AKUNTANSI INTERNASIONAL SESI 7: PELAPORAN KEUANGAN DAN PERUBAHAN HARGA

Summary

TLDRThis video lecture covers International Accounting, focusing on financial reporting during periods of price changes. It explains the challenges of misleading financial reports during inflation or deflation, including how historical cost accounting distorts financial performance. Key concepts discussed include general price level changes, specific pricing adjustments, and how inflation affects both monetary assets and liabilities. The lecture also covers various methods of adjusting financial statements, with examples from hyperinflationary environments. Additionally, it explores the implications of these adjustments for maintaining a company's purchasing power and productive capacity.

Takeaways

- 😀 Changing prices in financial accounting refer to adjustments made due to inflation or deflation, which affect financial reporting.

- 😀 Two key types of price changes are discussed: General Price Level (GPL) and Specific Price Level (SPL). GPL refers to inflation or deflation in the economy, while SPL focuses on price changes of specific assets.

- 😀 GPL adjustments are made using price indices, such as the General Price Index (GPI), which compares the cost of a basket of goods over different periods.

- 😀 Specific Price Level (SPL) adjustments track the price changes of particular items, like inventory or equipment, impacted by demand or supply factors.

- 😀 Financial reports can be misleading during periods of inflation because income is reported based on the current price level, while expenses are based on historical prices.

- 😀 Misleading financial statements can result in overstated earnings, higher taxes, inflated dividends, and excessive wages, all of which distort managerial decision-making.

- 😀 Adjusting for price changes is essential to preserve the purchasing power of initial investments and to maintain accurate projections and comparisons with budgets.

- 😀 A clear example of historical cost accounting is given: if a company starts with $1,000 in cash and it is converted to inventory, the financial outcome without price changes results in a net income of $500.

- 😀 Adjusting for inflation ensures that a company’s equity grows in line with the general price level. This can involve recalculating earnings or equity using inflation indices.

- 😀 Inflation and specific price adjustments are particularly critical for companies in hyperinflationary economies, where the purchasing power of money can decrease rapidly.

- 😀 The script also touches on the challenges of financial reporting in countries experiencing hyperinflation, where both historical cost and current cost accounting methods must be adjusted for inflation.

Q & A

What is the concept of General Price Level (GPL) change and how is it measured?

-General Price Level (GPL) refers to the overall movement in the price of goods and services in an economy, which can either increase (inflation) or decrease (deflation). It is measured using a price index, such as the Consumer Price Index (CPI), which compares the cost of a 'basket' of goods in the current period with its cost in a previous period.

What is the difference between General Price Level (GPL) change and Specific Price Level (SPL) change?

-GPL change refers to the overall increase or decrease in the prices of all goods and services in an economy, affecting macroeconomic conditions like inflation or deflation. SPL change, on the other hand, refers to price fluctuations in specific assets, such as inventory or machinery, which are influenced by factors like supply and demand for those specific goods.

Why can financial statements be misleading during periods of price changes like inflation?

-During inflation, financial statements based on historical cost accounting can be misleading because revenues are recorded based on current prices, while expenses, such as depreciation, are recorded based on the lower costs of assets acquired in the past. This leads to distorted performance metrics and inaccurate profitability reports.

What is the role of historical cost in financial reporting and why is it problematic in times of inflation?

-Historical cost accounting records assets and liabilities at their original cost, which does not account for inflation. This is problematic during inflation because the value of money decreases over time, meaning the reported costs and revenues do not reflect the actual economic conditions or the purchasing power of money.

How should financial reports be adjusted for inflation according to the script?

-To adjust for inflation, financial reports must be recalculated using price indices. For General Price Level (GPL) changes, both revenues and expenses should be adjusted based on current purchasing power, while for Specific Price Level (SPL) changes, assets like inventory or equipment must be restated to reflect their replacement cost.

What are the consequences of not adjusting financial statements during inflationary periods?

-Failure to adjust financial statements during inflationary periods can lead to distorted financial results, such as overestimating profits, underestimating costs, and incorrectly calculating taxes and dividends. This can mislead investors, creditors, and other stakeholders about the financial health of a business.

What are the two types of monetary items discussed, and how do they behave during inflation?

-The two types of monetary items are 'monetary assets' (such as cash or receivables) and 'monetary liabilities' (such as debts). During inflation, monetary assets lose purchasing power, while monetary liabilities increase in value since the fixed amount owed becomes more expensive to pay in real terms.

How do specific price adjustments (SPL) differ from general price adjustments (GPL) in terms of financial reporting?

-Specific Price Level (SPL) adjustments are made for changes in the prices of specific items, such as inventory, and aim to reflect the current replacement cost of those assets. General Price Level (GPL) adjustments, on the other hand, affect the overall purchasing power of money and adjust both revenues and expenses to reflect inflation or deflation in the broader economy.

