Energy Storage Excel Financial Model

Summary

TLDRDog Business Consultants present an energy storage Excel financial model designed for energy storage businesses. The model includes an input sheet for assumptions, a revenue analysis, financial statements, a dashboard, and various financial schedules such as depreciation, loan amortization, and a startup summary. It also features monthly profit and loss statements, cash flow statements, break-even analysis, project evaluation, sensitivity analysis, and key performance indicators (KPIs). The model aims to provide a comprehensive visual and analytical representation of the financial performance of energy storage businesses.

Takeaways

- 📊 Dog Business Consultants introduce a new energy storage financial model in Excel, designed for energy storage businesses.

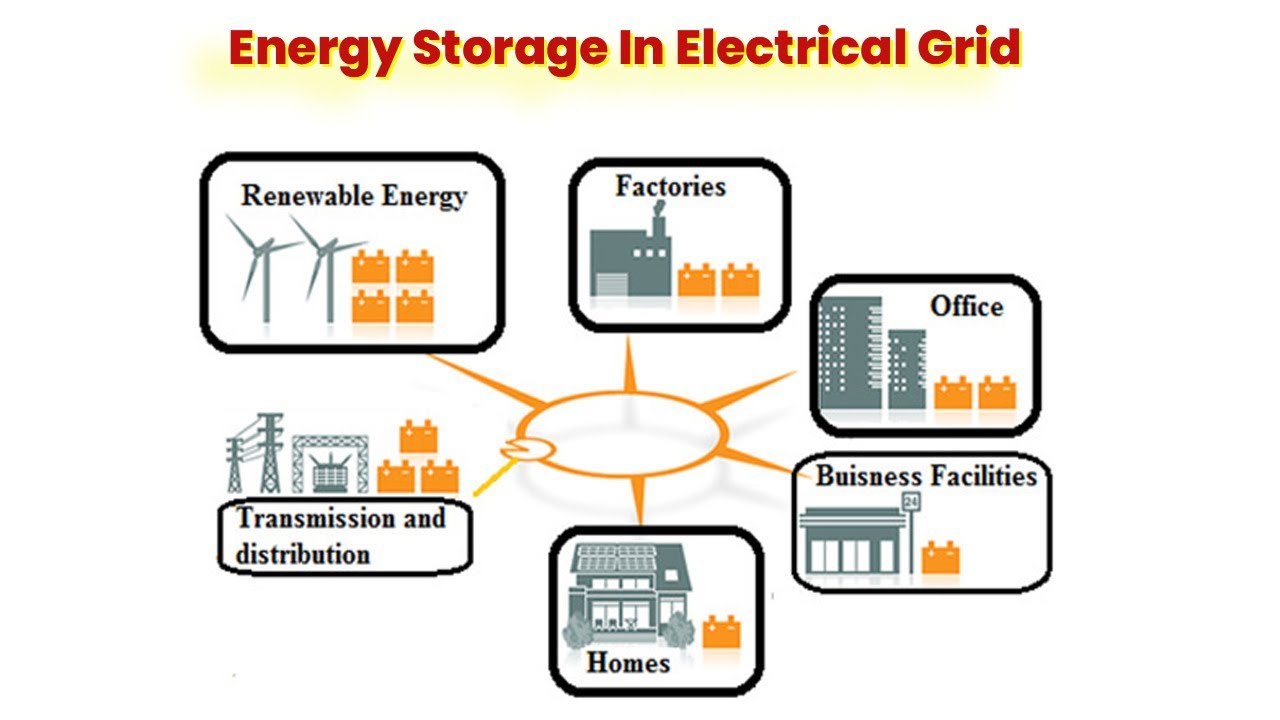

- ⚡ Energy is purchased, stored based on demand and capacity, then sold to consumers.

- 📋 The table of contents includes input sheet, revenue analysis, financial statements, and a dashboard for visual representation of financial performance.

