Islamic Banking a Fraud? | History & Reality of Banking

Summary

TLDRThe video critiques Islamic banking practices, highlighting how they often violate core Islamic principles of fairness and justice. The speaker points out issues such as the exploitation of customers' financial hardships, unlawful profit-making in the form of excessive rent, and the misuse of concepts like *muraabaha* and *ijara*. The analysis also addresses the contradiction between Islamic and conventional banking systems, especially in terms of wealth circulation and unjust enrichment. The video calls for a return to genuine Islamic financial ethics based on mutual consent, justice, and the avoidance of exploitation.

Takeaways

- 😀 Islamic banks often violate key principles of Islamic finance by combining multiple contracts, such as sale and lease, in a single transaction.

- 😀 The practice of leasing goods with inflated rent rates violates the Islamic prohibition on *riba* (usury) and exploitation of customers.

- 😀 Customers are often coerced into signing contracts with Islamic banks, lacking true consent due to their financial constraints.

- 😀 Islamic banks use market-distorting pricing practices, charging excessive rents that may be double or triple the market rate for vehicles and property.

- 😀 Islamic banking practices resemble conventional banking by extracting excessive profits from clients, similar to *riba* in non-Islamic finance.

- 😀 The Quranic principle that wealth should circulate among society is violated by both Islamic and conventional banking systems, contributing to wealth inequality.

- 😀 The concept of 'real consent' in Islamic finance is undermined when customers feel forced into agreements, as they do not freely choose the terms of contracts.

- 😀 The practice of requiring large upfront payments (such as security deposits) from customers in Islamic banking further exacerbates the financial burden on individuals.

- 😀 The Quran forbids taking advantage of a person's financial desperation for personal gain, a principle that is often ignored in Islamic banking models.

- 😀 The reliance on the concept of 'Murabaha' (profit-making through resale at higher prices) leads to unfair profit-making for banks while customers bear the burden of inflated prices.

Q & A

What is the main critique of Islamic banking practices in the script?

-The main critique of Islamic banking practices in the script is that many of their operations, such as the lease-to-own system and profit-making methods, resemble conventional banking systems, which violate core Islamic principles such as fairness, shared risk, and the prohibition of exploitative transactions.

What is the significance of the principle of 'riba' (interest) in Islamic finance?

-'Riba' refers to the prohibition of charging or paying interest in financial transactions. The script emphasizes that Islamic banks should not earn profit without sharing in the risk of the transaction, and that any form of interest-based profit is forbidden in Islam, as it exploits financial need without risk-sharing.

How does the script describe the concept of 'gharar' (uncertainty) in Islamic finance?

-The script explains that 'gharar', or uncertainty, in financial transactions is impermissible in Islam. Transactions should be transparent and based on clear terms to avoid exploitation. The practice of combining multiple transactions, like buying and renting a car through a bank, introduces unnecessary uncertainty and is seen as unlawful.

Why is the practice of leasing with excessive rent considered problematic in Islamic finance?

-Leasing with excessive rent is problematic because it can lead to financial exploitation. If the rent is disproportionately high compared to the market rate, it essentially becomes a form of interest or unjust profit, which is contrary to the Islamic principles of fairness and justice.

What is the script's stance on the claim that Islamic banks are 'Sharia-compliant'?

-The script argues that despite claims of being 'Sharia-compliant', Islamic banks often engage in practices that contradict Islamic finance principles. For example, the 'lease-to-own' arrangements and the manipulation of interest-like profits indicate that these banks are operating similarly to conventional banks, which is against Shariah law.

How does the script interpret the Quranic principle that wealth should not circulate only among the rich?

-The script interprets the Quranic principle as a warning against wealth concentration and exploitation. It criticizes both conventional and Islamic banks for creating systems where the wealthy continue to benefit at the expense of the poor, thereby violating the Islamic ideal of wealth distribution and social equity.

What does the script suggest about the practice of 'murabaha' in Islamic banking?

-The script suggests that the practice of 'murabaha' (a cost-plus financing arrangement) is problematic because it often involves indirect interest-like practices. The customer is essentially paying more than the market price for an item, which means the bank is earning profit without assuming real financial risk, violating the principle of fair trade.

What does the script say about the use of 'murabaha' as a way for Islamic banks to avoid interest?

-The script critiques 'murabaha' as a deceptive practice where banks try to circumvent the prohibition of interest by structuring the transaction as a sale with a markup, when in reality it operates similarly to a loan with interest. This practice undermines the ethical principles that Islamic finance aims to uphold.

