Balance Sheet Red Flags (4 Warnings Signs)

Summary

TLDRIn this informative video, financial educator Brian Feroldi highlights four critical red flags on a company's balance sheet that investors should watch for. These include excessive debt compared to cash, high proportions of intangible assets, significant goodwill write-downs, and overall deteriorating financial metrics. By understanding these indicators, investors can better assess a company's financial health and make informed decisions. Feroldi emphasizes the importance of analyzing financial statements and offers a free resource, 'Financial Statement School,' to aid in this crucial learning process.

Takeaways

- 😀 Balance sheets can reveal financial stability; look for red flags indicating potential issues.

- 😀 A key red flag is when a company's debt exceeds its cash and cash equivalents.

- 😀 Companies should ideally have more cash than debt to ensure financial health.

- 😀 Excessive intangible assets can make a company's balance sheet illiquid, posing risks in financial emergencies.

- 😀 Intangible assets should make up less than 50% of total assets to maintain liquidity.

- 😀 Goodwill write-downs indicate management's admission of overpaying for acquisitions, signaling financial trouble.

- 😀 A significant decline in goodwill compared to total assets is a critical red flag for investors.

- 😀 Rapid deterioration of key metrics, like declining cash and increasing debt, signals financial distress.

- 😀 Investors should track cash balances, receivables, inventory, and debt over time for warning signs.

- 😀 Not all red flags mean a company is a bad investment, but they require further investigation.

Q & A

What is the primary purpose of the video?

-The video aims to educate viewers on how to identify red flags on a company's balance sheet to assess its financial health quickly.

Who is the presenter of the video?

-The presenter is Brian Feroldi, a financial educator with over 20 years of experience in analyzing and investing in businesses.

What constitutes an 'upside down' balance sheet?

-An upside down balance sheet is when a company's liabilities and debt far exceed its cash and cash equivalents.

Why is it concerning for a company to have more debt than cash?

-Having more debt than cash can signal financial instability, as the company may struggle to meet its obligations, especially in times of economic downturn.

What is the significance of intangible assets in a balance sheet?

-Intangible assets, such as goodwill, trademarks, and patents, are important because they can affect a company's liquidity; excessive intangible assets can make it difficult for a company to quickly access cash.

What is a goodwill write-down, and why is it a red flag?

-A goodwill write-down occurs when a company reduces the value of its goodwill on the balance sheet, indicating that it may have overpaid for an acquisition. This is a red flag as it suggests mismanagement or poor investment decisions.

What key metrics should investors watch to determine if a company's balance sheet is deteriorating?

-Investors should monitor metrics such as cash balances, accounts receivable, inventory levels, and total debt to assess the health of a company's balance sheet.

Can a company with red flags still be a good investment?

-Yes, while red flags indicate potential issues, they do not automatically disqualify a company as a good investment; further investigation is essential to understand the context.

How can investors access information about a company's balance sheet?

-Investors can find balance sheet information on financial websites such as Finviz, where they can view key financial metrics like cash, debt, and intangible assets.

What resource does Brian Feroldi offer to help viewers understand financial statements?

-Brian Feroldi offers a free ebook titled 'Financial Statement School,' which explains the terms and components of financial statements in plain English.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Why Charlie Munger HATED EBITDA

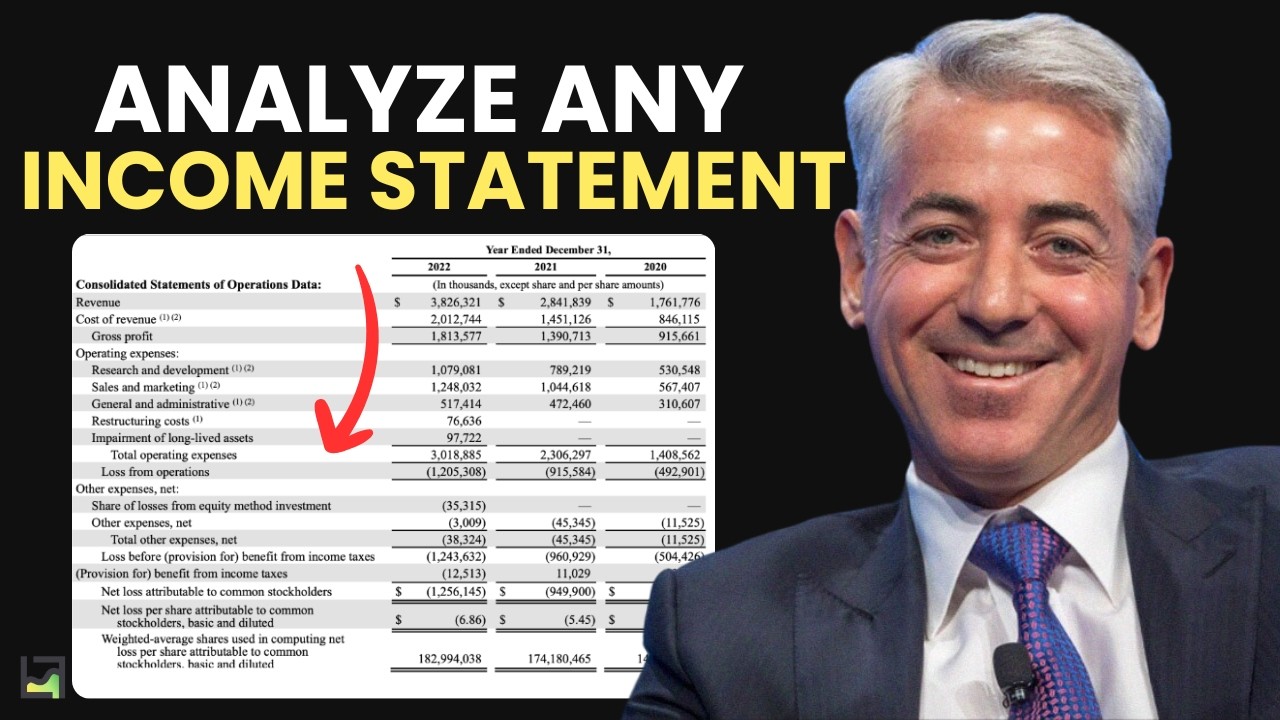

Reading Income Statements Is EASY When You Know This

Kenalan dengan Laporan Keuangan Emiten | feat. Brenda Andrina

EBITDA vs Net Income Vs Free Cash Flow (Analyst Explains)

How to Read Company Financial Statements (Basics Explained)

The KEY to Understanding Financial Statements

5.0 / 5 (0 votes)