IRL vs ERL

Summary

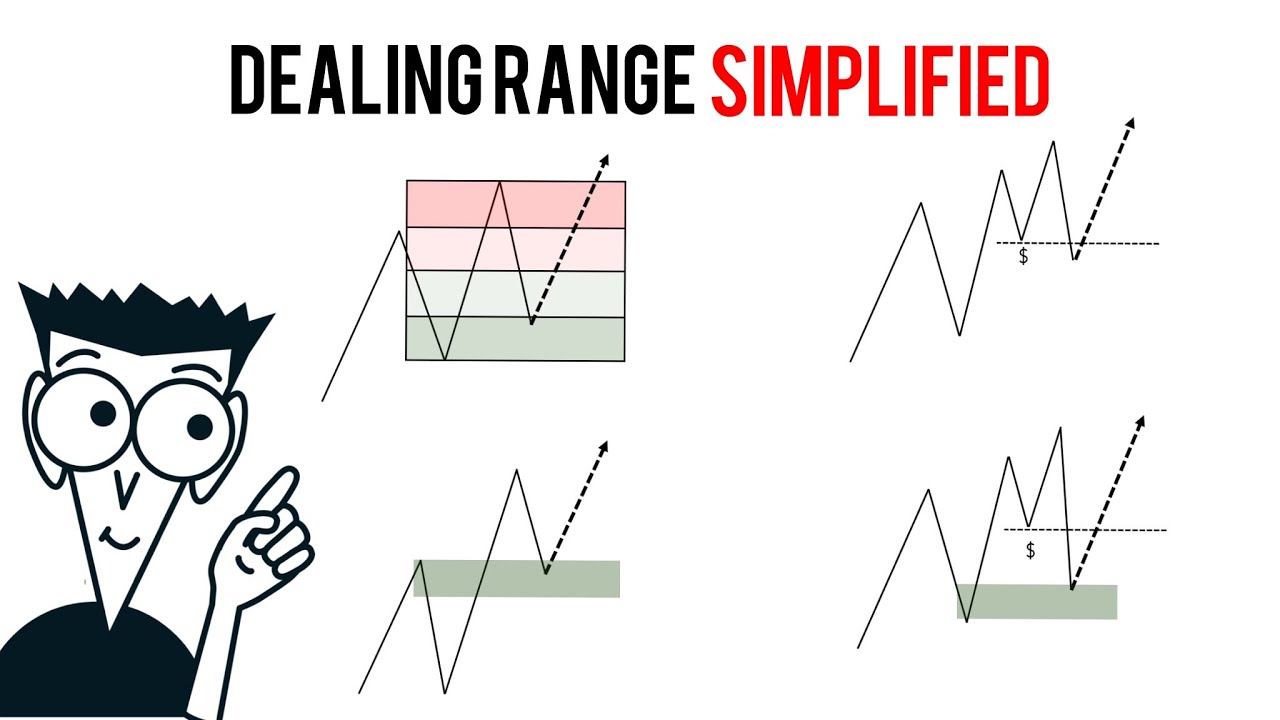

TLDRThe video script is an educational discussion on trading strategies, focusing on charting techniques and the significance of internal and external liquidity ranges. The speaker clarifies misconceptions about volume interpretation at market highs and lows, emphasizing the importance of understanding market structure and context. They detail their approach to chart analysis, from monthly to minute time frames, and how to identify and trade using accumulation, distribution, and manipulation patterns. The goal is to provide viewers with a deeper insight into market behavior and improve their trading strategies for 2024.

Takeaways

- 📊 The speaker emphasizes the importance of understanding internal and external liquidity in charting and trading.

- 🕒 They discuss how to identify timeframes and apply them to trading strategies, starting from monthly to weekly, then daily.

- 📈 The concept of 'sweeps' is introduced, which refers to high volume trades that indicate a shift from one swing point to another.

- 📉 The speaker explains that markets are efficient and tend to trade from level to level, balancing internal ranges before moving to external ones.

- 📋 They mention that accumulation and distribution are key processes in the market, with accumulation typically at lows and distribution at highs.

- 🚫 The speaker advises against trading breakouts or breakdowns at external highs or lows without seeing a potential fake break.

- 📌 The importance of context in trading is highlighted, suggesting that understanding where you are in the chart in relation to ranges is crucial.

- 📈 The speaker shares their personal trading approach, which involves starting with higher timeframes to establish external ranges and then moving to lower timeframes for internal ranges.

- 🔍 They discuss the significance of volume and how it can be misleading, especially at potential breakout or breakdown points.

- 📊 The speaker provides a detailed example using Tesla's stock chart to illustrate how to apply the concepts of internal and external ranges.

- 🔑 The final takeaway is about patience and trading with the trend, using the understanding of internal and external ranges to find ideal entries and exits.

Q & A

What is the main topic of the video?

-The main topic of the video is explaining the concepts of internal and external liquidity in trading, using high and low price ranges to define the current dealing range, and how to use these concepts to understand market movements.

Why did the speaker decide to make this video?

-The speaker decided to make this video to address a question raised in a Discord discussion about Anna King's book and to clarify the confusion around market volume behavior at highs and lows.

What is the significance of high volume at market lows and highs?

-High volume at market lows is usually indicative of buying from big money, while high volume at market highs is indicative of selling pressure. This is important because it helps traders understand the intentions of big money players in the market.

What is the difference between internal and external ranges?

-Internal range refers to the highs and lows within the dealing range, typically on lower time frames. External range refers to the broader high and low that defines the current dealing range, usually based on higher time frames.

Why is understanding the market's cyclical nature important for traders?

-Understanding the market's cyclical nature is important because it allows traders to identify patterns and trends across different time frames, which can help in predicting future price movements and making informed trading decisions.

What is the role of accumulation and distribution in the market?

-Accumulation and distribution are processes where big money players buy or sell large volumes of assets, creating high volume at certain price levels. Accumulation typically occurs at lows, while distribution occurs at highs, influencing market trends.

Why does the speaker avoid trading on external high breakouts?

-The speaker avoids trading on external high breakouts because they often represent opportunities for big money players to sell their positions to willing buyers, which can lead to fake breakouts and less predictable market behavior.

What time frames does the speaker use for charting?

-The speaker uses a top-down approach, starting with monthly charts, moving to weekly, then daily, and finally to 4-hour, 1-hour, 15-minute, and 5-minute charts for execution.

How does the speaker execute trades based on the understanding of internal and external liquidity?

-The speaker executes trades by identifying the external and internal liquidity ranges on higher time frame charts and then looking for entry points on lower time frames, such as the 15-minute and 5-minute charts.

What is the importance of understanding the context of where you are on the chart?

-Understanding the context of where you are on the chart is crucial because it helps traders identify the current market structure, anticipate potential price movements, and make better-informed decisions about when and where to enter or exit trades.

How does the speaker use the concept of internal and external liquidity to refine trading strategies?

-The speaker uses the concept of internal and external liquidity to refine trading strategies by identifying key support and resistance levels, looking for high volume areas that indicate big money activity, and耐心等待合适的交易机会,如等待价格回调到内部或外部流动性范围内的支撑或阻力水平。

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade Now5.0 / 5 (0 votes)