MATERI AKUNTANSI INTERNASIONAL - Akuntansi Perubahan Harga dan Inflasi Internasional

Summary

TLDRThis video explores international accounting in the context of inflation and price changes, focusing on how these economic factors impact companies' financial performance and reporting. Key topics include the effect of inflation on financial positions, alternative accounting methods such as General Purchasing Power Accounting (GPP) and Current Value Accounting (CVA), and how international standards address inflation-related issues. The video also highlights the importance of adjusting financial statements for inflation through various approaches and discusses the regulatory frameworks and policies in place to mitigate inflation's effects on global accounting practices.

Takeaways

- 😀 Inflation significantly affects the financial position and performance of companies, especially regarding asset values and decision-making.

- 😀 Managers need to understand inflation's impact to avoid inefficient operational decisions that could harm the company’s financial health.

- 😀 Three main alternatives for accounting inflation: General Purchasing Power Accounting (GPP), Current Value Accounting (CVA), and a combination of both.

- 😀 GPP adjusts financial statements based on the real purchasing power of money, reflecting inflation by recalculating asset values.

- 😀 CVA focuses on determining the current value of assets, capturing changes in their prices over time, unlike GPP’s focus on purchasing power.

- 😀 The combination of GPP and CVA merges both approaches to account for inflation’s effects on assets and liabilities more comprehensively.

- 😀 International regulations and accounting standards, such as those from the UN and IASC, aim to harmonize practices for handling inflation in financial reporting.

- 😀 Some countries, particularly in developing regions, experience hyperinflation, which poses unique challenges in accounting for inflation accurately.

- 😀 Accounting standards like ESAB 16 (UK) and other international regulations have introduced specific frameworks for inflationary reporting, such as using current cost accounting methods.

- 😀 In international accounting, fluctuations in foreign exchange rates must be considered when converting foreign currencies to local currencies for financial reports.

- 😀 Intangible assets such as goodwill and royalties need to be treated with care in inflation accounting, as they also impact financial reporting and company valuations.

Q & A

What is the main focus of the lecture on international accounting?

-The main focus of the lecture is on how inflation and price changes impact international accounting practices, particularly how they affect financial reporting and decision-making in companies.

How does inflation affect companies according to the script?

-Inflation affects companies by impacting their financial position and performance. Specifically, it can lead to inefficient operational decisions if managers fail to understand its effects on financial statements and asset values.

What are the three alternatives for accounting inflation discussed in the lecture?

-The three alternatives for accounting inflation discussed are: General Purchasing Power Accounting (GPP), Current Value Accounting (CVA), and a combination of both GPP and CVA.

How does General Purchasing Power Accounting (GPP) work?

-GPP focuses on maintaining the real purchasing power of capital owners. It involves adjusting financial statements, including assets and liabilities, based on the purchasing power of money at the time of reporting, reflecting changes in the economy.

What is the key concept behind Current Value Accounting (CVA)?

-CVA focuses on adjusting the value of assets based on their current price, considering price changes over time, rather than just historical costs or purchasing power.

How do GPP and CVA differ in their approach to accounting for inflation?

-GPP adjusts financial statements based on the purchasing power of money, while CVA adjusts values based on current market prices. GPP addresses the impact of inflation on the economy, whereas CVA reflects the current value of assets.

What role do international organizations like the United Nations and IASC play in managing inflation accounting?

-International organizations like the UN and IASC help harmonize accounting practices globally by setting standards and recommendations on how to handle inflation in financial reporting, ensuring consistency across different countries and regions.

How do inflation accounting practices differ between developed and developing countries?

-Developing countries often face higher inflation rates, which leads them to adopt specific inflation accounting practices like GPP and CVA to mitigate the effects of hyperinflation. Developed countries may not face such severe inflation and tend to use different approaches.

Why is it important to consider current value when making accounting decisions?

-Considering current value is crucial because it reflects the real-time market conditions and the changing value of money. This helps companies make more accurate financial decisions, especially in the face of inflation or price volatility.

