Materi TE Mikro 1 Chapter 8: Cost Fungtion

Summary

TLDRIn this video, the instructor discusses Chapter 8 on cost functions, building upon previous lessons on production functions. The focus is on the distinction between how accountants and economists view costs. Accountants view costs as historical expenditures, while economists emphasize opportunity costs. The video explores labor costs, capital costs, and the role of entrepreneurs in profit generation. Emphasizing the importance of cost-efficiency, the instructor explains how understanding opportunity costs can help businesses make better decisions to maximize profits. The session concludes with a brief introduction to optimizing production costs.

Takeaways

- 😀 The lecture begins with a greeting and a brief introduction, explaining that the class will be conducted online due to certain challenges.

- 😀 The main topic of the lesson is Chapter 8, focusing on the concept of 'cost function' or 'biaya' (cost), which is an essential topic for businesses aiming to maximize profit through cost management and efficiency.

- 😀 The difference in how accountants and economists view cost is highlighted: accountants focus on historical costs and expenses, while economists emphasize opportunity cost or potential lost opportunities due to certain decisions.

- 😀 An example of labor cost (biaya tenaga kerja) is used to illustrate the difference between the accountant's and economist's perspectives. Accountants view it as an expenditure, while economists consider the opportunity cost of not choosing a better-paying job elsewhere.

- 😀 The concept of capital cost is explained from both the accountant's and economist's viewpoints. Accountants focus on historical prices and depreciation, while economists consider capital costs as 'sunk costs' and analyze the opportunity costs of not utilizing capital in alternative ways, such as renting it out.

- 😀 The role of the entrepreneur is discussed. An accountant views the entrepreneur as the owner of all profits and losses after expenses, while an economist considers the entrepreneur's time and effort as costs that need to be compensated, even if they are not paid wages.

- 😀 Economic profit is defined as the total revenue minus total cost, where costs include both explicit and implicit costs, such as labor and capital, as well as opportunity costs that are often ignored in accounting.

- 😀 The economic profit formula is explained, where total cost (C) is the sum of labor (WL) and capital (VK), and total revenue (TR) is derived from the price (P) and quantity (Q) of goods or services produced.

- 😀 A key concept introduced is the idea of maximizing profit through minimizing cost. The formula involves adjusting labor (L) and capital (K) inputs to find the most cost-efficient combination.

- 😀 The graph and mathematical formula show how to find the optimal cost point by minimizing costs using isocost and isoquant curves, where the point of tangency between the curves represents the most efficient allocation of resources.

Q & A

What is the main topic of Chapter 8 in this video?

-The main topic of Chapter 8 is 'Cost Function' or 'Fungsi Biaya', which is a continuation from the previous chapter on 'Production Function'. This chapter discusses the structure and the calculation of costs in a production process.

How does the definition of cost differ between accountants and economists?

-Accountants view cost as historical expenditure, focusing on actual payments made for production inputs. Economists, however, see cost from an opportunity cost perspective, considering the value of alternatives that could have been pursued instead of the current choice.

Can you explain the concept of 'labor cost' from both an accountant's and an economist's perspective?

-For an accountant, labor cost is simply the expenditure on wages paid to workers. From an economist's point of view, labor cost includes not only wages but also the opportunity cost of the worker's time, which could have been spent working elsewhere for a different wage.

What is the significance of opportunity cost in economic analysis?

-Opportunity cost refers to the potential benefit that is foregone when one alternative is chosen over another. In economics, this concept is crucial for evaluating decisions, as it helps in understanding the true cost of a choice, not just the direct financial outlay.

What is the difference in how accountants and economists view capital costs?

-Accountants look at capital costs based on historical prices, considering the depreciation of assets over time. Economists, on the other hand, focus on the opportunity cost of using capital, such as the potential income lost if the capital was invested elsewhere or rented out.

How does the role of an entrepreneur in a firm differ between accounting and economics?

-From an accountant's perspective, the entrepreneur is seen as the owner of all profits and losses after paying for inputs. In economics, however, the entrepreneur's time, effort, and management are considered as costs, which should be accounted for as opportunity costs of running the business.

What does the term 'economic profit' refer to, and how is it calculated?

-Economic profit is the difference between total revenue and total economic costs, which include both explicit costs (like wages and capital costs) and implicit costs (like the opportunity cost of the entrepreneur's time and foregone alternatives). It is calculated by subtracting total costs from total revenue.

Why is it important for businesses to analyze opportunity costs when making decisions?

