Finance: The History of Money (combined)

Summary

TLDRThis script offers a concise history of money, from its early forms like whale's teeth to modern digital currencies. It explores the evolution of money through metal coins, paper money, and the concept of debt. It discusses the significance of trust in currency value, the impact of money supply on inflation, and the role of money in international relations and banking. The script also touches on the power dynamics of money and speculates on the future of currency in a digital age.

Takeaways

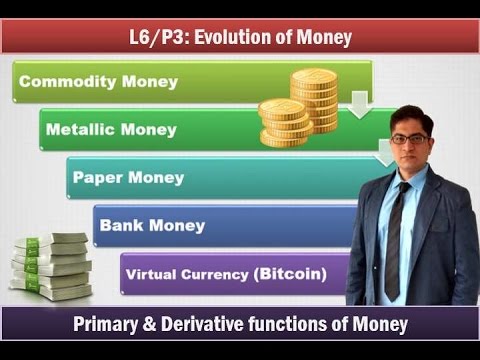

- 🏔️ Early Money: Before money was invented, people bartered goods and services and used tally systems to keep track of exchanges.

- 🐳 Whale's Teeth IOU: As communities grew, people used objects like whale's teeth as a form of IOU to facilitate trade and store value.

- 🏺 Metal Money: Metals like gold and silver were used for coins due to their portability, durability, divisibility, and intrinsic value.

- 📉 Debased Currency: Rulers often devalued their currency by reducing the metal content or mixing cheaper metals to create more money.

- 📜 Paper Money: The Chinese invented paper money as a lighter alternative to metal coins for long-distance trade.

- 🔗 Gold Standard: Paper money's value was linked to gold to create a standard for exchange rates, but this was eventually abandoned for flexible rates.

- 🏝️ Yap Stone Money: The Yap islanders used large stones as money, which led to a form of banking when promissory notes were issued against the stones' value.

- 📈 Money and Inflation: The influx of gold from Spanish colonies led to inflation, illustrating the relationship between money supply and prices.

- 🌐 International Money: The British forced American colonies to use pounds, leading to the American Revolution and the creation of the US dollar.

- 🏦 Fractional Reserve Banking: Banks can lend more money than they hold in deposits, a practice known as fractional reserve banking.

- 💵 Money Creation: Banks create money through loans, while governments can create it by issuing bonds, affecting the economy differently.

- 💸 Power of Money: The US dollar retains its value through trust and the widespread holding of dollar assets, despite not being backed by a physical commodity.

- 💳 Future Money: Digital currencies like Bitcoin are emerging, potentially challenging traditional government-backed money.

Q & A

What was the primary method of exchange before money was invented?

-Before money was invented, people exchanged goods and services in small communities, relying on memory and tallies to keep track of who owed what.

Why did people start using objects like whale's teeth as a form of money?

-As communities grew and exchanges became more complex, people used objects like whale's teeth as IOU tokens to facilitate trade and store purchasing power for future use.

What were some of the drawbacks of early forms of money like barley, shells, or feathers?

-Barley was heavy and not portable, whale's teeth weren't divisible, shells were not scarce, and feathers had little intrinsic value, making them impractical for trade outside of local communities.

How did metal coins become a standard form of money?

-Metal coins were introduced by rulers who minted them with an emblem that guaranteed their weight and value, making them durable, portable, divisible, and useful for trade beyond local communities.

Why did early Chinese rulers introduce paper money?

-Chinese rulers introduced paper money as a more convenient alternative to carrying large quantities of heavy metal coins, particularly for long-distance trade.

What role did trust play in the use of paper money?

-People trusted that paper money was worth what it claimed to be, as it could be exchanged for the gold, silver, or coins it represented, even though the paper itself had no intrinsic value.

How did fractional reserve banking change the banking industry?

-Fractional reserve banking allowed banks to lend out more money than they had in deposits, as long as all depositors didn't ask for their money at once, significantly increasing the money supply.

What led to inflation in 16th century Spain after acquiring precious metals from the colonies?

-Inflation occurred in Spain because the influx of new precious metals increased purchasing power, but traders raised prices, meaning the additional wealth did not result in better economic conditions.

What is the significance of the US dollar as a reserve currency?

-The US dollar became the most widely used reserve currency due to America's vast trade network and stable tax base, with many countries, including Britain, holding large reserves of dollars.

What could signal the importance of new digital currencies like Bitcoin in the future?

-A sign that digital currencies like Bitcoin have become important would be if governments started accepting them for taxes or if banks began lending in them, indicating broader financial integration.

Outlines

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифMindmap

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифKeywords

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифHighlights

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифTranscripts

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифПосмотреть больше похожих видео

The Evolution of Money Explained

The Fascinating History of Money: From Bartering to Modern Currency

Do SAL ao BITCOIN: a evolução do dinheiro

Uang dan Lembaga Keuangan

KENAPA KERTAS BISA JADI UANG? Sejarah Gila Uang Dari Dulu Sampai Sekarang! | Learning By Googling

L3/P7: Money- Evolution, Types and functions

5.0 / 5 (0 votes)