Process for Understanding Internal Control & Assessing Control Risk

Summary

TLDRThe script discusses the five components of internal controls, with a focus on control activities. It outlines the audit process in four phases: understanding internal controls during planning, assessing control risk, testing controls' reliability, and determining the extent of substantive procedures based on control assessment. The auditor evaluates the control environment and tests transactions to ensure they align with client descriptions.

Takeaways

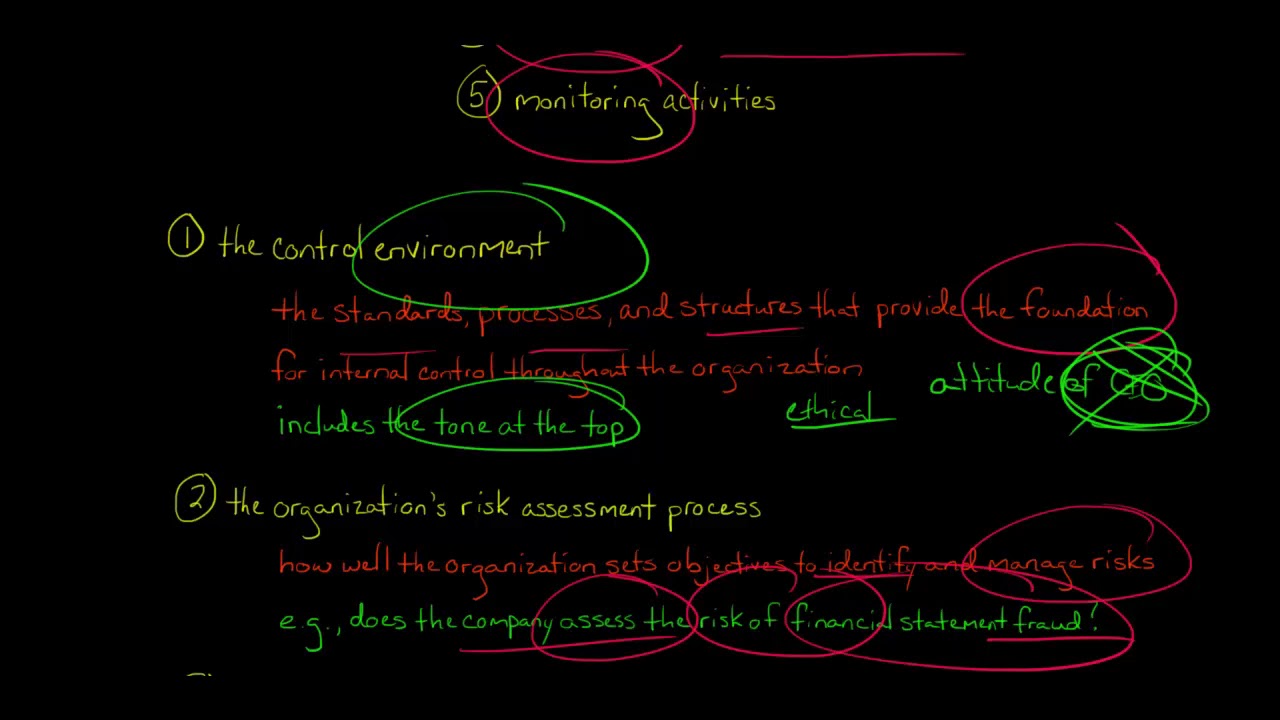

- 🔍 The discussion revolves around the five components of internal controls, emphasizing the importance of control activities.

- 🔑 Auditors use the Closer framework to assess the five components of internal controls during an audit.

- 📈 The first phase of the audit involves the auditor obtaining an understanding of the internal control design and operation.

- 🗂️ Phase two is focused on assessing control risk, which may include walkthroughs and testing the effectiveness of controls.

- 🔎 In phase three, auditors determine if they can rely on internal controls by performing tests on a sample of transactions.

- 📊 Phase four involves the auditor deciding the nature and extent of substantive testing based on their understanding and reliance on internal controls.

- 🤝 Auditors engage with clients during the planning phase to gather information about the internal control environment.

- 📉 Control risk assessment is a critical part of the audit process, influencing the auditor's approach to substantive testing.

- 📋 The auditor's reliance on internal controls can reduce the extent of substantive testing required.

- 🔑 The effectiveness of internal controls is a key factor in the overall audit strategy and approach.

- 📝 The script highlights the iterative nature of audits, with ongoing activities to maintain and assess internal controls.

Q & A

What are the five components of internal controls?

-The five components of internal controls are not explicitly mentioned in the script, but they generally include control environment, risk assessment, control activities, information and communication, and monitoring.

What does the Closer framework refer to in the context of internal controls?

-The Closer framework is not explicitly defined in the script, but it is likely referring to a framework used by auditors to evaluate internal controls, possibly an acronym or a mnemonic for the five components.

What is the focus of the auditor when considering internal controls?

-The focus of the auditor is on the control activities component of internal controls, which involves assessing the effectiveness of the controls in place.

What are the phases of the audit process as described in the script?

-The phases of the audit process described are: obtaining an understanding of internal control design and operation (Phase one), assessing control risk (Phase two), testing controls and transactions if relying on internal controls (Phase three), and determining the nature and extent of substantive procedures based on the understanding and reliance on internal controls (Phase four).

What does the auditor do during the planning phase of the audit?

-During the planning phase, the auditor talks to the client, gathers information about the internal control environment, and plans the audit strategy.

How does the auditor assess control risk?

-The auditor assesses control risk by performing walkthroughs, testing to see if the controls are operating as designed or described by the client, and evaluating the effectiveness of the controls.

What happens in Phase three of the audit if the auditor determines they can rely on internal controls?

-In Phase three, if the auditor determines they can rely on internal controls, they perform tests on a sample of transactions to audit the controls around those transactions.

What is the purpose of substantive procedures in the audit process?

-The purpose of substantive procedures is to provide direct evidence about the fairness of the financial statement amounts, which is done after considering the understanding and reliance on internal controls.

Why is it important for auditors to understand the internal control environment?

-Understanding the internal control environment is important for auditors because it helps them assess the risk of material misstatement and plan their audit procedures accordingly.

What is the relationship between control activities and the overall effectiveness of internal controls?

-Control activities are a critical component of internal controls, as they directly influence the effectiveness of the controls by ensuring that they are operating as intended to prevent or detect errors and fraud.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade Now5.0 / 5 (0 votes)