- 📝 The input sheet covers assumptions for capital structure, cost and price of revenue streams, monthly payroll, operating expenses, capital expenditure, and receivable/payable days.

- 💡 The revenue analysis sheet includes available capacity in kilowatt-hours, usable energy transmission per month, revenue from each stream, and total cost of services.

- 📉 The depreciation and loan amortization schedule details asset value reduction over five years and monthly principal and interest payments.

- 💼 The startup summary estimates first-year investment needs, with a graphical representation of total cost and fund utilization.

- 📈 The monthly profit and loss statement outlines revenue, cost of services, operating expenses, and net income before and after taxes.

- 💵 The cash flow statement shows net cash flows from operating, investing, and financing activities, along with a working capital table for account receivable and payable amounts.

- ⚖️ The statement of financial position details assets, equity, and liabilities for the year ended, while the break-even analysis indicates the point where costs and income are equal.

- 📊 The project evaluation includes company valuation at year 0, fundroid analysis, and minimum investment required.

- 🔍 The sensitivity analysis compares company valuation in actual, optimistic, and worst-case scenarios.

- 📊 The KPIs and ratios cover profitability, liquidity, solvency, and efficiency, with graphical illustrations.

- 📊 The dashboard displays key financial metrics and graphical representations for better understanding of performance measures.

Q & A

What is the main purpose of the energy storage Excel financial model?

-The main purpose of the energy storage Excel financial model is to help energy storage businesses manage and analyze their financial performance by purchasing, storing, and selling energy according to demand and storage capacity.

What are the key components included in the table of contents of the financial model?

-The key components included in the table of contents are the input sheet, revenue analysis, financial statements, and a dashboard for visual representation of financial performance.

What assumptions are covered in the input sheet?

-The input sheet covers assumptions for the capital structure, cost and price of revenue streams, monthly payroll, operating expenses, capital expenditure, and receivable and payable days.

What information does the revenue analysis sheet provide?

-The revenue analysis sheet provides information on available capacity in kilowatt hours, usable energy transmission per month, revenue from each stream, and the total cost of services.

What is included in the depreciation and loan amortization schedule?

-The depreciation and loan amortization schedule includes the reduction in the value of assets over five years and the monthly principal and interest payments.

What does the startup summary estimate?

-The startup summary estimates the required investment in the first year of the business and provides a graphical representation of total cost and utilization of funds.

What details are shown in the monthly profit and loss statement?

-The monthly profit and loss statement includes details about revenue, cost of services, operating expenses, and net income before and after taxes.

What information is provided in the cash flow statement?

-The cash flow statement shows the net cash flows from operating activities, investing activities, and financing activities.

What does the working capital table display?

-The working capital table displays the amounts in accounts receivable and payable and the changes in these accounts.

What does the break-even analysis determine?

-The break-even analysis determines the point at which the costs and income of the business are equal, shown with respect to sales amount and kilowatt hours of energy used, along with a graphical representation.

What is the purpose of the project evaluation section?

-The project evaluation section shows the value of the company at year 0, includes fundroid analysis, and determines the minimum investment required.

What scenarios are compared in the sensitivity analysis?

-The sensitivity analysis compares the valuation of the company in actual, optimistic, and worst-case scenarios.

What financial ratios are included in the KPIs and ratios section?

-The KPIs and ratios section includes profitability, liquidity, solvency, and efficiency ratios with their graphical illustrations.

What is the function of the dashboard in the financial model?

-The dashboard provides the most relevant financial graphical representations of the model, depicting key financial metrics for better understanding of performance measures.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Introduction to Pure Storage FlashBlade with Par Botes

How Tesla Is Quietly Expanding Its Energy Storage Business

Gravitationsspeicher

Batteries aren't the only way to store energy. Here's another.

Understanding Energy Storage in Electrical Power Grid

Will NTPC Green benefit from green energy revolution? NTPC Green IPO Fundamental Analysis

5.0 / 5 (0 votes)