Contoh Kasus Perhitungan Pembagian Harta Warisan dengan Metode Radd

Summary

TLDRThis video provides a detailed explanation of calculating inheritance distribution using the 'road method.' The example discusses a deceased husband leaving behind a wife, mother, and daughter, with inheritance assets of 24 million rupiah after debts and funeral costs. The video walks through determining each heir's share according to Islamic inheritance law, equalizing denominators, and addressing any remainder. The wife receives her fixed share, while the mother and daughter receive their portions plus additional distribution from the remainder. The step-by-step process clarifies how to apply the road method for fair and precise inheritance division among blood relatives.

Takeaways

- 😀 The video explains how to calculate inheritance distribution using the 'road method' in Islamic law.

- 😀 The example involves a deceased husband leaving three heirs: a wife, a mother, and a daughter, with inheritance assets of 24 million rupiah after debts and funeral costs.

- 😀 Fixed shares (fardh) according to Islamic inheritance rules are: wife 1/8, mother 1/6, and daughter 1/2.

- 😀 To simplify calculations, denominators of the shares are equalized using the least common denominator (LCD), which in this example is 24.

- 😀 Initial distribution based on fixed shares is: wife 3 million, mother 4 million, daughter 12 million rupiah.

- 😀 After initial distribution, a remainder of 5 million rupiah is left unallocated, which is only distributed to blood relatives, not the spouse.

- 😀 Using the road method, the remainder is distributed proportionally among the mother and daughter: mother 1/4 (1.25 million), daughter 3/4 (3.75 million).

- 😀 Final inheritance distribution: wife 3 million, mother 5.25 million, daughter 15.75 million rupiah.

- 😀 The road method ensures that all inheritance is fully allocated without violating blood-relative priority.

- 😀 Only heirs related by blood are eligible for the remainder; spouses do not receive this portion.

- 😀 This method emphasizes proportional allocation and fairness in inheritance division according to Islamic principles.

Q & A

What is the main topic discussed in the video?

-The video explains how to calculate inheritance distribution in Islamic law using the 'road method', including practical examples.

Who are the heirs mentioned in the example case?

-The heirs in the example are the wife, the mother, and the biological daughter of the deceased.

What is the total inheritance amount used in the example?

-The total inheritance, after subtracting debts and funeral costs, is 24,000,000 rupiah.

Why does the wife receive 1/8 of the inheritance?

-The wife receives 1/8 because the deceased had children, which reduces her share according to Islamic inheritance law (dzawil furudh).

How is the mother’s share determined in the example?

-The mother’s share is 1/6 because there is a daughter from the deceased. This follows the fixed shares specified in the Qur'an.

What fraction of the inheritance does the daughter receive initially?

-The daughter initially receives 1/2 of the total inheritance.

How is the remainder of the inheritance distributed using the 'road method'?

-The remainder is distributed only among blood relatives (mother and daughter). In this example, the mother receives 1/4 of the remainder and the daughter receives 3/4.

Why does the wife not receive any part of the remainder?

-The wife does not receive any remainder because she is related by marriage, not by blood, and the 'road method' restricts remainder distribution to blood relatives.

What is the final inheritance for each heir in the example?

-Wife: 3,000,000 rupiah; Mother: 5,250,000 rupiah; Daughter: 15,750,000 rupiah.

Why is it necessary to use a common denominator when calculating inheritance shares?

-A common denominator allows for accurate calculation and distribution of fractional shares, ensuring the initial fixed shares and the remainder are properly allocated.

What preliminary steps must be taken before calculating inheritance shares?

-Debts and funeral costs must be subtracted from the total estate to determine the net amount available for distribution among the heirs.

Outlines

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифMindmap

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифKeywords

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифHighlights

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифTranscripts

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифПосмотреть больше похожих видео

Menghitung Kewarisan anak dalam kandungan (Hamlun). MAHSISWA WAJIB NONTON!!!!!!!!!!!