How does the script explain the concept of shared risk in Islamic finance?

-In Islamic finance, shared risk is a foundational concept. The script emphasizes that both parties in a financial transaction should bear risk together. However, many Islamic banking practices, like excessive rent in leasing or profit from 'murabaha', result in one-sided risk distribution, where the customer bears the full financial burden without the bank sharing in the risks.

What Quranic verses are referenced to criticize Islamic banking practices, and what is their significance?

-The script references several Quranic verses, such as Surah An-Nisa (4:29), which prohibits unjust enrichment, and Surah Al-Ma'idah (5:2), which promotes mutual support in good deeds and prohibits collaboration in sin. These verses are used to highlight how Islamic banks, by exploiting customer hardships and concentrating wealth, are in violation of Islamic teachings on fairness and social justice.

Outlines

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифMindmap

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифKeywords

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифHighlights

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифTranscripts

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифПосмотреть больше похожих видео

Prinsip-prinsip Dasar Bank Syariah • Perbankan Syariah #4

Benarkah Bank syariah hanya kedok? - Ustadz Dr Erwandi Tarmizi LC, MA

FAQ EKONOMI SYARIAH #2: Perbedaan Ekonomi Konvensional & Syariah

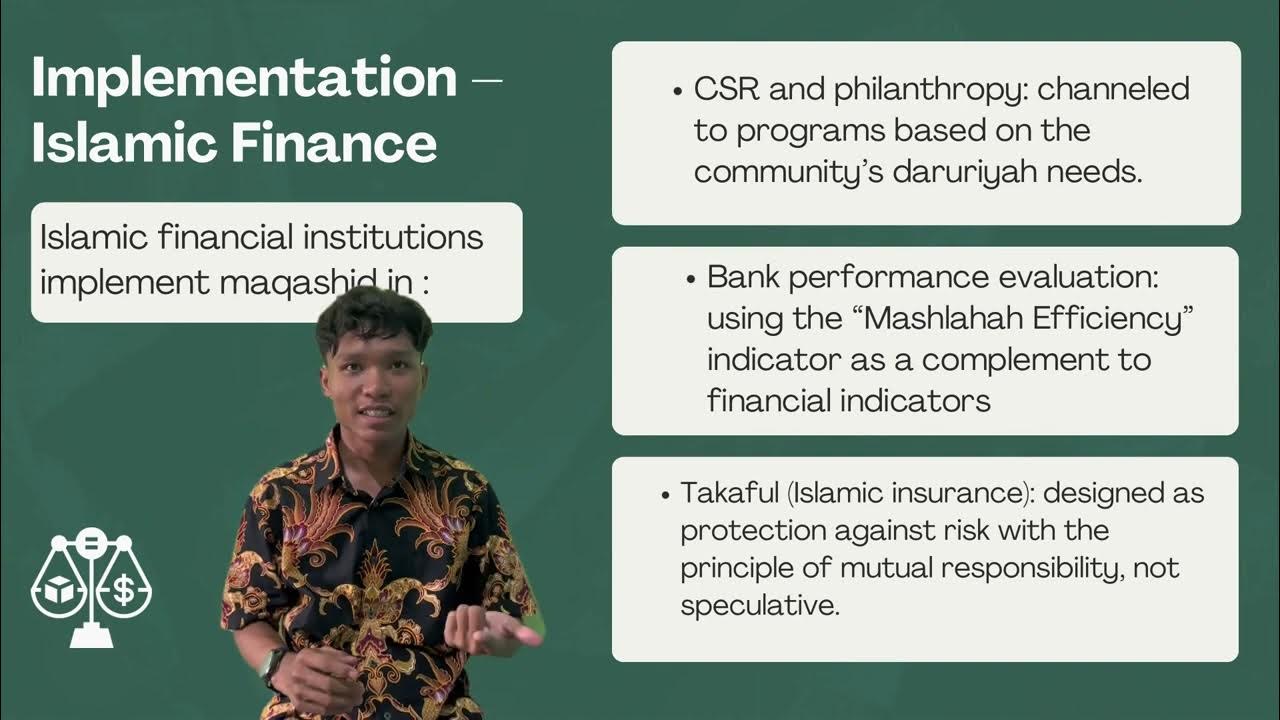

Maqashid Sharia As The Goals of Islamic Economics

How Islamic Finance Actually Works

EKONOMI ISLAM, ZAKAT, WAKAF, DAN PAJAK Oleh Ulul Huda, S.Pd.I., M.Si.

5.0 / 5 (0 votes)