Why Charlie Munger HATED EBITDA

Summary

TLDRIn this video, financial educator Brian Feroldi explains the concept of EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization), a financial metric commonly used by businesses and investors to gauge cash flow. He details how EBITDA is calculated, its origin with cable mogul John Malone, and its growing popularity on Wall Street. However, Warren Buffett and Charlie Munger criticize EBITDA due to its exclusion of important expenses like depreciation, taxes, and interest, and its potential for manipulation. Feroldi emphasizes why Buffett and Munger prefer alternative financial metrics to assess a company's true earnings power.

Takeaways

- 😀 EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortization, and is used to measure a company's profits.

- 😀 EBITDA is a non-GAAP term, meaning it does not comply with generally accepted accounting principles and won't be listed on most financial statements.

- 😀 EBITDA is calculated by adding back interest, taxes, depreciation, and amortization to a company's EBIT (Earnings Before Interest and Taxes).

- 😀 Depreciation is the process of spreading the cost of a tangible asset (e.g., machinery, car, or building) over its useful life.

- 😀 Amortization is similar to depreciation, but it applies to intangible assets (e.g., patents or loans).

- 😀 EBITDA excludes non-cash charges like depreciation and amortization, making it easier to estimate cash flow generated by a company.

- 😀 John Malone popularized EBITDA as a way to assess cash flow, especially when interest and taxes are manipulated or significant.

- 😀 EBITDA became popular because it helps compare companies with different capital structures by excluding interest expenses.

- 😀 Warren Buffett and Charlie Munger criticize EBITDA for ignoring important costs like depreciation, interest, and taxes.

- 😀 Buffett and Munger also warn that EBITDA can be manipulated by CFOs, potentially hiding problems with a company’s financial health.

- 😀 Buffett and Munger prefer using other financial metrics such as gross margin, return on equity, and owner earnings to evaluate companies.

Q & A

What does EBITDA stand for, and what is its purpose?

-EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortization. It is used as an alternative way to measure a company's profits, and many people use it to estimate how much cash flow a business is generating over a specific period.

Why is EBITDA considered a non-GAAP term?

-EBITDA is considered a non-GAAP (Generally Accepted Accounting Principles) term because it does not comply with the standardized accounting principles. Therefore, you won't typically find EBITDA listed directly on most companies' financial statements.

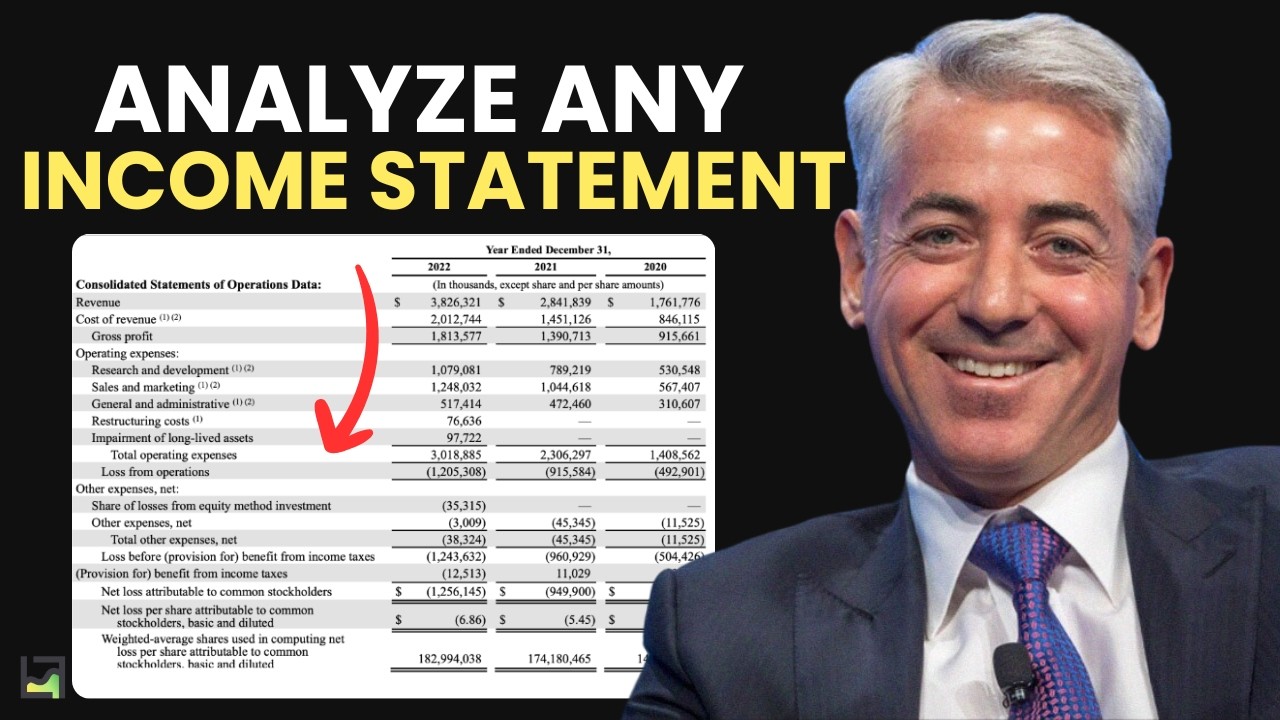

How can you calculate EBITDA?