What is IAS 21, and how does it relate to hyperinflationary environments?

-IAS 21 is an International Accounting Standard that provides guidelines for financial reporting in hyperinflationary environments. It requires companies to adjust their financial statements to reflect changes in the purchasing power of money and to use constant purchasing power accounting to ensure accurate reporting in highly inflationary conditions.

What is the controversy regarding IAS 21 when consolidating financial statements from subsidiaries in hyperinflationary countries?

-The controversy stems from whether companies should first adjust the financial statements of subsidiaries in hyperinflationary countries for inflation before translating them into the parent company’s currency, or whether they should first translate the statements and then apply inflation adjustments. The goal is to avoid double counting of inflation effects.

Outlines

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифMindmap

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифKeywords

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифHighlights

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифTranscripts

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифПосмотреть больше похожих видео

MATERI AKUNTANSI INTERNASIONAL - Akuntansi Perubahan Harga dan Inflasi Internasional

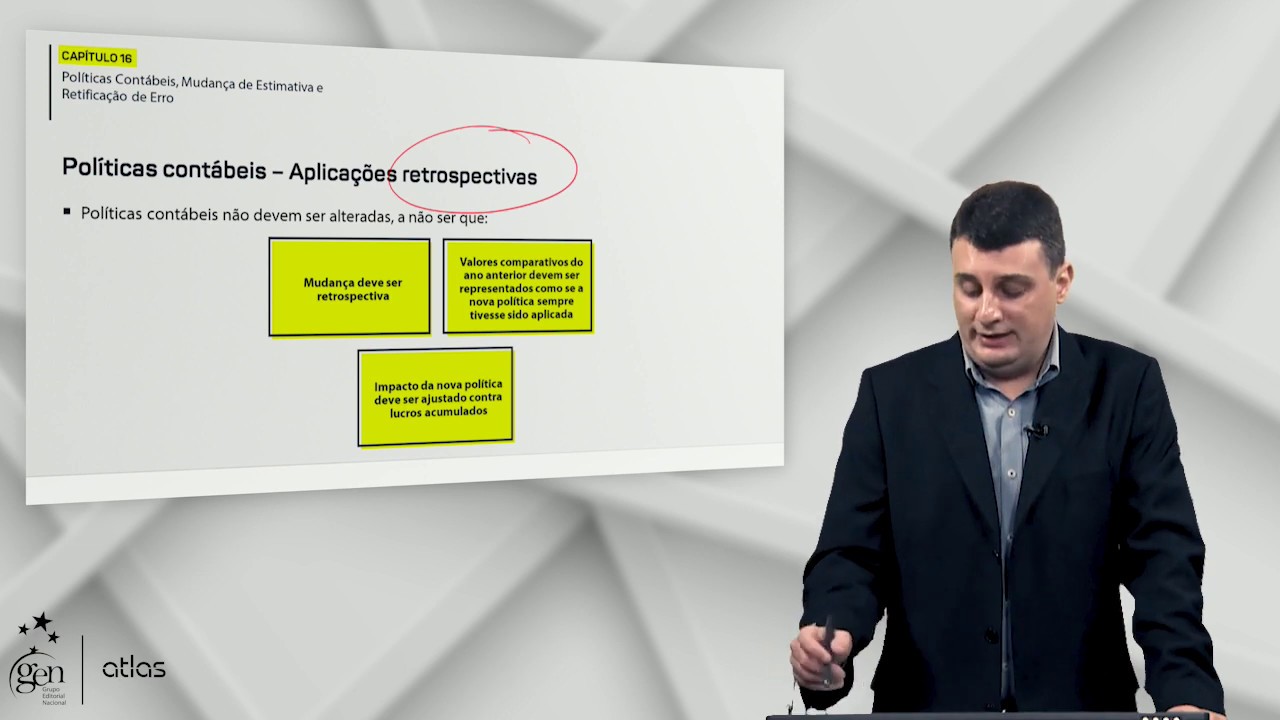

Políticas Contábeis, Mudança de Estimativa e Retificação de Erro | Contabilidade Avançada | 2ª ed.

PELAPORAN DAN ANALISIS KEUANGAN (LAPORAN KEUANGAN) l BARBARA GUNAWAN

Accounting Intermediate - Kieso : Chapter 1 (Financial Reporting & Accounting Standards)

[MEET 9] AKUNTANSI EKUITAS & PELAPORAN KEUANGAN - PERUBAHAN AKUNTANSI & ANALISIS KESALAHAN

What Is Accounting Theory?

5.0 / 5 (0 votes)