Procedimentos Contábeis Básicos

Summary

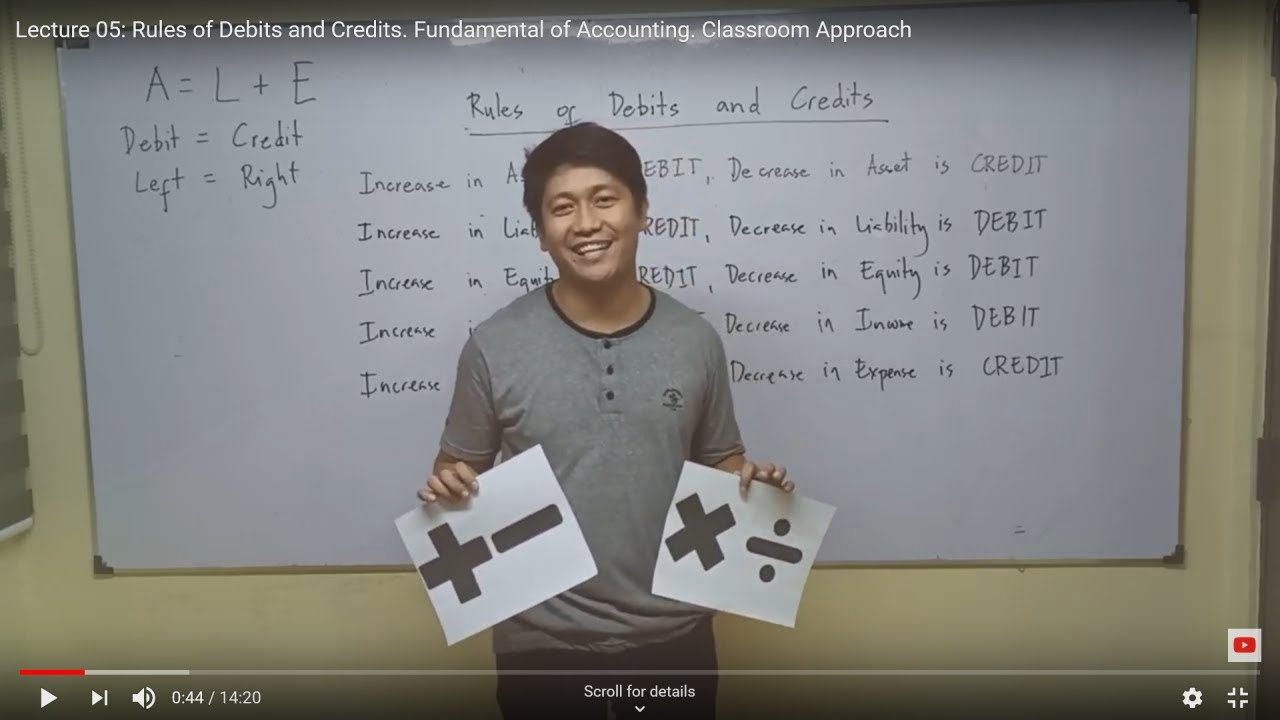

TLDRThis video lecture, presented by Denise, an accounting professor, introduces fundamental accounting principles, particularly focusing on debits and credits. Denise explains the importance of maintaining balance in accounting records, utilizing ledger accounts, and ensuring that every transaction follows the double-entry system. The lecture emphasizes how asset and liability accounts are managed, and how debits increase assets while credits increase liabilities and equity. Denise also highlights the role of technology in streamlining accounting processes, moving from traditional notebooks to digital tools, while reinforcing the core concepts of financial accounting.

Takeaways

- 😀 Accounting has evolved from manual bookkeeping to digital systems, improving efficiency and reducing errors.

- 😀 Double-entry accounting is fundamental, ensuring that every debit has a corresponding credit to maintain balance.

- 😀 The balance sheet represents two main categories: assets (left side) and liabilities and equity (right side).

- 😀 Debit entries increase asset accounts, while credit entries increase liability and equity accounts.

- 😀 When debiting assets, it means applying resources, while crediting liabilities and equity means showing the origin of funds.

- 😀 In modern accounting, ledger entries are used for each account, with individual controls for better organization and clarity.

- 😀 The importance of credit and debit balance is emphasized—both sides must always be equal to maintain the accuracy of the books.

- 😀 Accounting is more than just recording transactions; it involves logical reasoning to track resources and origins accurately.

- 😀 Simplification of accounting records helps reduce the complexity and time involved in tracking large volumes of transactions.

- 😀 Ledger accounts should be consistently updated and aligned with the balance sheet, ensuring the financial picture is accurate at all times.

- 😀 As you advance in accounting, the use of debits and credits becomes intuitive, and automation tools further streamline the process.

Q & A

What is the primary purpose of the balance sheet in accounting?

-The primary purpose of the balance sheet is to provide a snapshot of a company's financial position at a specific point in time. It shows the company's assets, liabilities, and equity, ensuring that the accounting system is in balance.

What is the double-entry accounting system?

