How Card Payments Work

Summary

TLDRIn this video, Sisha explains the complex ecosystem behind simple payment transactions. She breaks down the traditional four-party model, detailing the roles of the cardholder, merchant, acquiring bank, card network, and issuing bank. The process is divided into key stages: authorization, clearing, and settlement. Sisha also discusses the differences between open and closed-loop networks, and the unit economics of payment fees, highlighting how merchants pay for transaction fees, ultimately passed on to consumers. The video offers valuable insights into the intricate systems and fees involved in card payments.

Takeaways

- 😀 Payments appear simple to customers but involve a complex ecosystem of institutions, risk allocation, and fee distribution.

- 😀 The traditional payment model is called the four-party model, involving five roles: card holder, merchant, acquiring bank, card network, and issuing bank.

- 😀 The card holder is the person who initiates the transaction, whether by swiping, tapping, or paying online. They authenticate using PIN, one-time passcode, or biometric verification.

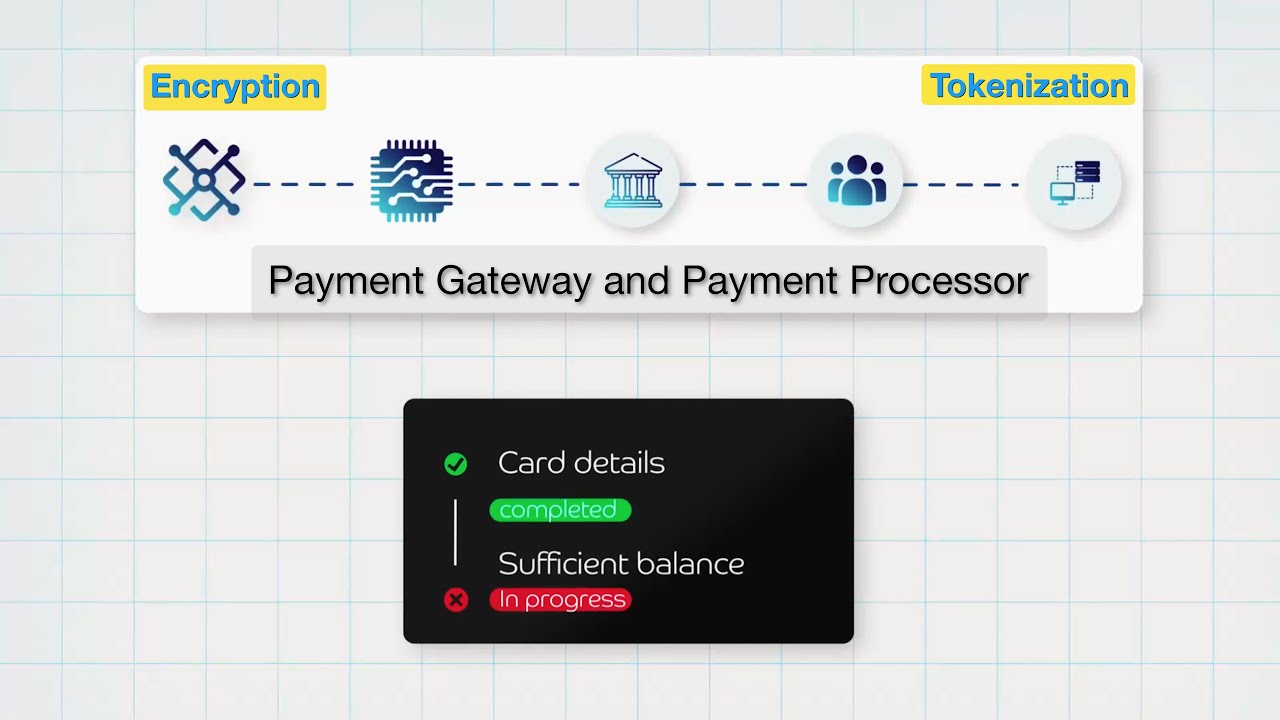

- 😀 Merchants (businesses) like Target or Walmart accept card payments and integrate with payment gateways to submit transactions to the acquirer.

- 😀 The acquiring bank onboard merchants, perform KYC, provide payment gateway access, and forward transactions to the card network.

- 😀 Card networks like Visa, Mastercard, and Amex provide transaction rails, set interchange categories, route messages, and clear and settle balances between banks.

- 😀 The issuing bank is responsible for issuing cards, performing authorization decisions, and extending credit if it’s a credit card. They also handle fraudulent transaction holds and repayment collection.

- 😀 In a transaction, no money moves during authorization; the issuer simply places a temporary hold to assess the risk of the transaction.