-To calculate EBITDA, you start with a company's operating income (EBIT), which is its earnings before interest and taxes. Then, you add back depreciation and amortization expenses, which are non-cash charges that don't affect the company's cash flow.

What is the difference between depreciation and amortization?

-Depreciation is the process of allocating the cost of tangible assets, like buildings or equipment, over their useful life, while amortization is similar but applies to intangible assets, such as patents or loans.

Why did John Malone popularize the use of EBITDA?

-John Malone used EBITDA to help his business, especially when borrowing money from banks. By focusing on EBITDA instead of net income, he could present his company's financials more favorably and secure large loans, which helped him grow his cable company empire.

How does EBITDA help compare companies with different capital structures?

-EBITDA is useful for comparing companies with different capital structures because it excludes interest expense. This allows for a more accurate comparison of operational performance, as companies with different levels of debt won’t be affected by interest expenses.

What is one of the main criticisms that Warren Buffett and Charlie Munger have regarding EBITDA?

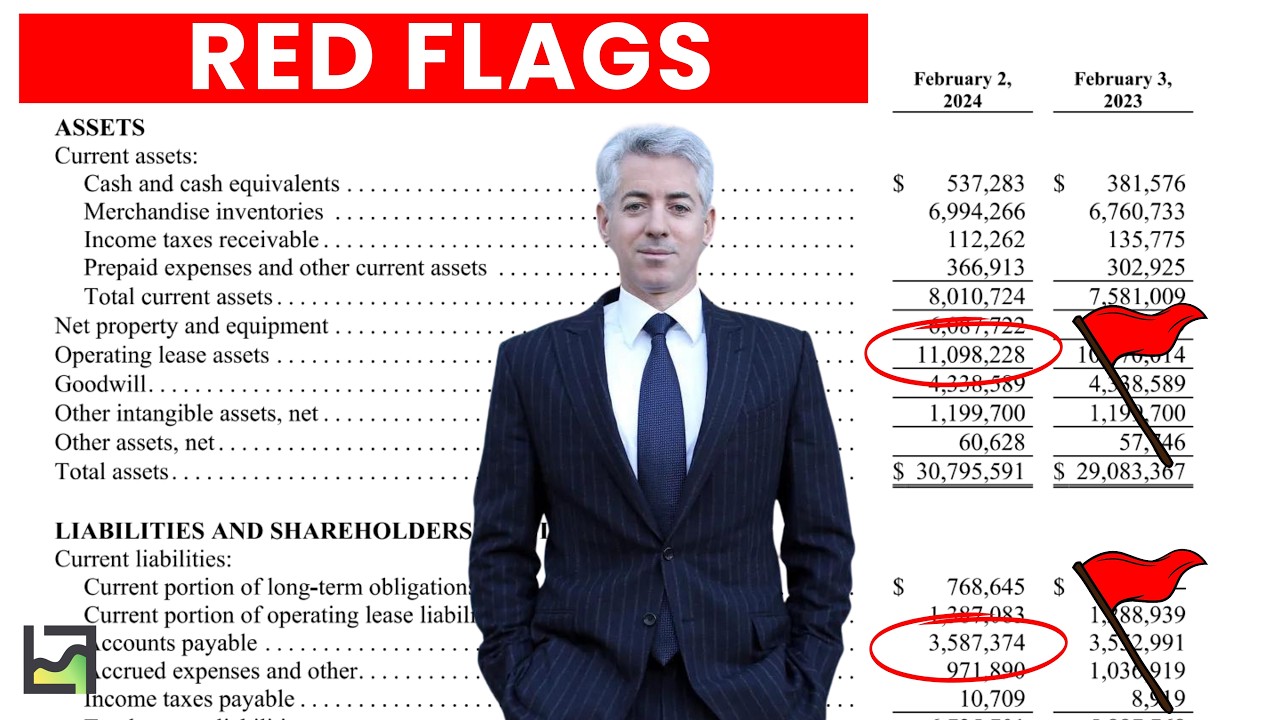

-One major criticism is that EBITDA ignores depreciation, which Buffett and Munger argue is a real expense because it reflects the decline in value of tangible assets. They believe it is misleading to exclude depreciation from the calculation of profits.

What other costs does EBITDA ignore that might be important?

-EBITDA ignores several real business costs such as income taxes, interest payments, stock-based compensation, and restructuring expenses. Depending on the business, these can be significant factors in determining a company's profitability.

Why do Buffett and Munger argue that EBITDA is easier to manipulate?

-EBITDA can be manipulated more easily by skilled CFOs because it is not standardized. Companies can adjust the way they report expenses, potentially presenting a more favorable view of their financial health. This lack of transparency is concerning for Buffett and Munger.

What financial metrics do Warren Buffett and Charlie Munger prefer over EBITDA?

-Instead of EBITDA, Buffett and Munger prefer using metrics like gross margin, return on equity, and owner earnings, as these provide a clearer and more accurate picture of a company’s earnings potential and financial health.

Outlines

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифMindmap

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифKeywords

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифHighlights

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифTranscripts

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тариф5.0 / 5 (0 votes)