Análisis Vertical Estado Resultados - Interpretar y Como reducir Costos y Gastos

Summary

TLDRThis video tutorial offers a comprehensive guide to vertical analysis of financial statements, focusing on interpreting and reducing costs and expenses. It explains how to calculate each account's percentage of net sales, starting with net sales as 100%. The video highlights the importance of comparing actual results with projected values, emphasizing profit margins and suggesting strategies to enhance financial outcomes. It also discusses specific cost control measures for various business types, from commercial to manufacturing, and touches on managing non-operating income and expenses, offering practical advice for financial analysis and planning.

Takeaways

- 📊 The vertical analysis of financial statements involves calculating and interpreting the percentage size of each account relative to net sales.

- 🔢 The formula for vertical analysis is to divide each account by net sales and multiply by 100 to express it as a percentage.

- 💹 Net sales, which represent 100%, are calculated by subtracting returns and discounts from total sales.

- 📉 Managers and analysts first look at the bottom line to determine if the company made a profit or loss and compare it with the expected profit for the year.

- 📈 A lower profit percentage than expected indicates a need to evaluate and potentially reduce costs and expenses for better results in the following year.

- 🛒 Cost of goods sold is a significant expense, often representing a large percentage of net sales, and should be closely monitored and controlled.

- 📋 Selling expenses are crucial to manage as they can significantly impact profitability; strategies include evaluating salaries, travel costs, and marketing expenses.

- 🏢 Administrative expenses, which are fixed and not directly related to production or sales, should be assessed for potential reductions.

- 💼 Non-operating income and expenses are not controllable and are often incidental, but they can affect the net profit.

- 💵 Interest expenses are a significant cost for companies with debt and can be reduced by managing debt levels and financing strategies.

- 💼 Taxes are a necessary expense, and strategies to manage them include timely payments to avoid penalties and maintaining accurate financial records.

Q & A

What is vertical analysis of an income statement?

-Vertical analysis of an income statement involves expressing each line item as a percentage of net sales to understand the proportion of each account relative to net sales.

How is the formula for vertical analysis calculated?

-The formula for vertical analysis is calculated by dividing each account or line item by net sales and then multiplying by 100 to get the percentage.

What are net sales in the context of vertical analysis?

-Net sales in vertical analysis refer to the result of subtracting returns and discounts from total sales, which serves as the base for calculating percentages of other income statement items.

How does one perform the calculation for vertical analysis in a spreadsheet?

-In a spreadsheet, one would divide each line item by net sales, use the fill handle to copy the formula down the column, and format the cells to display percentages with two decimal places.

What does it mean if net sales represent 100% in vertical analysis?

-If net sales represent 100% in vertical analysis, it means that the calculation is normalized, and all other figures are shown as a percentage of these net sales.

What is the significance of comparing the results of vertical analysis to projected values?

-Comparing the results of vertical analysis to projected values helps in evaluating whether the company's actual performance aligns with its financial planning and expectations.

How can a company reduce costs and expenses as suggested by vertical analysis?

-A company can reduce costs and expenses by closely examining each account, improving quality management to reduce returns, optimizing discount policies, controlling the cost of goods sold, and managing operational expenses more efficiently.

What is the role of cost of goods sold (COGS) in vertical analysis?

-In vertical analysis, COGS is a significant line item that often represents a large percentage of net sales. It's crucial for companies, especially commercial ones, to manage and potentially reduce this cost to improve profitability.

Why is it important to manage returns and discounts as part of vertical analysis?

-Managing returns and discounts is important because they directly impact profitability. Reducing returns can increase net sales and thus improve the bottom line, while managing discounts effectively can ensure that they are a strategic sales tool rather than a financial burden.

How can a company's marketing expenses be optimized according to vertical analysis?

-According to vertical analysis, a company can optimize marketing expenses by evaluating the return on marketing investment, focusing on cost-effective marketing channels like social media, and ensuring that marketing efforts align with sales objectives.

What steps can be taken to reduce administrative expenses as indicated by vertical analysis?

-To reduce administrative expenses, a company might consider measures such as evaluating and adjusting salaries, utilizing interns for basic tasks, reducing non-essential spending, promoting energy efficiency, and encouraging digitalization to cut down on paper use.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

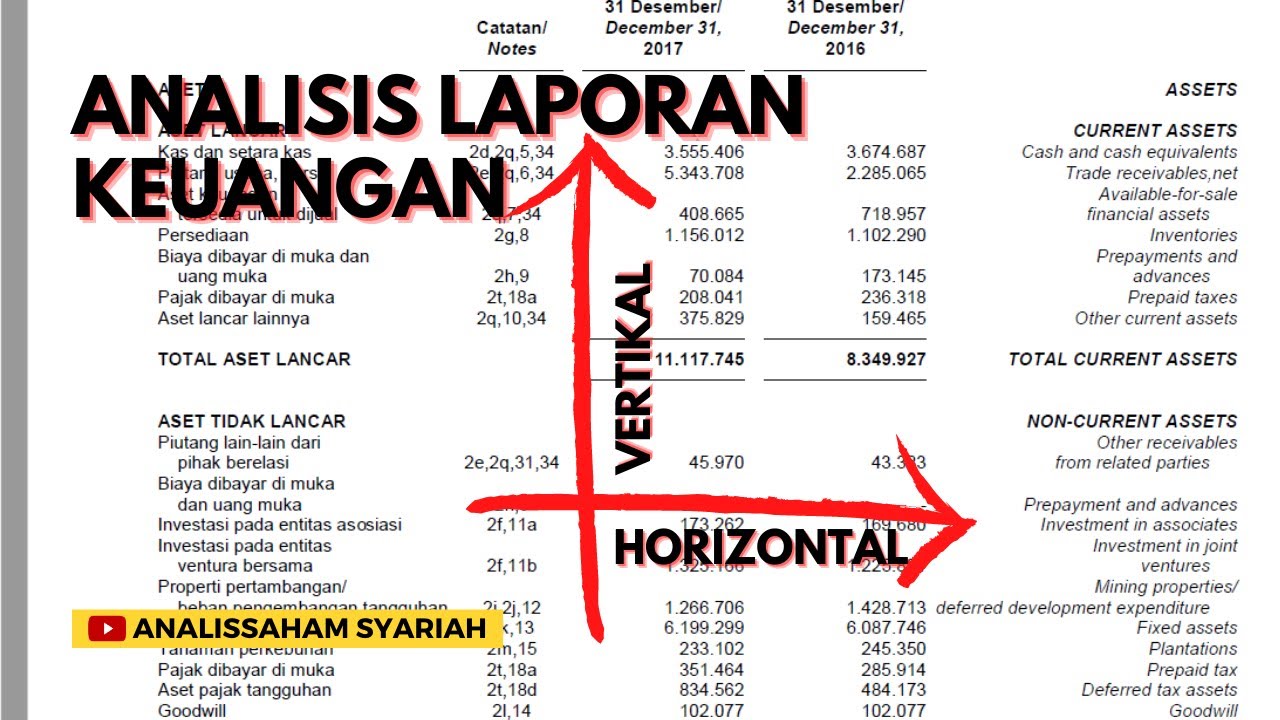

Contoh Cara Menghitung Analisis Vertikal / Horizontal Laporan Keuangan

Cara Menggunakan Accurate Online untuk Pemula ‼️

07- Análisis Horizontal y Vertical dentro de los Estados Financieros

Moving to London? What it ACTUALLY Costs in 2024 (& my one mistake)

Financial reporting basics & examples | Start your business

The ACCOUNTING BASICS for BEGINNERS

5.0 / 5 (0 votes)