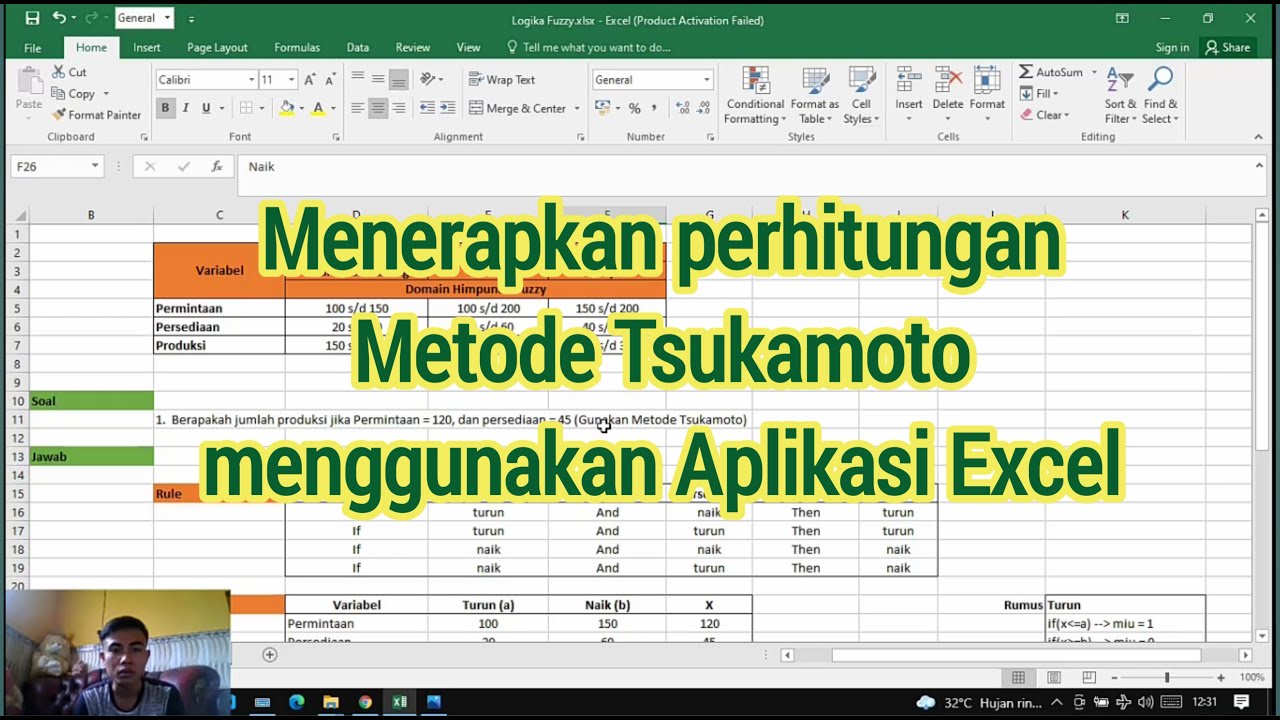

Perhitungan Metode Tsukamoto Menggunakan Aplikasi Microsoft Excel

Método Algebraico

Manajemen Operasional - Strategi Lokasi

MENGOLAH DATA MENGGUNAKAN FUNGSI FINANSIAL | SPREADSHEET | METODE PENYUSUTAN

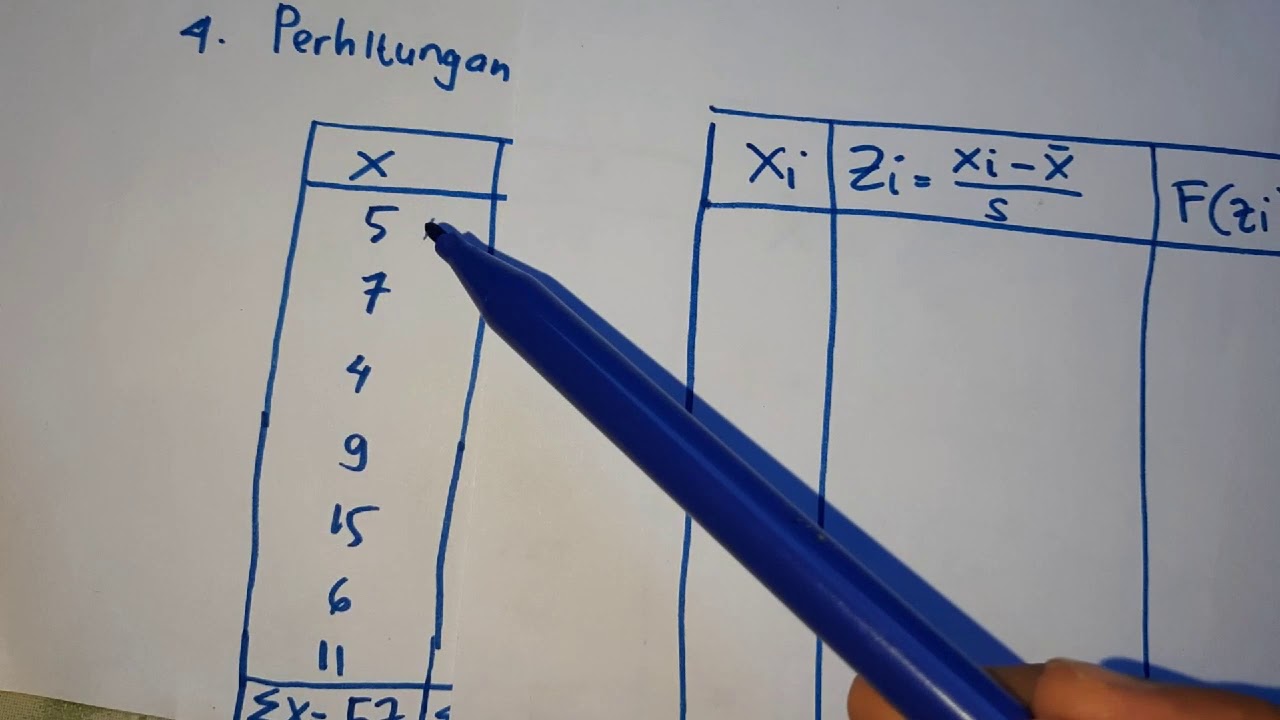

STATISTIKA : UJI NORMALITAS

5.0 / 5 (0 votes)