-Analyzing opportunity costs helps businesses make more informed decisions about resource allocation. By considering alternative uses for capital and labor, firms can identify the most profitable strategies and avoid unnecessary losses from suboptimal choices.

What is the connection between cost minimization and maximizing profit in production?

-Cost minimization and profit maximization are closely linked. By reducing costs (such as labor and capital expenses) while maintaining production levels, businesses can increase their profit margins. Efficient use of resources ensures that businesses operate at the most cost-effective level, leading to higher profits.

How do economists view the cost of using capital in a production process?

-Economists see the use of capital as incurring an implicit cost, even if the capital is owned by the firm. This is because the capital could have been used for alternative investments, or it could be rented out, generating income. The cost is the foregone rental income that could have been earned.

Outlines

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифMindmap

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифKeywords

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифHighlights

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифTranscripts

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифПосмотреть больше похожих видео

9.1: What is an Array? - Processing Tutorial

PY4E - Functions (Chapter 4 Part 1)

Data Structures in Python: Doubly Linked Lists -- Append and Prepend

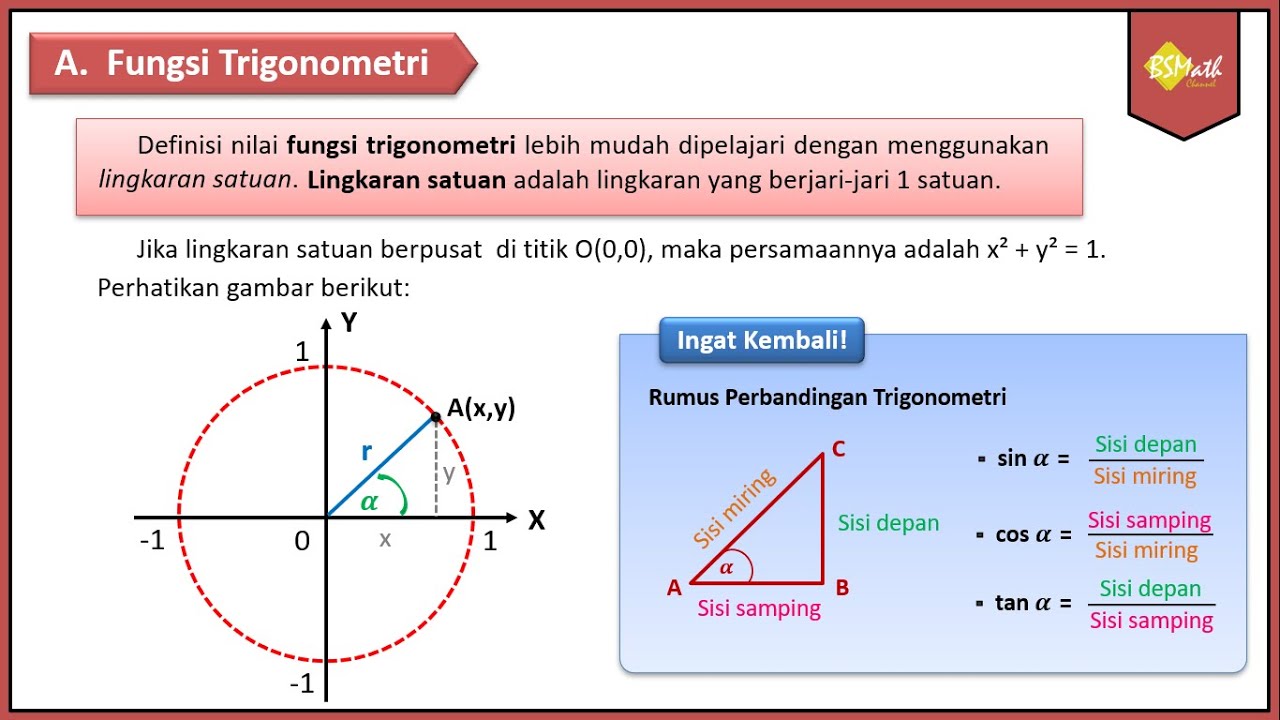

Tanda Fungsi Trigonometri Tiap Kuadran | Matematika Tingkat Lanjut SMA Kelas XI Kurikulum Merdeka

Derivada de una suma o diferencia | Reglas de derivación

NCERT| RBSE | CBSE| Class12 |अर्थशास्त्र| उपभोक्ता के व्यवहार का सिद्वान्त। पाठ्यपुस्तक के प्रश्न-2

5.0 / 5 (0 votes)