V5 | Backtesting

Summary

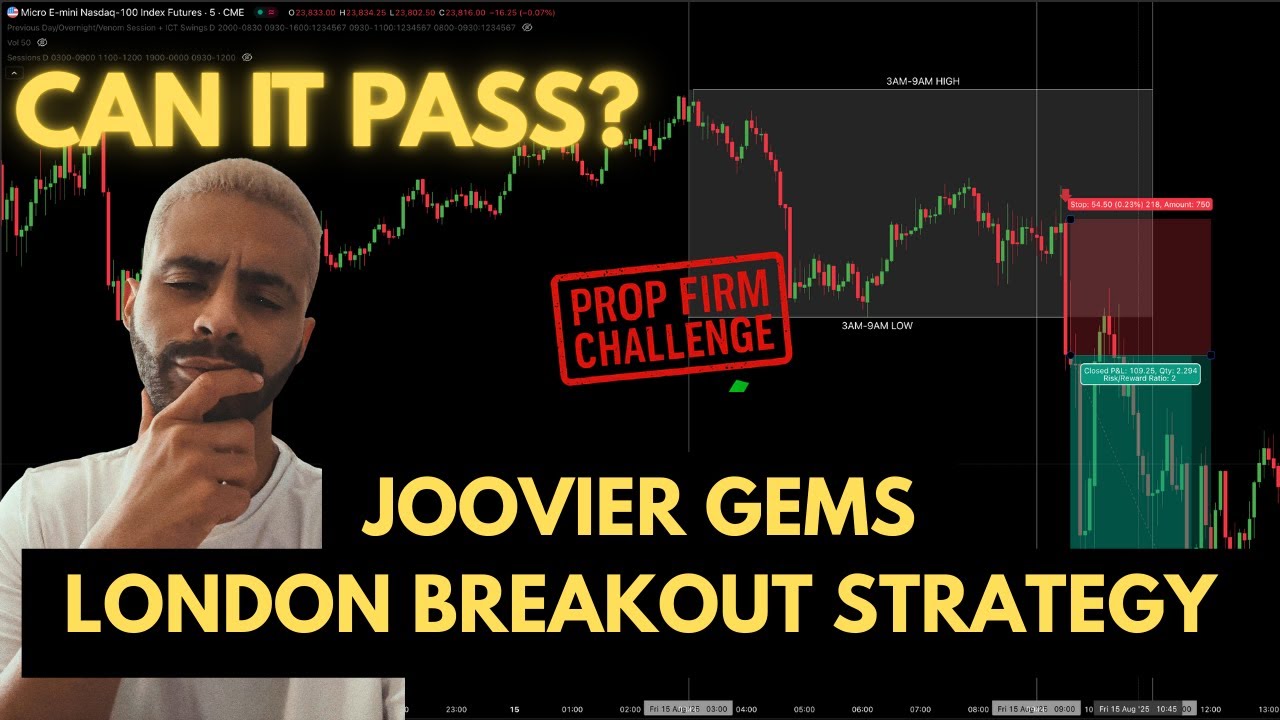

TLDRIn this video, the speaker demonstrates the process of testing a swing trading strategy using FX Replay. They walk through setting up a new session, configuring necessary settings, and applying key tags to analyze market conditions, entries, and emotional factors. The focus is on identifying trading opportunities by assessing price movements and confirming setups with specific indicators. The speaker emphasizes strategy testing through practical examples, documenting trades, and analyzing results for future improvement. Ultimately, the goal is to refine the approach and gather valuable data for better decision-making in the trading strategy.

Takeaways

- 😀 Set up a new FX replay session with specific trading pairs (GBP/USD) and timeframes for testing strategies.

- 😀 Tags are created to track important aspects of trades, including market conditions, entry models, draw targets, and emotions.

- 😀 The strategy focuses on understanding market conditions such as whether the market is in a range, discount, or equilibrium.

- 😀 The ICT indicator is used to highlight critical elements like the midnight open, fair value gaps, and past four-week sessions.

- 😀 Trade decisions are made based on technical analysis, such as fair value gaps, liquidity sweeps, and specific price levels.

- 😀 A trade journal is maintained with detailed screenshots and tags to record and review trading performance.

- 😀 Confidence levels are tracked, and emotions such as hesitation or confidence are categorized to assess their impact on trade execution.

- 😀 Draw targets are defined in relation to internal and external liquidity, helping traders identify areas to target in future trades.

- 😀 The entry strategy involves waiting for price confirmation on the 1-hour chart before executing trades.

- 😀 The user plans to run 30 trades in total, gather data from each, and refine the strategy based on performance insights.

Q & A

What is the first step in setting up the FX replay session?

-The first step is creating a new session in FX replay, naming it (e.g., 'gu swing'), and selecting the currency pair (e.g., GBP/USD) to trade. You also choose the timeframe and advanced settings such as enabling spreads and commissions.

Why are spreads and commissions enabled in the FX replay session?

-Spreads and commissions are enabled to simulate realistic trading conditions, as brokers typically charge a spread and commission for each trade. This helps to reflect real-life trading costs.

How are tags used in the strategy testing process?

-Tags are used to categorize different market conditions, entry models, draw hits, and emotions. They help in tracking and analyzing trades, making it easier to identify patterns and assess performance over time.

What are the key categories for creating tags?

-The key categories for creating tags include market conditions (e.g., trend, range, premium, discount), entry model (e.g., entry time and timeframe), draw (whether the draw target has been hit), and emotions (e.g., confident, hesitant).

How do market conditions affect the strategy execution?

-Market conditions, such as whether the price is in a trend, range, or at a discount or premium, help inform trade decisions. For example, if the price is in a discount, it might suggest a buying opportunity, while a premium could indicate a potential sell.

What role does the higher timeframe play in the strategy?

-The higher timeframe helps identify key levels, such as points of interest and liquidity, that guide trade decisions. The user looks for significant levels on the daily chart, like the 50% retracement of a swing, to inform their trading strategy on lower timeframes.

What is the significance of a fair value gap in the strategy?

-A fair value gap is an area on the chart where price moves quickly and leaves a gap. It is considered a potential area for price to retrace to, providing entry points for trades. In the video, the user uses these gaps in conjunction with other factors like liquidity sweeps and swing highs.

Why does the user wait for confirmation before entering a trade?

-The user waits for confirmation, such as a liquidity sweep or a retracement to key levels, to ensure that the market has aligned with their expectations. This helps increase the probability of success by waiting for a clear entry signal.

How does the user manage emotions when trading?

-The user tracks their emotional state through tags, noting if they feel confident, hesitant, or neutral. Emotional awareness helps the user make more objective decisions and stay disciplined during the trading process.

What is the importance of journaling each trade?

-Journaling each trade allows the user to record important details like entry points, draw levels, and emotional states. This process helps to track performance, identify patterns, and refine the strategy over time. It also provides a way to analyze trades later for improvement.

Outlines

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифMindmap

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифKeywords

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифHighlights

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифTranscripts

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифПосмотреть больше похожих видео

Backtesting a Simple ICT Entry Model Using FX Replay!

ICT Silver Bullet Strategy - No Daily Bias | With Backtest!

Replay Market Data

Fibonacci Trading - Complete Guide & Settings

Prop Firm Strategy Backtest - Joovier Gems - CAN IT PASS?

How To Trade Smart Money Concepts | LuxAlgo Full 2025 Updated Guide and Trading Strategy

5.0 / 5 (0 votes)