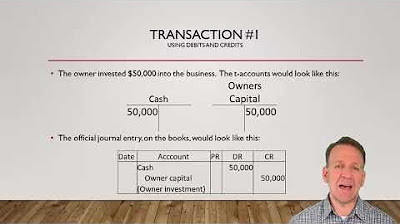

-The double-entry accounting system is a method where every financial transaction affects two accounts: one debit entry and one credit entry. The total of debits must always equal the total of credits to maintain balance in the accounting records.

How does a debit entry affect asset and liability accounts?

-A debit entry increases asset accounts and decreases liability accounts. In accounting, debits are used to record increases in assets and decreases in liabilities or equity.

How does a credit entry affect asset and liability accounts?

-A credit entry decreases asset accounts and increases liability or equity accounts. Credits are used to record increases in liabilities or equity and decreases in assets.

Why is it important to have equal debits and credits in every transaction?

-It is important to have equal debits and credits in every transaction because it ensures that the accounting records are balanced. This is a fundamental principle of the double-entry system, where every transaction affects both sides of the balance sheet equally.

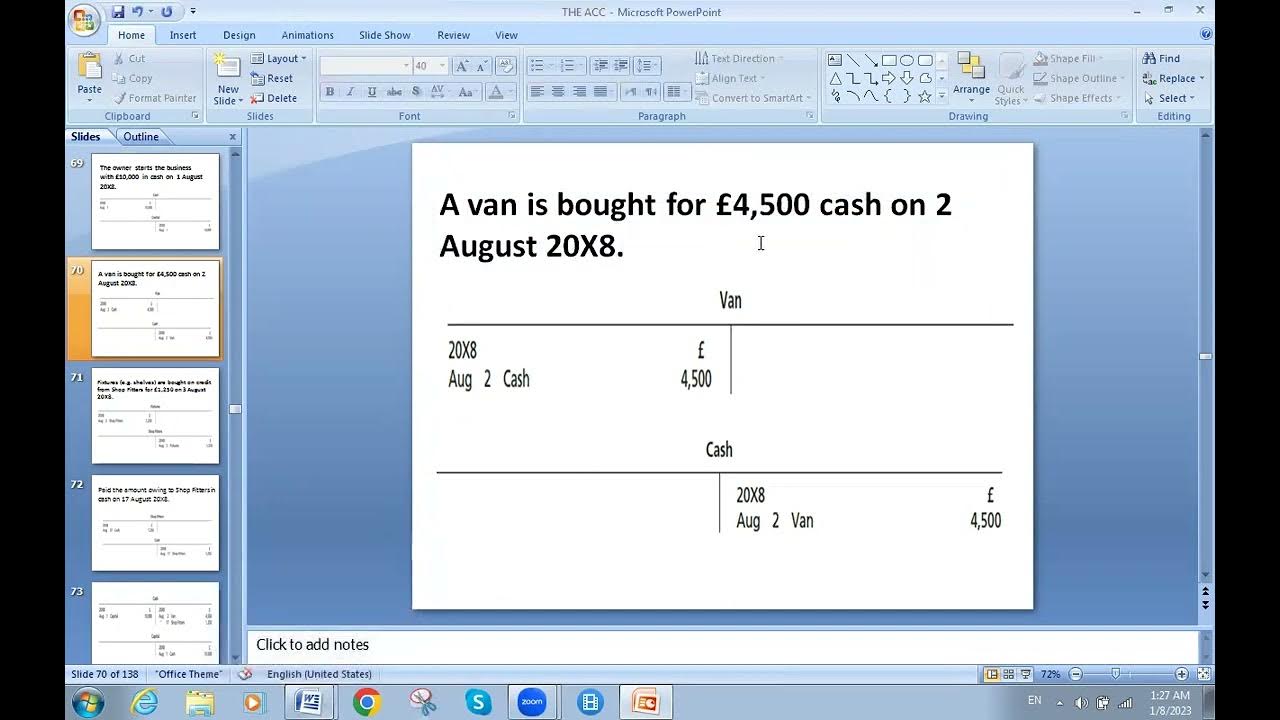

What role do ledgers play in accounting?

-Ledgers are used to record individual transactions for each account. Each account will have its own ledger where debits and credits are recorded, helping to track changes in the financial position of a business over time.

What happens if there is an imbalance between debits and credits in an accounting system?

-If there is an imbalance between debits and credits, it indicates an error in the accounting records. This could lead to discrepancies in the financial statements, which would need to be corrected to ensure accuracy.

What is the difference between assets, liabilities, and equity in a balance sheet?

-In a balance sheet, assets are resources owned by the company, liabilities are debts or obligations owed by the company, and equity represents the owner's stake in the company after liabilities are subtracted from assets.

How does the balance sheet help in understanding a company's financial health?

-The balance sheet helps assess a company's financial health by showing the relationship between its assets, liabilities, and equity. It provides insights into the company's ability to meet its obligations and the value of the owner's interest in the business.

What is meant by the 'debit increases asset' and 'credit increases liability' rule?

-This rule means that when a debit is recorded, it increases the asset account (because the company is gaining value), and when a credit is recorded, it increases the liability or equity account (because the company is taking on an obligation or increasing owner’s equity).

Outlines

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифMindmap

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифKeywords

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифHighlights

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифTranscripts

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифПосмотреть больше похожих видео

5.0 / 5 (0 votes)