How do I add a tax to my business tax account?

Summary

TLDRThis video provides a step-by-step guide on how to add key services to your Business Tax Account, including Corporation Tax, Self Assessment, PAYE for employers, and VAT. The video explains the necessary steps for each service, such as entering your Unique Taxpayer Reference, Company Registration Number, and National Insurance number, among others. It also covers how to activate services through PINs and provides guidance on registering for Self Assessment or PAYE if necessary. The video concludes with a reminder to find additional information on the GOV.UK website.

Takeaways

- 😀 You can add more than 40 services to your Business Tax Account.

- 😀 The four main services you can add are Corporation Tax, Self Assessment, PAYE for employers, and VAT.

- 😀 Services added will appear on the Business Tax Account home page.

- 😀 For some services, you'll receive an activation PIN within 10 working days, which you will need to start using the service.

- 😀 To add Corporation Tax, enter your 10-digit Corporation Tax Unique Taxpayer Reference and either your Company Registration Number or postcode of your registered office.

- 😀 For Self Assessment, you'll need your Unique Taxpayer Reference number. If you don’t have it, you'll be directed to register for Self Assessment.

- 😀 Once you receive your Unique Taxpayer Reference letter, log back into your Business Tax Account to complete the process.

- 😀 If you’re an individual or sole trader, you’ll be asked to enter your National Insurance number or postcode.

- 😀 For PAYE for employers, you’ll need your PAYE reference number, HMRC office number, and Accounts Office reference number.

- 😀 To add VAT, you'll need to enter your 9-digit VAT number, the date you became VAT registered, and details from your latest VAT return.

- 😀 More information about the Business Tax Account can be found on GOV.UK.

Q & A

How can I add services to my Business Tax Account?

-You can add more than 40 services to your Business Tax Account by selecting 'add a tax, duty or scheme' on the home page, and then choosing the services you want to add.

What services can I add to my Business Tax Account?

-The 4 main services you can add to your Business Tax Account are Corporation Tax, Self Assessment, PAYE for employers, and VAT.

What happens after adding a service to my Business Tax Account?

-After adding a service, it will appear on your Business Tax Account home page. For some services, you will receive an activation PIN within 10 working days to start using the service.

How do I add Corporation Tax to my Business Tax Account?

-To add Corporation Tax, select 'add a tax, duty or scheme,' then choose 'Corporation Tax.' Enter your 10-digit Corporation Tax Unique Taxpayer Reference (UTR) and either your Company Registration Number or the postcode of your registered office.

Can I add Self Assessment to my Business Tax Account immediately?

-You can add Self Assessment only if you already have a Unique Taxpayer Reference (UTR). If you don’t have it, you will be directed to register for Self Assessment first.

What should I do if I don’t have my Unique Taxpayer Reference number for Self Assessment?

-If you don't have your UTR, you can’t add Self Assessment at the moment. You will need to register for Self Assessment and, once you receive the UTR, you can add the service by logging back into your Business Tax Account.

What information do I need to add Self Assessment if I am an individual or sole trader?

-If you are an individual or sole trader, you will need to enter your National Insurance number. If you don’t have it, you will be asked for your postcode.

How do I confirm my identity for Self Assessment?

-You can confirm your identity to get access to Self Assessment right away. If you are unable to confirm it online, you can still request an activation PIN by post.

What details do I need to add PAYE for employers?

-To add PAYE for employers, you need to enter your PAYE reference number, HMRC office number, and your Accounts Office reference number. If you don't have a PAYE reference number, you will be directed to register as an employer.

What information is required to add VAT to my Business Tax Account?

-To add VAT, you need to select the type of VAT service and enter your 9-digit VAT number. You will also need to provide the date you became VAT registered, the postcode of your business's VAT registration, and details of your latest VAT return and accounting period.

Outlines

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифMindmap

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифKeywords

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифHighlights

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифTranscripts

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифПосмотреть больше похожих видео

CARA MEMBUAT NPWP PRIBADI UNTUK PEDAGANG RUMAH MAKAN SECARA ONLINE

Airbnb Business Structure (You Need An LLC) #airbnb #taxtips #llc

CARA LAPOR SPT TAHUNAN CORETAX TERBARU || LAPOR PAJAK UMKM OMZET DIBAWAH 500 JUTA

Sistem Pajak di Indonesia I Ekonomi Kelas 11 - EDURAYA MENGAJAR

Cara Membuat NPWP ONLINE Terbaru 2025 | Cara Daftar Coretax

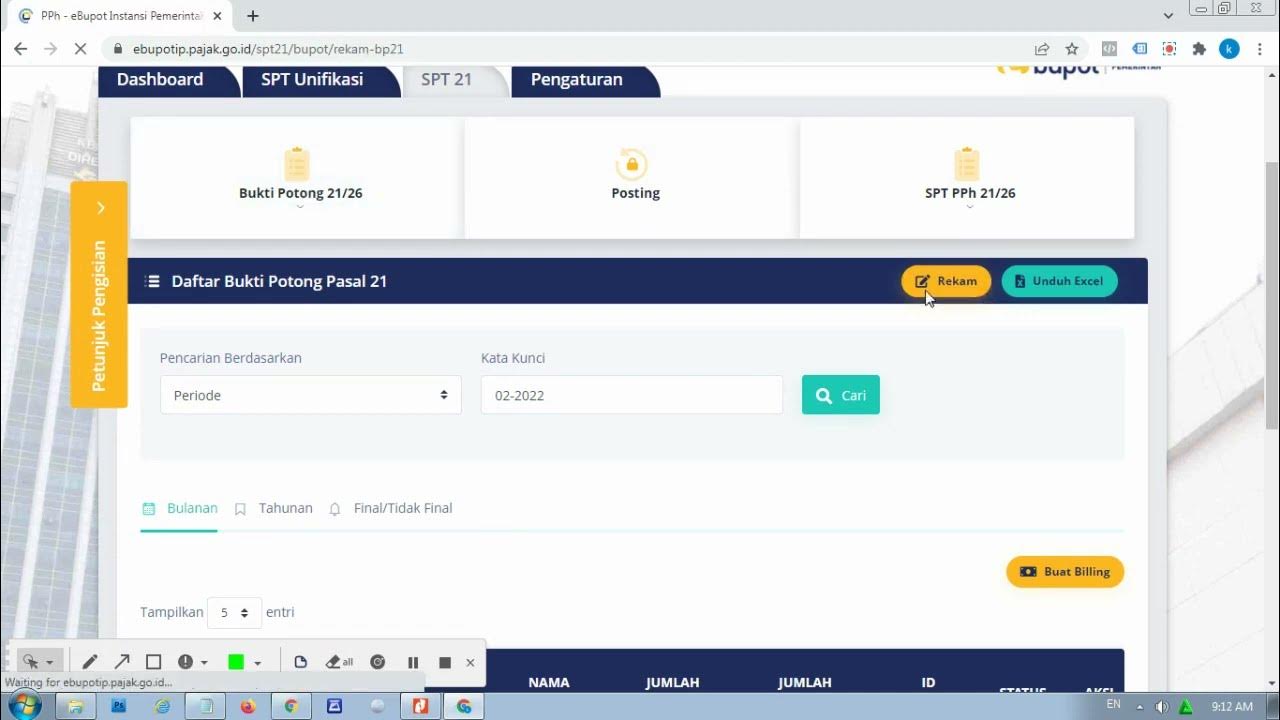

Tata Cara input PPh 21 di E-Bupot dan Pelaporannya

5.0 / 5 (0 votes)