- 😀 Clearing occurs after authorization, where transaction details like amounts, merchant ID, and fees are finalized.

- 😀 Settlement is the key step where money actually moves to the merchant, typically occurring within 1-2 days or in some cases, on the same day.

- 😀 Open-loop networks (e.g., Visa, Mastercard) have separate issuers and networks, leading to decentralized ecosystems and competitive fees. Closed-loop networks (e.g., Discover) integrate both, leading to higher fees and centralized control.

- 😀 Unit economics highlight that the merchant pays for fees via the Merchant Discount Rate (MDR), which is recouped from the cardholder. The MDR consists of interchange, network, and processing fees.

Q & A

What is the four-party model in payments?

-The four-party model in payments involves five roles: the cardholder (consumer), the merchant (business or provider), the acquiring bank, the card network (Visa, Mastercard, etc.), and the issuing bank (customer’s bank). It represents the ecosystem of institutions that manage and process a payment transaction.

Who is the cardholder in the four-party model?

-The cardholder is the individual (consumer) who initiates the transaction, typically through a swipe, tap, or online payment. They agree to pay the issuing bank, authenticate the transaction, and proceed with payment.

What role does the merchant play in the payment transaction?

-The merchant is the business or provider who accepts card payments. They integrate with payment gateways and submit transaction data to the acquirer for processing.

What is the function of the acquiring bank in the payment flow?

-The acquiring bank onboards merchants, performs KYC (Know Your Customer), underwrites them to the platform, provides access to payment gateways, collects transactions from the merchant, and forwards them to the card network for processing.

What are the responsibilities of the card network (e.g., Visa, Mastercard)?

-Card networks provide the transaction rails, set operating rules, route authorization messages, and manage the clearing and settlement of transactions between banks. They define interchange categories and ensure balances are cleared between the institutions.

What role does the issuing bank play in the four-party model?

-The issuing bank issues the card to the cardholder, authorizes the transaction, extends credit (for credit cards), places a hold during authorization for fraud checks, and collects repayment from the cardholder.

What happens during the authorization phase of a payment transaction?

-During authorization, no money actually moves. The issuing bank places a temporary hold on the transaction, verifying the cardholder's identity and checking for sufficient funds. This step is crucial for risk management and fraud prevention.

What is the clearing phase in the transaction flow?

-Clearing occurs after authorization, where the transaction details are finalized. This involves determining the amount, creating a merchant ID, setting the interchange fee category, and calculating the relevant fees. It usually happens at the end of the day.

What occurs during the settlement phase of a transaction?

-Settlement is the phase where actual money moves from the cardholder’s account to the merchant’s account. It typically happens within one to two days (T+1, T+2) or, in some cases, on the same day.

What is the difference between open and closed loop networks?

-In an open loop network, the issuer and the network are separate entities (e.g., Visa, Mastercard), with distributed ownership and shared pricing power. In a closed loop network, the issuer and the network are the same entity (e.g., Discover), with centralized ownership and often higher fees.

What is a merchant discount rate (MDR)?

-The merchant discount rate (MDR) is the fee that merchants pay for processing card payments. It includes three main fees: the interchange fee, network fee, and processing fee. This cost is often recouped from the cardholder.

Who ultimately bears the cost of payment fees in the four-party model?

-The merchant typically bears the payment fees, which are passed on to the cardholder through the merchant discount rate. However, these fees are distributed among various parties, including the acquirer, the issuer, and the card network.

What is the interchange fee, and who pays it?

-The interchange fee is set by the card network and is paid by the acquirer to the issuer. It compensates the issuer for credit and fraud risks associated with the transaction.

What is the role of the network fee in the transaction ecosystem?

-The network fee is set by the card network and is paid by the acquirer to the network. It is passed onto the merchant as part of the merchant discount rate and contributes to the overall transaction costs.

What does the processing fee cover in the payment transaction?

-The processing fee is set by the acquirer and represents a markup on the merchant's transaction fees. It is paid by the merchant to the acquirer for the cost of processing the payment.

Outlines

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифMindmap

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифKeywords

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифHighlights

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифTranscripts

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифПосмотреть больше похожих видео

Payment Gateway, Payment Processor and Payment Security Explained

How digital payment system works: Beginner's Guide to Electronic Transactions

QRIS vs. Alipay, Paytm, DuitNow — Why Indonesia’s Winning the Cashless Race!

Yuk, Kenali Sistem Pembayaran dan Peran Bank Sentral | Ekonomi Kelas X - KHATULISTIWA MENGAJAR

Cards and Payments - Part 2 - Role of a Merchant and Acquirer

x402 - how it works

5.0 / 5 (0 votes)