What is the significance of asset valuation in inflation accounting?

-Asset valuation in inflation accounting is critical because it determines how assets are recorded in financial statements. Whether using GPP or CVA, accurate asset valuation ensures that companies' financial positions are correctly represented, particularly in volatile economic conditions.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

AKUNTANSI INTERNASIONAL SESI 7: PELAPORAN KEUANGAN DAN PERUBAHAN HARGA

Accounting Intermediate - Kieso : Chapter 1 (Financial Reporting & Accounting Standards)

Reasons For Accounting Diversity | International Accounting Course

PELAPORAN DAN ANALISIS KEUANGAN (LAPORAN KEUANGAN) l BARBARA GUNAWAN

Ruang Lingkup Bisnis Internasional

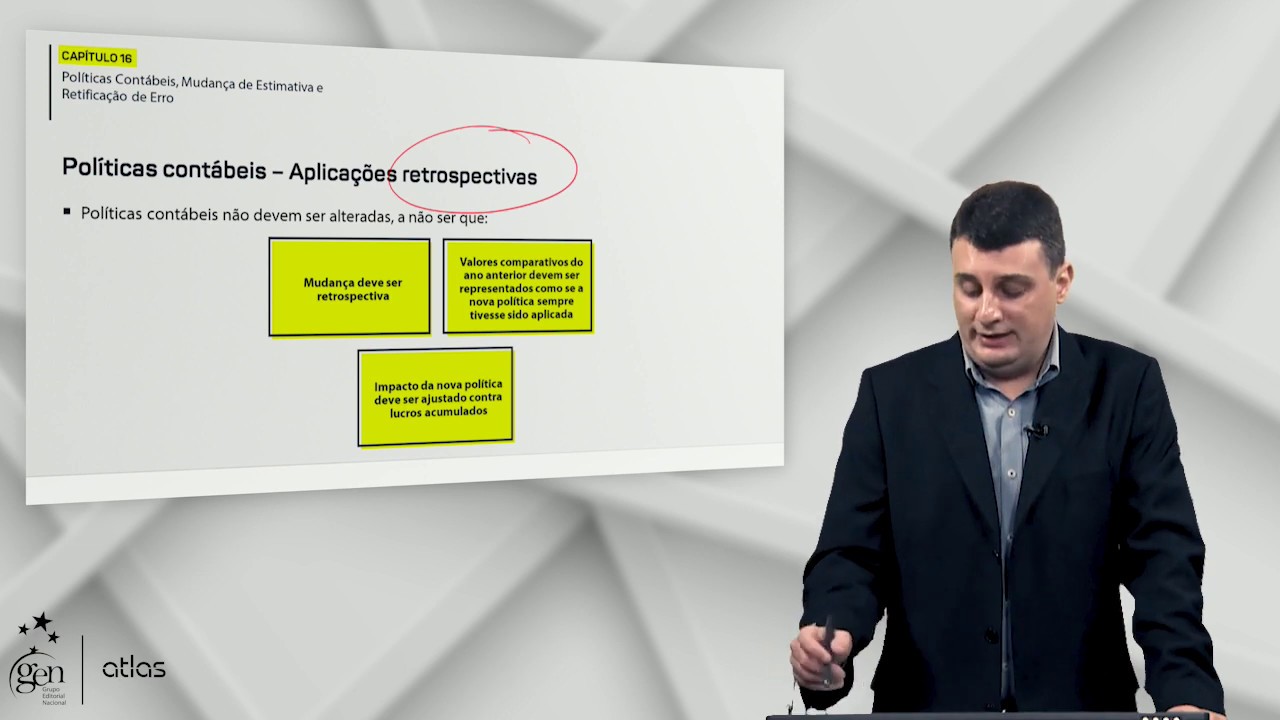

Políticas Contábeis, Mudança de Estimativa e Retificação de Erro | Contabilidade Avançada | 2ª ed.

5.0 / 5 (0 votes)