8 ACC JOURNA STARTING AND BUYING

Summary

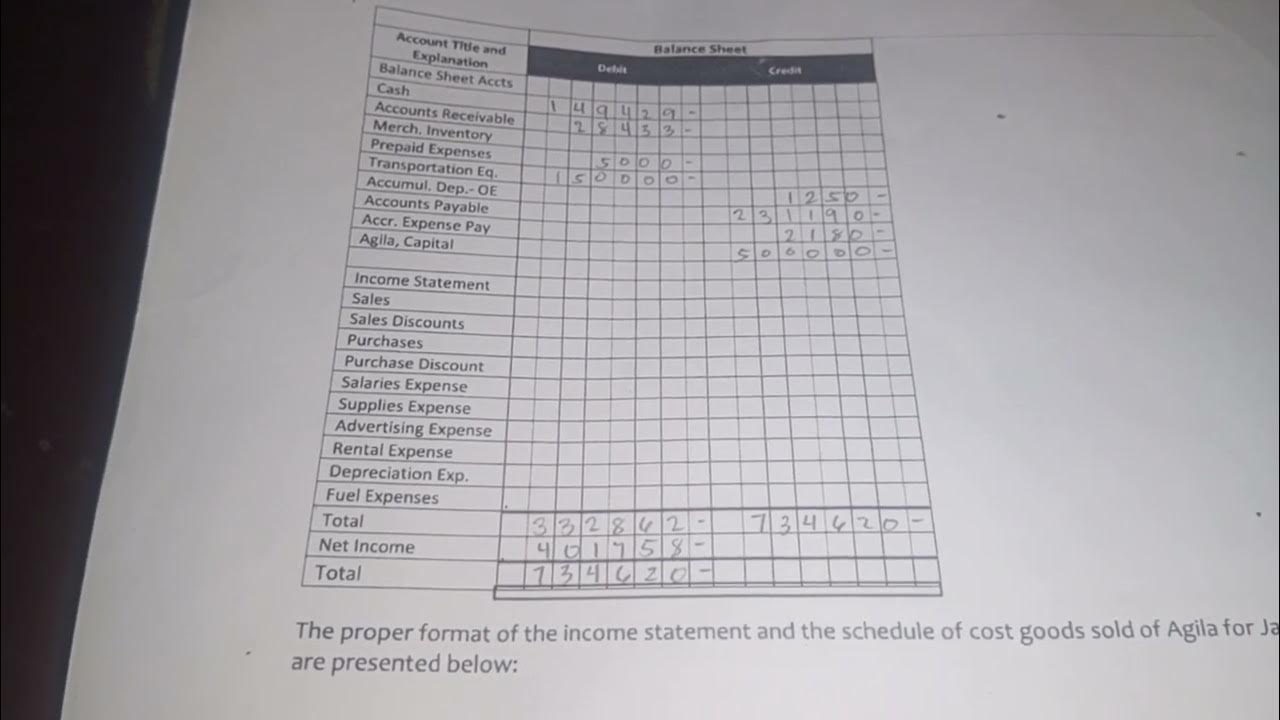

TLDRThis video lecture provides a comprehensive guide to the foundational accounting process, focusing on journal entries, ledger posting, and trial balance preparation. The instructor walks through key examples, such as starting a business with an initial cash deposit, purchasing assets like a van and a vehicle, and the necessary steps to record these transactions accurately. Emphasizing the rules of debits and credits, the lecture is designed to help students grasp the mechanics of financial recordkeeping, with practical exercises for deeper understanding and application of these essential accounting principles.

Takeaways

- 😀 Journal entries are the first step in the accounting process, where transactions are recorded by categorizing debits and credits.

- 😀 The accounting process follows three steps: journal entries, posting to the ledger, and preparing the trial balance.

- 😀 Debit entries represent an increase in assets or expenses, while credit entries indicate a decrease in assets or expenses, and an increase in liabilities or equity.

- 😀 For example, when a business starts, the owner's cash deposit increases the cash asset and capital equity, with the cash being debited and capital credited.

- 😀 The ledger is where journal entries are transferred to individual accounts for better organization and tracking of balances.

- 😀 The trial balance ensures the accuracy of journal entries by confirming that the total debits equal the total credits.

- 😀 When a business purchases an asset, like a van or vehicle, the transaction involves debiting the asset account (increasing its value) and crediting cash (decreasing its value).

- 😀 Descriptions for journal entries should include brief explanations of each transaction, such as 'owner starts business' or 'purchasing van for business.'

- 😀 The format for journal entries includes placing debits on the left side and credits on the right side, with the amounts clearly listed next to each.

- 😀 It's crucial to remember the correct transaction date to ensure the journal entry reflects the actual time of the business activity.

Q & A

What are the three main steps in the accounting process as outlined in the script?

-The three main steps in the accounting process are: 1) Journal Entries, 2) Ledger, and 3) Trial Balance.

What happens during the first step of the accounting process, Journal Entries?

-In the first step, Journal Entries, all transactions are recorded. This includes debiting and crediting accounts based on the transaction type, such as increasing cash or capital.

In accounting, what is the difference between a debit and a credit?

-A debit increases assets and decreases liabilities or equity, while a credit decreases assets and increases liabilities or equity.

What does the term 'Ledger' refer to in the accounting process?

-The Ledger is the second step in the accounting process, where journal entries are posted to specific accounts to classify and summarize the transactions.

Why is it important to include a description with each journal entry?

-Including a description with each journal entry is important for clarity, as it explains the nature of the transaction and provides context for future reference.

What is the significance of the Trial Balance in accounting?

-The Trial Balance is the final step in the accounting process, ensuring that the debits and credits balance, which helps in identifying any errors before preparing financial statements.

How should a business owner record the investment of cash into their business?

-When a business owner invests cash into the business, they should debit the Cash account (increasing assets) and credit the Capital account (increasing owner’s equity).

What should be recorded when a business purchases an asset like a van using cash?

-When a business buys an asset like a van for cash, the Van account should be debited (increasing assets), and the Cash account should be credited (decreasing assets).

What is the accounting treatment when a business purchases a vehicle using cash?

-When a business purchases a vehicle with cash, the Vehicle account is debited (increasing assets), and the Cash account is credited (decreasing assets).

Why does the script emphasize 'cash' in the purchase transactions?

-The script emphasizes 'cash' because it affects the cash balance directly. In cash transactions, cash is decreased, which must be recorded as a credit, while the asset purchased is recorded as a debit.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

TRIAL BALANCE CHAPTER -14 T.S.Grewal Solution question number -2 Class-11 accounts session (2022)

Studi Kasus Jurnal, Posting, Neraca Saldo

Financial Accounting Chapter-4 | Trial Balance | BCom/BBA 1st Year | CWG for BCOM

November 15, 2024

MEMBUAT JURNAL UMUM, BUKU BESAR, NERACA SALDO

Process and Basis of Accounting | Class 11 | Accountancy | One Shot

5.0 / 5 (0 votes)