ICT Market Maker Model - Live Trade Explanation

Summary

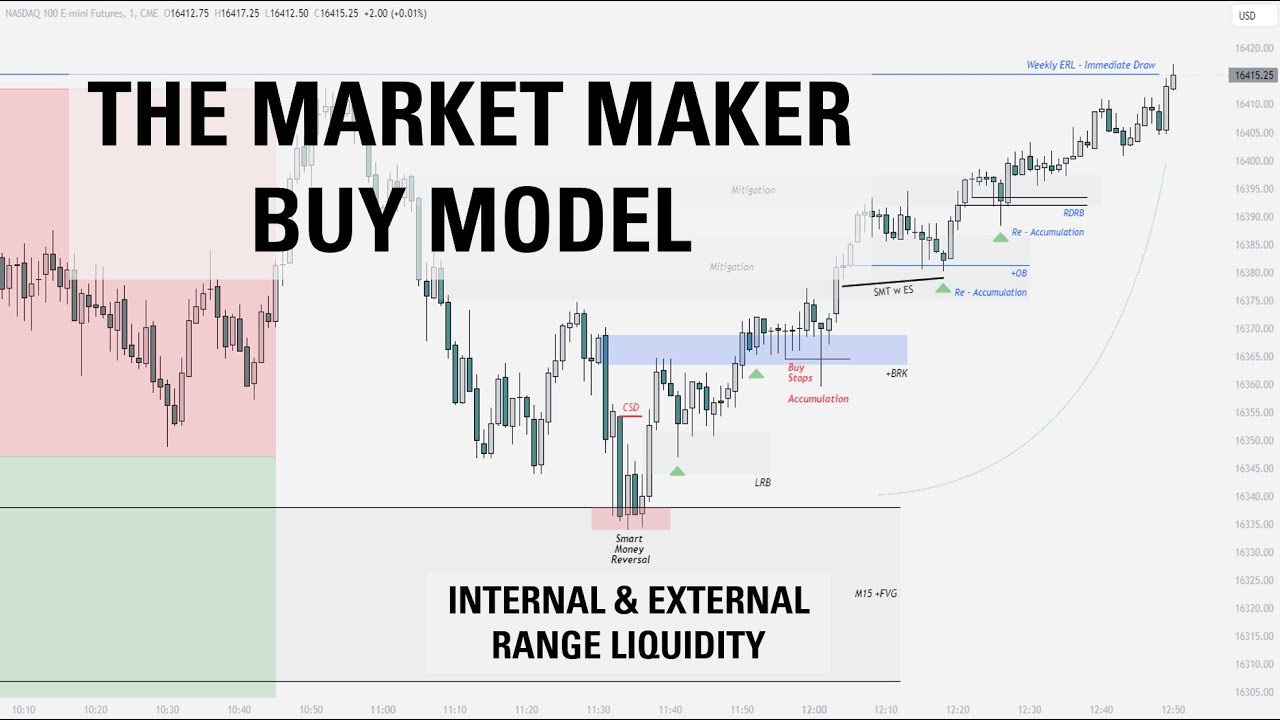

TLDRIn this video, the speaker demonstrates how to trade using the market maker buy model, focusing on identifying key liquidity zones and fair value gaps. The speaker explains their process for spotting buy stops, smart money reversals, and understanding market delivery shifts, with a detailed breakdown of higher and lower time frames. Emphasis is placed on using price patterns like fair value gaps, order blocks, and market structure shifts to enter trades. Throughout, the speaker shares insights from personal experience, including the importance of probabilities, patience, and data collection for refining trading strategies.

Takeaways

- 😀 Identify the Market Maker Buy Model by looking for the original consolidation and liquidity engineering. This is key to understanding price movement.

- 😀 Market Maker Buy Models rely on creating liquidity by engineering buy stops, which retail traders often place above old highs. Price often moves toward these buy stops before reversing.

- 😀 Higher time frames (like the 4H chart) help identify bullish trends, fair value gaps, and important price areas for trading opportunities.

- 😀 Price respecting bullish PD arrays (fair value gaps, order blocks, etc.) signals a continuation of the bullish trend, while bearish PD arrays indicate a lack of respect for the bearish trend.

- 😀 Use the concept of a market structure shift to identify Smart Money Reversals. These shifts signal a move from bearish to bullish or vice versa.

