The Surprisingly Simple Way I Became A Profitable Trader

Summary

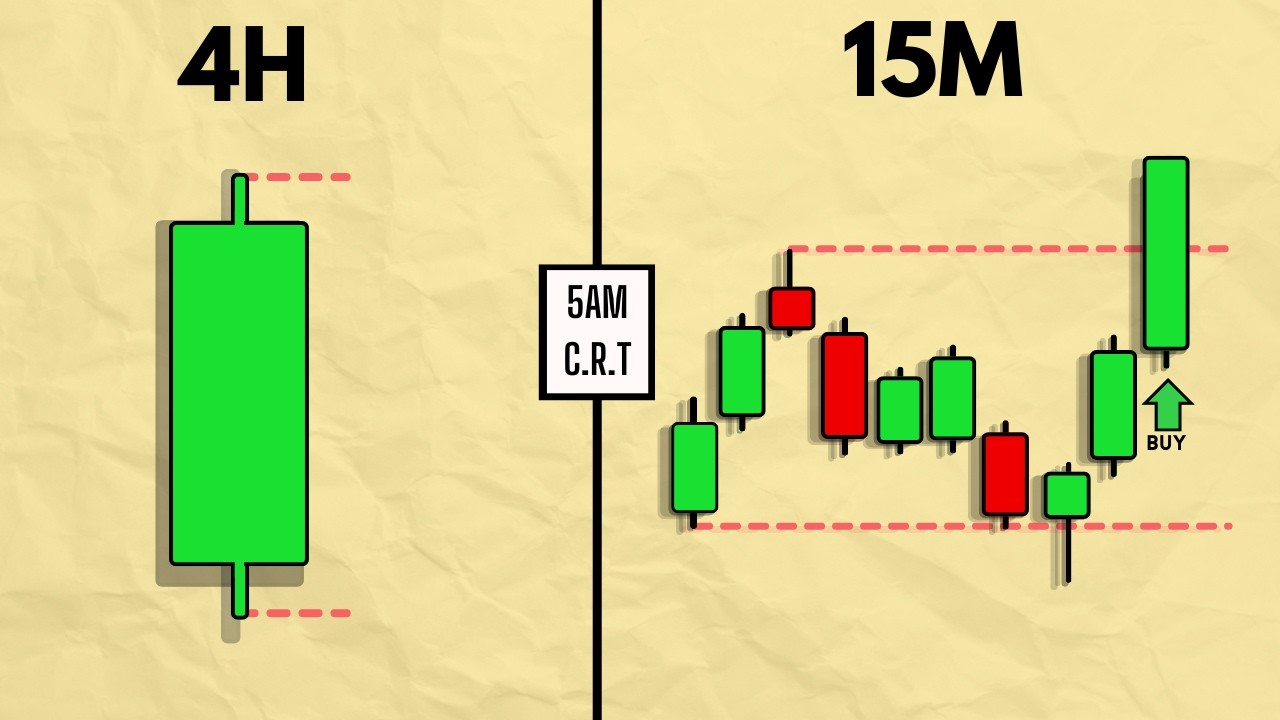

TLDRThis video outlines a comprehensive trading strategy focused on identifying key supply and demand levels, using specific candlestick patterns like engulfing and John Wick candles, and analyzing price ranges through Average True Range (ATR). The trader demonstrates how to apply these principles to real trades, including both short-term setups and risk management with target profits and stop losses. The strategy aims to pinpoint ideal entry and exit points based on market behavior, providing a repeatable method for success. A bonus resource, the 'Gains Guide,' offers premium levels for various assets, assisting traders in their journey.

Takeaways

- 😀 Identify premium levels in the market: Find the biggest seller (resistance) and buyer (support) to spot critical price zones for potential reversals.

- 😀 Master candlestick patterns: Look for engulfing candles or John Wick candles at premium levels to predict reversals.

