The ACCOUNTING BASICS for BEGINNERS

Summary

TLDRThis video script emphasizes the importance of accounting for business success, explaining it as an ongoing process of recording, reporting, and analyzing financial data. It outlines the three core parts of accounting: bookkeeping, financial statement creation, and data analysis. The script uses the example of a landscaping company to illustrate how understanding accounting can guide business decisions and growth, highlighting the significance of income statements, balance sheets, and cash flow statements in providing different financial perspectives. It concludes by showcasing the power of financial analysis through a case study of a tofu business owner who improved profitability by reducing costs.

Takeaways

- 📊 Accounting is essential for understanding and managing a business's financial health.

- 🔢 It involves recording, organizing, reporting, and analyzing financial data through an ongoing process.

- 💼 Key accounting principles include the recording of all financial transactions and categorizing them into revenue, expenses, assets, liabilities, and equity.

- 📈 The income statement shows a business's profitability over a period by comparing revenue and expenses.

- 🏦 The balance sheet provides a snapshot of a business's financial position, including assets, liabilities, and equity.

- 💧 The cash flow statement tracks the movement of cash in and out of the business, showing operational, investment, and financing activities.

- 📝 Financial statements offer different perspectives into a business's finances, helping to monitor performance and make decisions.

- 📊 Analyzing financial data through key metrics and ratios can uncover insights that lead to better business strategies.

- 📉 Identifying and addressing financial issues, such as high costs, can significantly improve a business's profitability.

- 📈 Making informed decisions based on financial analysis can lead to growth and increased profits, as illustrated in the tofu business example.

- 🔑 Maintaining accurate and clear financial records is crucial for effective accounting and decision-making.

Q & A

Why is accounting important for business owners?

-Accounting is important for business owners because it helps them understand their business's financial health, track performance, uncover insights, and make informed decisions for future growth and sustainability.

What are the three core parts of the accounting process mentioned in the script?

-The three core parts of the accounting process are recording all financial transactions, reporting with key financial statements, and analyzing the data to gain insights.

What is the purpose of recording financial transactions in a business?

-Recording financial transactions is essential as it serves as the foundation for tracking the business's financial activities, which is necessary for generating accurate financial statements and analyzing the business's performance over time.

What are the five main types of financial transactions that need to be recorded in a business?

-The five main types of financial transactions are revenue, expenses, assets, liabilities, and equity.

Can you explain the role of an income statement in a business?

-An income statement shows a business's revenue, expenses, and profit over a period of time, acting as a scorecard to assess the profitability of the business.

What does a balance sheet represent in the context of a business's financial health?

-A balance sheet provides a snapshot of a business's financial position at a specific point in time, outlining what the business owns (assets), what it owes (liabilities), and the owner's stake in the business (equity).

Why is the cash flow statement important for a business?

-The cash flow statement is important because it tracks the movement of cash in and out of the business, helping to answer questions about the business's ability to generate cash, pay debts, and invest wisely.

What is the significance of analyzing financial data in the context of business growth?

-Analyzing financial data is significant for business growth as it allows the business owner to identify patterns, problems, and potential opportunities, enabling them to make strategic decisions that can lead to a stronger and more profitable business.

How can a business owner use financial data to improve their profit margins?

-A business owner can use financial data to identify areas of high cost, adjust pricing strategies, optimize operations, and make informed decisions that can lead to increased profit margins.

What is the role of an accountant in helping a business owner understand and manage their finances?

-An accountant helps a business owner by providing expert analysis of financial data, identifying areas for cost reduction, revenue enhancement, and strategic financial planning, ultimately contributing to the business's financial health and growth.

How can a business owner ensure they have clean, clear, and concise financial data for better decision-making?

-A business owner can ensure they have clean financial data by maintaining proper bookkeeping practices, regularly reviewing and categorizing transactions, and using reliable accounting software or services to track and organize financial information.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

MGT101_Topic004

Accounting Basics for Small Business Owners [By a CPA]

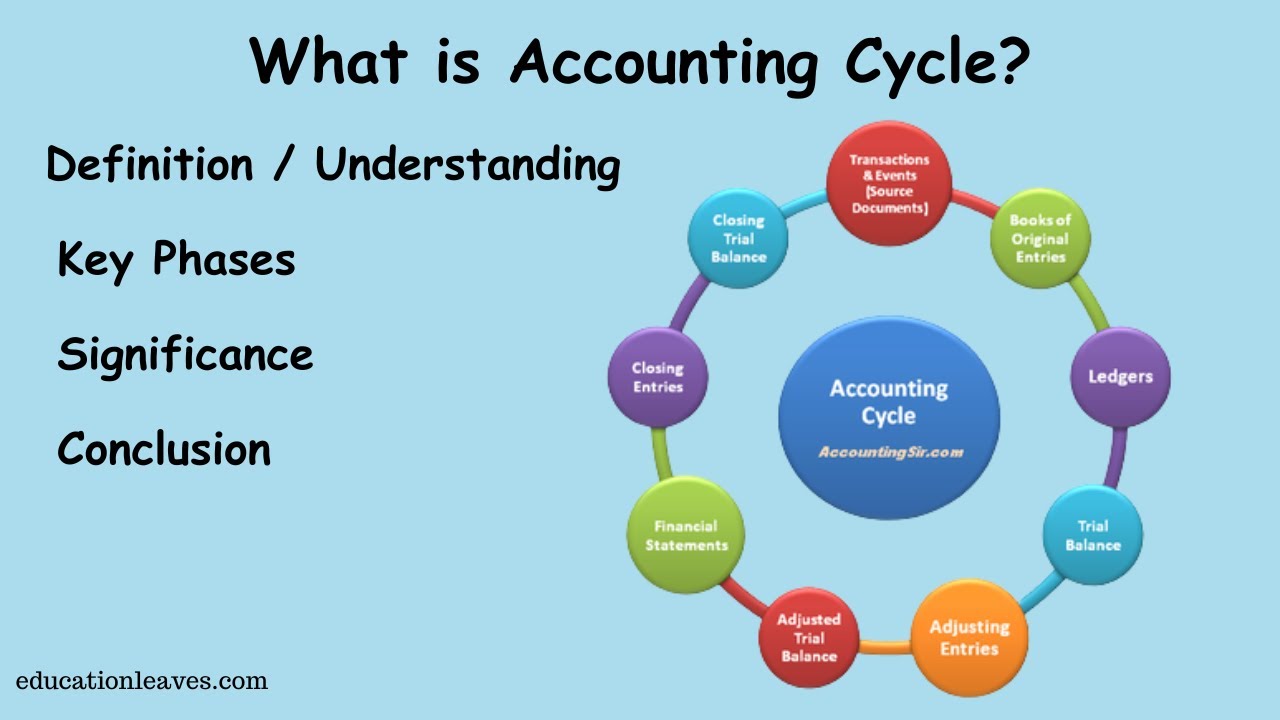

What is Accounting cycle? | Key phase, Significance of Accounting cycle

Akuntansi Sebagai Sistem Informasi | Ekonomi Kelas 12 - EDURAYA MENGAJAR

PENGANTAR BISNIS - Informasi Akuntansi dan Keungan Perusahaan - 14.2

Ruang Lingkup Akuntansi | Pengantar Akuntansi | Bahan Ajar Akuntansi Politeknik Negeri Medan

5.0 / 5 (0 votes)