- 😀 In the case of a Smart Money Reversal, look for price to retrace into a fair value gap or order block, then expand away from it for confirmation of a reversal.

- 😀 Mark higher time frame PD arrays to locate potential Smart Money Reversals, like bullish fair value gaps or order blocks, on the lower time frame.

- 😀 A low-risk buy point can be found after price retraces into a fair value gap, creates a reaccumulation, and then starts to expand upwards.

- 😀 Use the concept of propulsion blocks and order blocks that have retested each other for strong areas of support. These areas typically signal higher price movement.

- 😀 When trading the Market Maker Buy Model, focus on taking trades at logical price points where your stop loss would invalidate the entire idea, rather than unnecessarily tight stop placements.

Q & A

What is the Market Maker Buy model discussed in the video?

-The Market Maker Buy model is a trading strategy that identifies areas where market makers engineer liquidity to reverse the market from a bearish to a bullish phase. It involves observing price movements, such as retracements, fair value gaps, and market structure shifts, to find low-risk buy points.

Why is the level at 4614 and a quarter significant in the trade?

-The level at 4614 and a quarter is where buy stops are resting, and it represents a key price point that market makers target. The price is expected to draw into this level, as retail traders typically place their stops above these old highs, which market makers can use to engineer liquidity.

What does 'smart money reversal' mean in this context?

-'Smart money reversal' refers to the point in the market where institutional traders (smart money) reverse the market's direction. It typically happens after price has engineered liquidity and cleared out certain price levels. This reversal is often signaled by price moving away from certain consolidation zones or previous highs and lows.

What role do PD arrays play in the strategy?

-PD arrays, such as fair value gaps, order blocks, and breaker blocks, are used to identify key price levels where the market is likely to react. Bullish PD arrays are respected when price is in a buy program, while bearish PD arrays are often disrespected. These arrays help traders identify areas where smart money is expected to enter or reverse the market.

How do higher timeframes help in identifying trade opportunities?

-Higher timeframes, such as the 4-hour chart, provide a broader view of the market's trend and program. By observing how price reacts to significant levels like fair value gaps or previous highs and lows, traders can gauge the direction of the market and look for lower-risk entry points in line with the higher timeframe's trend.

What does the concept of 'liquidity engineering' mean in this model?

-Liquidity engineering refers to the process where market makers move price in a way that induces retail traders to place stop orders in certain areas, such as above old highs or below old lows. These areas are then targeted to collect liquidity, which is used to drive price in the opposite direction, often resulting in a reversal or breakout.

Why does the trader prefer a reaccumulation phase in a Market Maker Buy model?

-The reaccumulation phase provides a low-risk buy point where price retraces after an initial expansion. This phase offers traders an opportunity to enter the market at a better price before the next leg of the bullish move, based on the belief that the market will continue its upward trajectory.

How does the trader use the concept of a 'protected low' in this strategy?

-A protected low is identified once the market has moved above previous highs and created an imbalance or fair value gap. This low is considered safe from being taken out because the liquidity beneath it has already been captured by the smart money, making it less likely for the market to revisit this level.

What is the significance of a 'market structure shift' in the trading strategy?

-A market structure shift occurs when price breaks a significant high or low, indicating a change in trend direction. This shift is often accompanied by a fair value gap, and it signals that the market is likely to transition from a bearish to a bullish trend, which is key for identifying a low-risk entry point.

Why does the trader emphasize not trading every reversal point?

-The trader emphasizes not trading every reversal point because doing so can waste mental capital and lead to overtrading. Instead, the focus should be on identifying clear, high-probability setups based on the Market Maker Buy model, where there is a higher chance of success, and managing risk accordingly.

Outlines

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифMindmap

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифKeywords

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифHighlights

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифTranscripts

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифПосмотреть больше похожих видео

How To Spot the Bottom of ICT's Market Maker Model

Master these 3 Concepts and you will be Profitable

ICT Market Maker Models simplified in 9 Minutes

The Market Maker Buy Model | Full Trade Breakdown $NQ

HOW TO TRADE THE MARKET MAKER X MODEL without BIAS! trade RECAP pt.9 (detailed explanation)

How to Trade the ICT Market Maker Model (LIVE)

5.0 / 5 (0 votes)