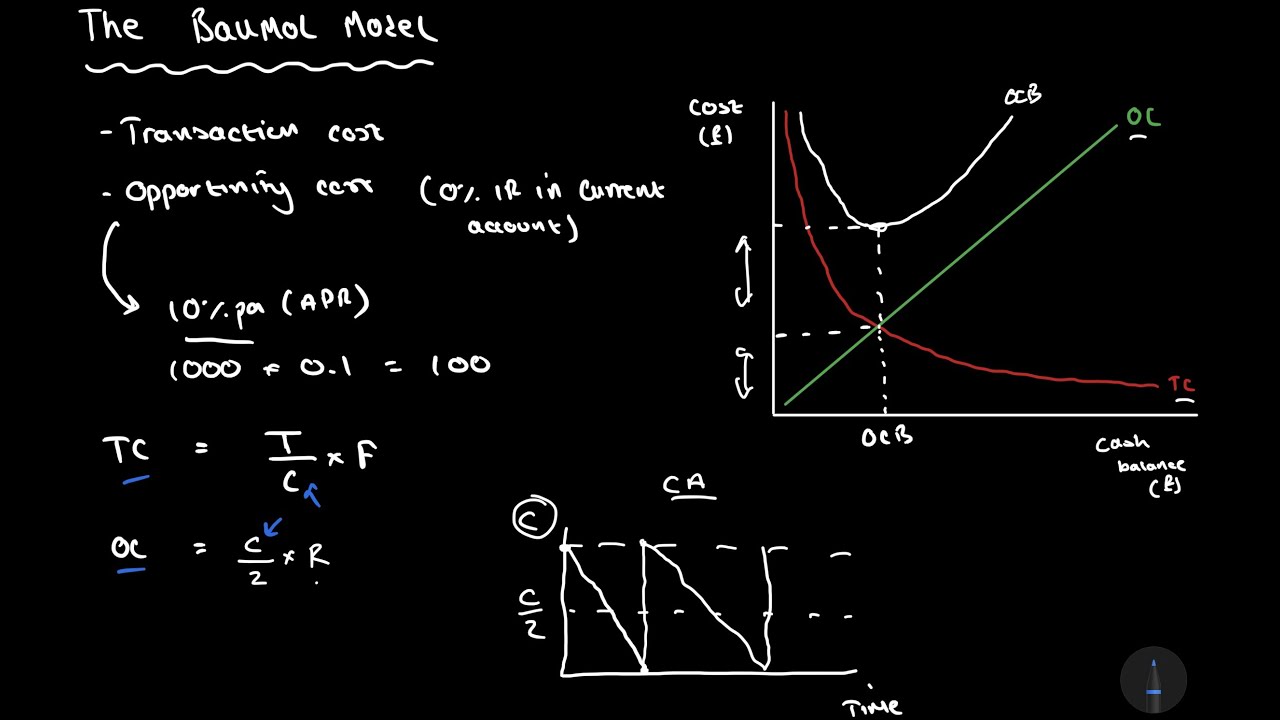

TLDRIn this video, Sava explains the Baumol-Tobin model, which addresses why individuals hold cash despite earning interest by keeping money in their bank accounts. The model demonstrates how to determine the optimal number of withdrawals to minimize costs, balancing the trade-off between withdrawal fees and foregone interest. Sava walks through the mathematical formulation of the model, highlighting how factors like income, interest rates, and transaction fees affect money demand. The video also includes examples and insights into optimizing cash management for both personal finances and modern retail trading apps.

Takeaways

- 📚 Nettle is a platform for distance learning in business, finance, and economics.

- 🔔 Viewers are encouraged to subscribe and turn on notifications to stay updated with new videos and tutorials.

- 🙌 The video appreciates current Patreon supporters and invites others to consider supporting via Patreon or YouTube memberships.

- 💡 The video explains the Baumol-Tobin model, a key concept in macroeconomics and financial economics.

- 💰 The Baumol-Tobin model investigates why individuals hold cash instead of earning interest by keeping it in a bank account.

- 📈 The model is based on the idea of finding the optimal number of withdrawals or trips to the bank to minimize costs.

- 💵 Holding cash results in a loss of interest income, while frequent bank trips incur withdrawal fees.

- ⚖️ The goal is to balance the trade-off between foregone interest (from holding cash) and fees paid for withdrawals.

- 🔧 The optimal number of withdrawals is calculated using a specific formula based on annual income, interest rate, and withdrawal fees.

- 📊 Changes in exogenous factors like income, interest rate, or transaction costs impact the number of withdrawals and demand for cash.

Q & A

What is the purpose of the video?

-The video aims to explain the Baumol-Tobin model, which sheds light on how transaction money demand is formed, particularly why individuals hold cash despite being able to earn interest by keeping money in a bank account.

Who are Baumol and Tobin, and what did they contribute?

-Baumol and Tobin independently developed the Baumol-Tobin model in 1952 and 1956, respectively. Their model explains how individuals decide the optimal number of times to withdraw cash from a bank or financial account to balance the trade-off between transaction fees and foregone interest.

What is the primary assumption made about the individual's income and spending in the Baumol-Tobin model?

-The model assumes that the individual earns a fixed income continuously throughout the year and spends it uniformly over time. The income is received in a savings account that offers an interest rate, and the individual must withdraw cash periodically to make purchases.

How does the model calculate the average cash holding of the individual?

-The average cash holding is calculated by dividing the annual income by two times the number of withdrawals. This formula represents the average amount of cash the individual holds over time as they spend it between withdrawals.

What costs does the individual face in the Baumol-Tobin model?

-The individual faces two types of costs: (1) transaction fees for each withdrawal they make, and (2) foregone interest, which is the interest they miss out on by holding cash instead of keeping it in their savings account.

How does increasing the number of withdrawals affect the individual’s total cost?

-Increasing the number of withdrawals reduces the amount of foregone interest because the individual holds less cash on average, but it increases the transaction fees. The total cost is minimized when the trade-off between these two factors is balanced.

What is the formula for the optimal number of withdrawals?

-The formula for the optimal number of withdrawals is the square root of (annual income × interest rate) divided by (2 × transaction cost). This formula helps determine the number of withdrawals that minimize the total cost.

How does a higher interest rate affect the number of optimal withdrawals?

-A higher interest rate incentivizes the individual to withdraw money more frequently, as they would want to minimize the amount of cash held and maximize the interest earned. This results in an increase in the optimal number of withdrawals.

What happens if the transaction cost increases?

-If the transaction cost increases, the individual is incentivized to withdraw money less frequently to avoid paying high fees, leading to a reduction in the number of optimal withdrawals.

What is the main takeaway from the Baumol-Tobin model regarding money demand?

-The Baumol-Tobin model shows that money demand (the amount of cash individuals hold for transactions) is influenced by factors such as income, interest rates, and transaction costs. Higher income or higher interest rates decrease money demand, while higher transaction costs increase money demand.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Deriving The Baumol Model of Cash Management | Corporate Finance

Così la Banca ti SPILLA i Soldi: dove mettere i RISPARMI oggi (e farli rendere)

How is money really made by banks? - Banking 101 (Part 3 of 6)

Homemade Banking: E-Money Services Emerge in Indonesia

Checking vs Savings Account

Do banks create money or just credit? - Banking 101 (Part 5 of 6)

5.0 / 5 (0 votes)