Simple vs. Compound Interest | Cash Course | PragerU Kids

Summary

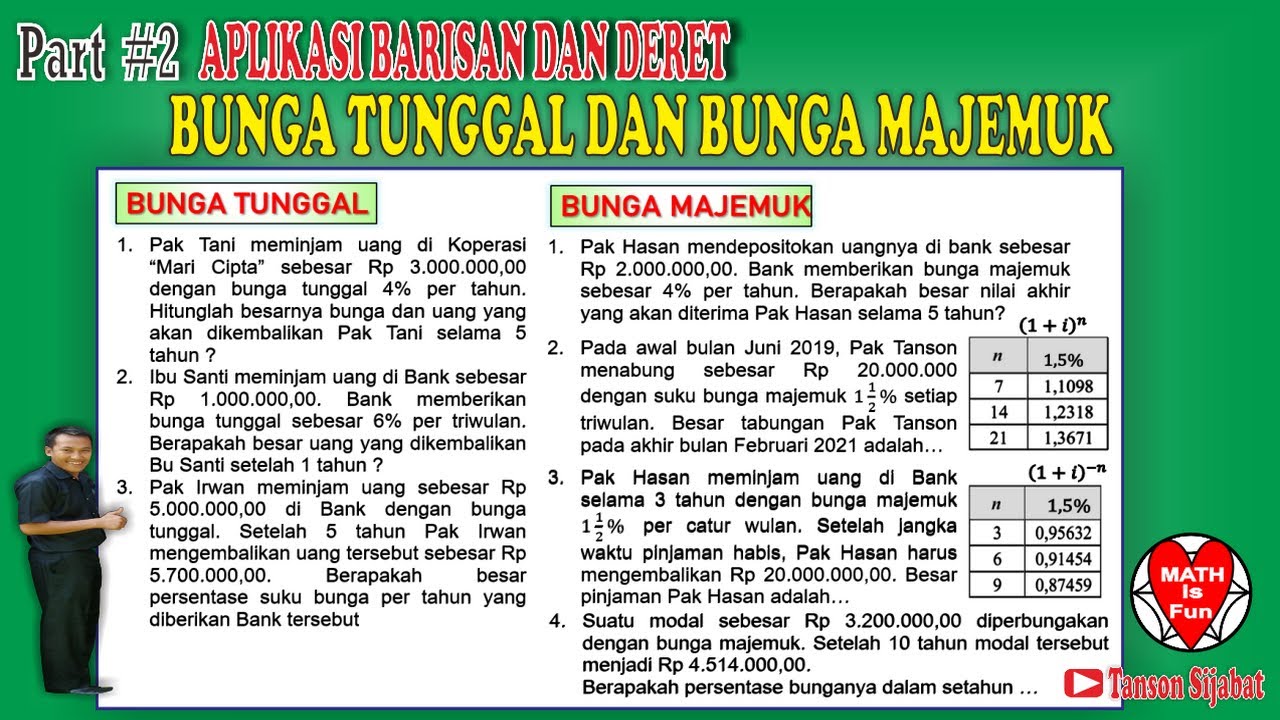

TLDRThis video explains the difference between simple and compound interest, helping viewers understand how interest works in both savings and borrowing. Simple interest is calculated only on the original principal, while compound interest adds interest to the principal, allowing it to grow exponentially over time. The video also highlights the impact of interest rates on credit card debt and loans, comparing different scenarios to show how interest can accumulate. The Rule of 72 is introduced as a tool to estimate how long it takes for investments to double, emphasizing the importance of time and smart financial planning.

Takeaways

- 😀 Interest is charged by lenders when you borrow money, and it can also be earned when you save or invest.

- 😀 Simple interest is calculated only on the original amount (the principal), whereas compound interest adds interest to the principal, leading to interest on the interest.

- 😀 With simple interest, if you deposit $1,000 at 6% annually, you would earn $60 after one year.

- 😀 Compound interest, when applied monthly at 6%, would give you $1,061.69 after one year instead of $1,060, thanks to interest being calculated on the increasing balance each month.

- 😀 The Rule of 72 helps estimate how long it takes for an investment to double: divide 72 by the interest rate. At 6%, it takes about 12 years to double your money with compound interest.

- 😀 With simple interest, it would take around 17 years to double the same amount at the same 6% rate.

- 😀 Compound interest is better for investing, as you earn interest on your interest, which can significantly boost your returns over time.

- 😀 When borrowing money, simple interest is usually preferred, as you are only charged interest on the original amount borrowed.

- 😀 Credit card interest compounds daily on any balance carried beyond the due date, which can add up quickly, increasing the total amount you owe.

- 😀 If you bought a $350 item on a credit card with a 20% APR, you could owe an additional $5.82 in interest after just one month if the balance isn't paid off.

- 😀 The faster you pay off loans or credit cards, the less interest you'll pay. The longer you save or invest, the more you can benefit from compound interest.

Q & A

What is the main difference between simple and compound interest?

-Simple interest is calculated only on the original principal, while compound interest is calculated on the principal plus any accumulated interest, meaning you earn 'interest on interest'.

How does compound interest affect savings over time?

-Compound interest helps your savings grow faster because the interest earned is added to the principal, allowing you to earn interest on both your original deposit and the interest that has accumulated.

What is the Rule of 72 and how does it help in investing?

-The Rule of 72 helps estimate how long it will take to double your investment. Divide 72 by the interest rate, and the result is the number of years it takes to double your money with compound interest.

How long would it take for $1,000 to double at a 6% compound interest rate using the Rule of 72?

-At a 6% compound interest rate, it would take approximately 12 years for $1,000 to double, according to the Rule of 72.

Why is simple interest considered better when borrowing money?

-Simple interest is usually better when borrowing money because it is only charged on the principal, which means you are not paying interest on interest, unlike compound interest.

How does compound interest work on credit card balances?

-Credit card interest compounds daily. This means that if you don’t pay off your balance, you’re charged interest not only on the amount you owe but also on the interest that has been added to your balance.

How much interest could you accrue on a $350 credit card balance with a 20% APR over one month?

-With a 20% APR, you could accrue up to $5.82 in interest on a $350 balance over one month, assuming the balance is carried past the due date and compounds daily.

What’s the best strategy for minimizing interest payments on borrowed money?

-The best strategy is to pay off the borrowed amount as quickly as possible. The faster you pay, the less interest you’ll end up paying over time.

How does interest affect long-term investments?

-For long-term investments, compound interest works in your favor by significantly growing your money over time. The longer you leave your money invested, the more interest you earn on both the principal and previously earned interest.

Why should you choose a low interest rate when borrowing and a high compound interest rate when investing?

-A low interest rate when borrowing helps minimize the amount you pay in interest, while a high compound interest rate when investing allows your money to grow faster, as compound interest accelerates your returns over time.

Outlines

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифMindmap

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифKeywords

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифHighlights

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифTranscripts

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифПосмотреть больше похожих видео

5.0 / 5 (0 votes)