If Your Win Rate Sucks, Watch This Before Your Next Trade

Summary

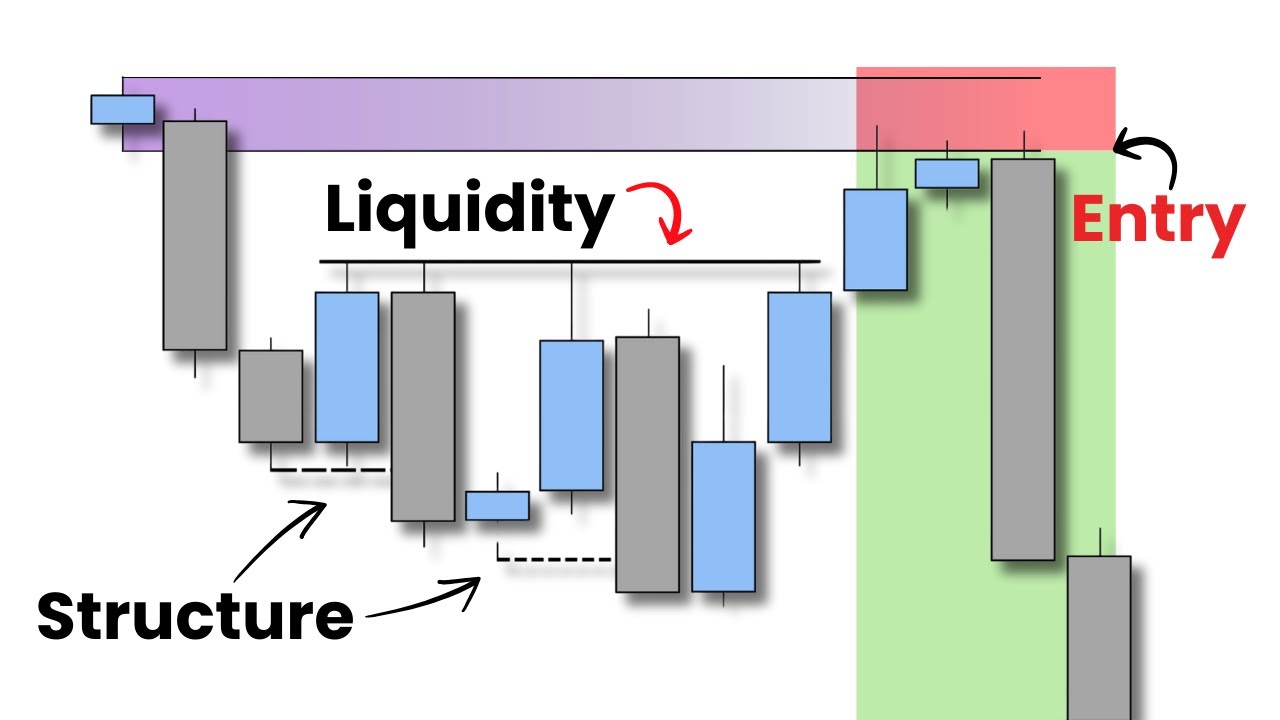

TLDRThis video offers a comprehensive guide on entry and exit strategies for trading, focusing on how to use supply and demand zones to optimize profits. The script emphasizes confirmation entries, partial profit-taking, and the importance of contingency planning to protect gains, especially when markets reverse. It explains how identifying previous price action helps set high-probability targets, with a focus on using supply zones for buy trades and demand zones for sell trades. The video also touches on advanced risk management strategies, such as using stop-losses to safeguard trades.

Takeaways

- 📉 In reversal trades, avoid taking profits at local highs; consider the entire potential trend for better profit realization.

- 🔄 Use previous supply and demand zones as profit targets in trading, as these areas often indicate high-probability reversals.

- 🎯 Identify and focus on supply zones for setting targets in an uptrend, as these are areas where price reversals are likely to occur.

- 💡 Partial profit-taking is a useful strategy—take some profits at the first supply zone and let the rest of the position run to further targets.

- 🛡️ Always have a contingency plan for trades; taking partial profits ensures gains even if the market reverses unexpectedly.

- 🔍 Use historical price action to the left of the chart to find high-probability targets for trades, leveraging previous supply and demand zones.

- 🚀 For buy scenarios, target previous supply zones, and for sell scenarios, look at previous demand zones to set your profit-taking levels.

- 💰 Using partial profit-taking can secure profits even if the market does not reach the final target, thus managing risk better.

- 📈 Continuation trades can be joined by identifying demand areas on lower time frames, allowing for better entry points in upward trends.

- 🛑 Contingency exits and stop-loss strategies are essential for protecting trades; consider exploring other methods to safeguard your positions.

Q & A

What is the primary focus when selecting profit targets in a new trend?

-The primary focus is to use previous areas of supply and demand rather than just taking profits at local highs, to maximize potential gains in the new trend.

Why is it not recommended to take all profits at the local high in a new trend?

-Taking all profits at the local high can limit your potential gains because it doesn't consider the full potential of the new trend. Instead, looking at previous supply and demand zones can help set more strategic targets.

How can supply and demand zones be used for setting trade targets?

-Supply and demand zones are areas of consolidation before large price moves. By identifying these zones on the left side of the chart, traders can set high-probability reversal points as their trade targets.

What is partial profit-taking and how does it benefit traders?

-Partial profit-taking involves taking a portion of the profits at an initial target (e.g., a supply zone) and leaving the rest to run towards a higher target. This strategy helps secure some gains while allowing for the potential of higher overall profits.

How can historical price action aid in setting profit targets?

-By looking at historical price action and identifying previous supply and demand zones, traders can determine high-probability reversal points to set more informed and strategic profit targets.

What is a contingency exit, and why is it important in trading?

-A contingency exit is a planned strategy to secure profits even if the market reverses. It typically involves partial profit-taking to ensure that some gains are locked in before a potential reversal occurs, helping manage risk.

When is it difficult to use previous price action for setting targets?

-It becomes difficult to use previous price action for setting targets when trading at all-time highs, as there may be limited historical data to reference.

What is the difference between a reversal trade and a continuation trade?

-A reversal trade occurs when the market changes direction (e.g., from downtrend to uptrend), while a continuation trade happens when the market continues in its current trend direction (e.g., an ongoing uptrend).

How can traders use lower time frame price action for continuation trades?

-Traders can use lower time frame price action to identify demand zones and join the market at opportune moments during an ongoing trend, aiming to take advantage of further price movements.

What should traders do if the market reverses after reaching the initial supply zone target?

-If the market reverses after reaching the initial supply zone target, traders who have employed partial profit-taking will still secure some profits, mitigating losses and ensuring that the reversal doesn't negate their entire trade gains.

Outlines

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифMindmap

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифKeywords

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифHighlights

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифTranscripts

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифПосмотреть больше похожих видео

Master Liquidity Concepts (Mechanical Strategy)

Liquidity + Structure = Profit

The Only Day Trading Strategy You'll Ever Need (Beginner to Pro)

Why Valid Order Blocks Fail in Forex Trading, Exploring the Order Flow Trading Strategy

The Surprisingly Simple Way I Became A Profitable Trader

The Exact Supply Demand System That Makes Me $100k/mo (Full Guide)

5.0 / 5 (0 votes)