The Evolution of Money Explained

Summary

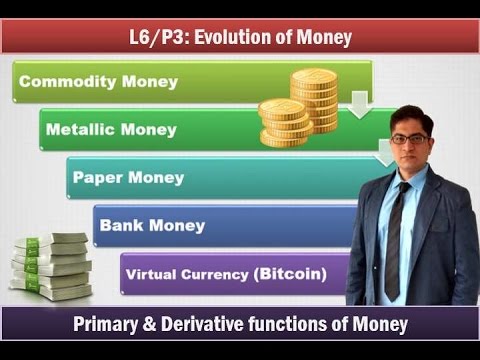

TLDRThis video script explores the evolution of money from its earliest forms in ancient civilizations to modern digital currencies. It traces the shift from bartering to the use of metals, the emergence of coinage, and the development of paper money and banknotes. Highlighting innovations like the Islamic Golden Age's economic concepts and the advent of cryptocurrencies and blockchain, it showcases how money has constantly adapted to human needs and technological advancements.

Takeaways

- 💡 The concept of money is arbitrary and its value is assigned by human society.

- 🌏 Trade has been a fundamental part of human civilization since ancient times, seen in societies like Egypt, China, and Sumer.

- 🔄 The shift from hunter-gatherer culture to a cooperative one was crucial for the development of human civilization and specialization.

- 🏭 Specialization in industries is a modern reflection of the ancient principle of people with different talents working together for collective success.

- 📚 The history of money is largely based on conjecture and logical inference due to the lack of ancient records.

- 📦 The barter system, where goods were exchanged based on their intrinsic value, was the earliest form of trade.

- 📉 The barter system had flaws, such as the absence of standardized valuation, leading to inefficient trading processes.

- 🏺 Ancient tokens made from clay and other materials were used as early forms of currency in Mesopotamia, Egypt, China, and India.

- 🗓 The first metallic coins appeared around the 7th century BCE, with China and India being among the first to mint coins.

- 🌐 The introduction of standardized currency facilitated trade and contributed to the wealth of empires like Lydia.

- 🛠 Metals like silver and gold became common currencies due to their intrinsic value and ease of verification.

- 🏦 The evolution of money includes the development of banknotes and representative money, culminating in digital currencies and blockchain technology.

- 💳 The advent of credit and debit cards in the 20th century and the rise of cryptocurrencies in the 21st century reflect the ongoing transformation of money.

- 🔑 Blockchain technology, underlying cryptocurrencies, is revolutionary due to its decentralized and immutable nature, distributing control among users.

Q & A

What is the fundamental concept of money as discussed in the script?

-The script suggests that the concept of money is entirely arbitrary, meaning its value is assigned by humans and can vary, as exemplified by both a credit card and a $100 bill.

How did trade play a role in the development of human civilization?

-Trade has been a cornerstone of human civilization, as seen in ancient societies such as Egypt, China, India, and Sumer, where it facilitated the specialization of tasks and the flourishing of early cities.

What was the hunter-gatherer culture's approach to survival?

-The hunter-gatherer culture was based on the principle of 'survival of the fittest,' where people operated primarily on an individual or tribal basis without realizing the benefits of collective work.

How did the specialization of tasks contribute to the advancement of human society?

-Specialization allowed people with different talents and abilities to work together, leading to the development of more complex societies and the establishment of the first cities, as seen in Mesopotamia.

What are the main flaws of the barter system as mentioned in the script?

-The barter system had issues with the lack of standardized valuation of goods, making trades time-consuming and inefficient, as goods were exchanged based on their intrinsic value rather than an assigned value.

When did the use of metallic coins as currency begin?

-The script mentions that the system of metallic coins began to emerge around the 7th century BCE, with instances of coin minting in China and the introduction of official currency in Lydia around 600 BCE.

What is the significance of the discovery of clay tokens in ancient civilizations?

-Clay tokens found in ancient Babylon, Egypt, China, and India were used to assign values against stored goods, indicating an early form of representational currency before the advent of metallic coins.

How did the introduction of standardized currency impact the Lydian empire?

-The introduction of standardized currency helped Lydia become one of the wealthiest empires in the region by facilitating trade and establishing a reliable medium of exchange.

What economic concepts were introduced during the Islamic Golden Age?

-The medieval Islamic world introduced concepts such as checks, transactional and savings accounts, exchange rates, bank loans, deposits, and the transfer of debt and credit, which are foundational to modern economics.

What was the significance of the 'Nixon shock' in the history of money?

-The 'Nixon shock' in the 1970s marked the end of the gold conversion system, leading to the value of the dollar being determined by the market rather than being pegged to gold reserves.

How does the script describe the evolution of money from its earliest forms to digital currencies?

-The script describes a progression from bartering valuable goods, to using metals as currency, then to standardized coins, paper money, banknotes, and finally to digital currencies and mobile payments, highlighting the continuous evolution and adaptation of money to suit human needs and technological advancements.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

The Fascinating History of Money: From Bartering to Modern Currency

Finance: The History of Money (combined)

Do SAL ao BITCOIN: a evolução do dinheiro

Historia de la literatura PARTE 1: El origen de las letras

L3/P7: Money- Evolution, Types and functions

Teknologi Informasi dan komunikasi (TIK) - Materi Prakarya kelas 8 bab 2

5.0 / 5 (0 votes)