What is fintech? | CNBC Explains

Summary

TLDRThis video explores the rapidly growing fintech industry, which encompasses a wide range of technologies like cashless payments, crowdfunding, robo-advisors, and virtual currencies. It highlights how fintech is transforming financial services globally, especially in countries like Kenya with mobile banking systems like M-Pesa. Major companies and startups alike are driving this revolution, with billions invested since 2010. While fintech brings many benefits, it also poses risks, such as cybersecurity threats and regulatory challenges. The video emphasizes fintech's potential and ongoing impact on consumers, businesses, and traditional finance.

Takeaways

- 📱 Fintech refers to financial technology, encompassing a wide range of products, technologies, and business models.

- 💳 Everyday activities like paying with a phone, using Venmo, or donating via Kickstarter are all examples of fintech.

- 🌍 Fintech is a global, multi-billion dollar industry that is rapidly changing how we pay, borrow, and manage money.

- 💼 Major companies like Apple and Alibaba are heavily investing in fintech, with products like Apple Pay and Alipay leading the way.

- 📈 Since 2010, nearly $100 billion has been invested in the fintech sector, with a significant surge in 2017.

- 👥 One out of three people in 20 major economies use at least two fintech services, with China and India leading in adoption.

- 📱 Fintech is bridging the gap for nearly two billion people worldwide who lack access to traditional banking services.

- 🇰🇪 Kenya’s M-Pesa mobile banking system is a prime example of fintech improving lives, helping 96% of households access banking and lifting 2% out of poverty.

- 🤖 Robo-advisors, using algorithms, are disrupting wealth management by offering automated financial planning at lower costs.

- ⚠️ Fintech also presents risks, including challenges with regulation, data privacy, and the potential instability of peer-to-peer lending platforms.

Q & A

What is fintech?

-Fintech is short for financial technology, referring to a wide range of products, technologies, and business models that are transforming the financial services industry. This includes everything from cashless payments and crowdfunding platforms to robo-advisors and virtual currencies.

How does fintech impact the financial industry?

-Fintech is disrupting traditional banking and finance by introducing innovative ways to pay, borrow, and manage money, such as mobile payments, peer-to-peer lending, and automated financial advice. It forces traditional financial institutions to adopt digital technologies.

What are some examples of fintech in everyday life?

-Examples of fintech include using Apple Pay or Venmo for cashless payments, transferring money through apps, donating to crowdfunding campaigns like Kickstarter, or using robo-advisors for financial planning.

Why is fintech receiving so much investment?

-Fintech investment has surged because consumers are rapidly adopting digital financial services. Startups focusing on payments and lending have received the majority of the nearly $100 billion invested in fintech since 2010.

Which countries are leading the way in fintech adoption?

-China and India are at the forefront of fintech adoption, with more than half of consumers using fintech services for money transfers, financial planning, borrowing, and insurance.

How has fintech benefited people without access to traditional banking services?

-Fintech has filled a gap for the nearly two billion people worldwide without bank accounts. Services like Kenya’s M-Pesa allow users to transfer money, pay bills, and take out loans via mobile phones, significantly improving financial inclusion.

What is M-Pesa, and how has it impacted Kenya?

-M-Pesa is a mobile banking system in Kenya that allows users to transfer money, pay bills, and take out loans directly through their phones. It is used by 96% of Kenyan households and has helped lift roughly 2% of households out of extreme poverty.

What are robo-advisors, and why are they popular?

-Robo-advisors are automated financial planning services powered by algorithms. They provide affordable, 24/7 investment management, making them an attractive alternative to traditional wealth managers. This has led to billions of dollars being managed by robo-advisors.

What are some risks associated with fintech?

-Fintech comes with risks such as regulatory challenges and data privacy concerns. Peer-to-peer lending platforms, for instance, might not be required to have as much capital as traditional banks, increasing the risk of defaults. Additionally, the digital nature of fintech increases the vulnerability to cyber attacks.

How are regulators responding to the rapid growth of fintech?

-Regulators have struggled to keep up with the fast-paced innovations in fintech. As digital financial services grow, regulators face challenges in ensuring adequate oversight, particularly in areas like peer-to-peer lending and data privacy.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

What is Fintech | What is Islamic Fintech

Fintech and the future of finance | Prof. Arman Eshraghi | TEDxCardiffUniversity

"Fintech" Marak di Indonesia. Apa Sih Itu?

PutraMOOC | PRT2008M Topic 6 Innovation and Challenges in Agriculture (Part 1/6)

The future of money: three ways to go cashless

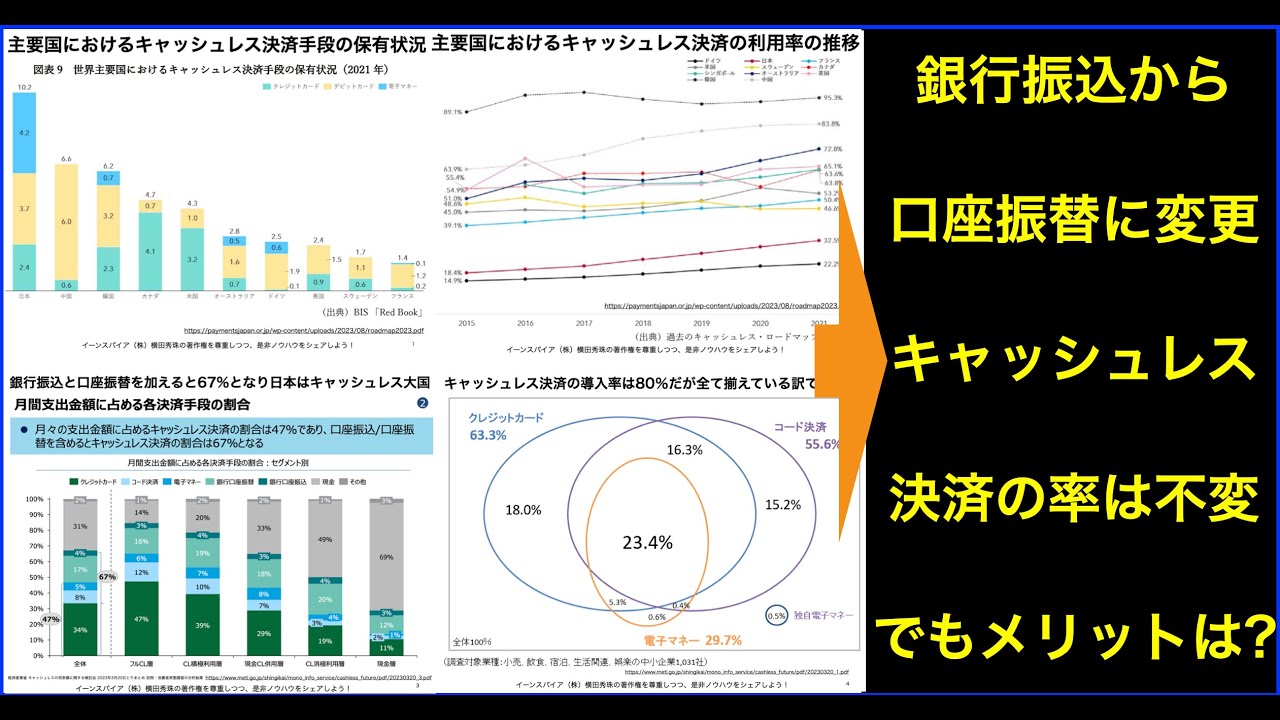

キャッシュレス決済のメリットとデメリットを最新データ分析②全6回

5.0 / 5 (0 votes)