- 😀 Use range extension to determine trade direction: Understand the daily range (ATR) to spot short-term overbought or oversold conditions.

- 😀 Keep it simple: Focus on key concepts—supply and demand levels, candlestick patterns, and market range—without overcomplicating your strategy.

- 😀 Draw pivot point lines: Mark out levels where significant price activity has occurred, as these are likely areas where the market will react.

- 😀 Recognize overbought conditions: When price moves aggressively toward resistance, expect a potential reversal based on the market's daily range.

- 😀 Apply the same strategy to different assets: The method works universally across different instruments, not just stocks but also indexes and other assets.

- 😀 Follow a repeatable three-step process: Identify key levels, look for reversal candlestick patterns, and measure market range to define entries and exits.

- 😀 Target a 2:1 risk-to-reward ratio: Set your stop loss and target levels based on calculated premium levels to optimize your trades.

- 😀 Take advantage of pre-market insights: Pre-market price movements can help identify key levels and better prepare for market openings.

- 😀 Utilize the Gains Guide: A free resource provided by the trader that lays out premium levels for major indexes and stocks, enhancing your trading decisions.

Q & A

What is the main focus of the trading strategy described in the video?

-The strategy primarily focuses on using supply and demand levels, candlestick patterns (like the John Wick and engulfing candles), and range analysis (using ATR) to identify high-probability trade setups.

How does the concept of supply and demand impact trading decisions?

-Supply and demand levels serve as key areas where price reversals are likely to occur. Traders aim to buy at demand levels (support) and sell at supply levels (resistance), as these areas often coincide with market extremes.

What is the significance of the John Wick candle and engulfing candles in the strategy?

-The John Wick candle and engulfing candles are used to signal potential reversals at key supply and demand levels. A reversal is confirmed when these candlestick patterns appear after a price move into a premium selling or buying zone.

How is the Average True Range (ATR) used in the strategy?

-The ATR is used to assess the daily price range of an asset. By calculating the ATR, traders can determine if a price move is overextended, which can indicate a potential reversal when the price reaches the extremes of its daily range.

Why is it important to identify the highest seller and lowest buyer on a chart?

-Identifying the highest seller and lowest buyer helps pinpoint the premium levels of supply and demand, which are crucial for making entry and exit decisions. These levels represent areas where price may reverse due to market forces.

What role do pivot points play in the trading strategy?

-Pivot points help identify key support and resistance areas. By marking out multiple pivot points, traders can anticipate where price might reverse or break through, adding clarity to trade decisions.

How does the strategy use range extension for trade entries?

-Range extension refers to price movements that go beyond the average daily range. When price extends to these levels, traders look for reversal opportunities. For example, a range extension at a premium seller level could lead to a short entry.

What is the significance of a 2:1 risk/reward ratio in this trading approach?

-A 2:1 risk/reward ratio means that the trader is targeting a profit that is twice as large as the potential loss. This risk management strategy ensures that even if only half of the trades are successful, the trader can remain profitable.

How does the strategy apply to both stocks and indexes like NASDAQ?

-The strategy is universal and can be applied to any asset, including stocks and indexes like NASDAQ. The key is identifying supply and demand levels, using candlestick patterns, and analyzing range, all of which are relevant across different asset classes.

What is the purpose of the 'Gains Guide' mentioned in the video?

-The 'Gains Guide' is a free resource that provides pre-mapped premium levels for various assets, including major indexes and stocks. It helps traders quickly identify key levels for potential entries and exits.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

The " ONE CANDLE " Scalping Strategy I Will Use For Life

The BEST Candlestick Pattern Guide You'll Ever Find

Candlestick Trading? Tidak Perlu di Hafal!

Memahami Logika Chart Seperti Profssional Lewat Pola Candle + Price Action || Seni Membaca Market

Trading one candle is easy, actually | Determine Market Direction and Daily bias

How To Make +$2k Daily Trading Gold: Trading Strategy & Breakdown

5.0 / 5 (0 votes)