Next Day Model - Fractal Way To Get Bias For Trading

Summary

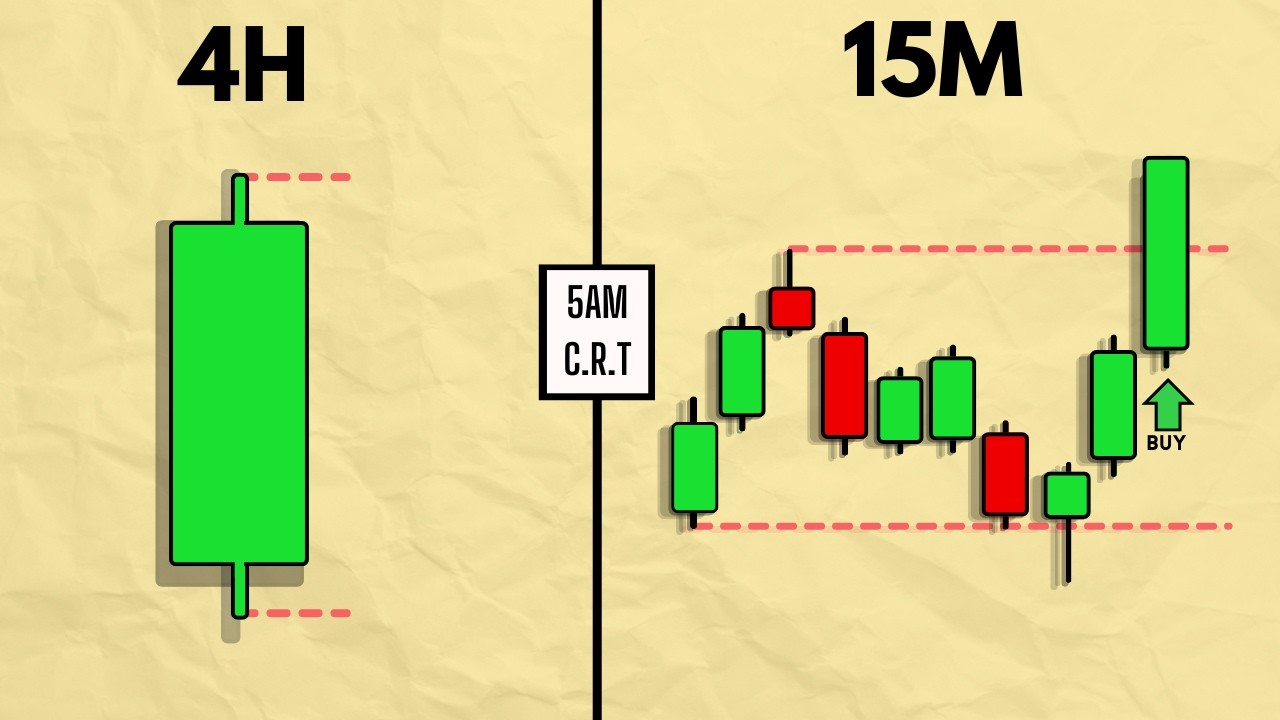

TLDRThis video delves into a trading model focused on predicting price movements by analyzing previous candle patterns. It emphasizes distinguishing between reversal and continuation scenarios, explaining how candle closures inform expectations for future price behavior. The presenter illustrates these concepts using TradingView examples and highlights the importance of context within market phases. By blending mechanical strategies with price delivery phases, traders can better anticipate market movements. The session concludes with insights applicable across various timeframes, reinforcing the fractal nature of the trading model and encouraging viewers to explore further learning opportunities.

Takeaways

- 📈 Understanding the 'Next Day Model' helps in anticipating price movements based on previous candle analysis.

- 🔄 A reversal is identified when a candle takes out the previous high or low and then closes within the prior range.

- ➡️ A continuation indicates that the price remains outside the previous candle's range, suggesting further movement in that direction.

- 🕯️ Daily candle closures provide critical insights into potential bullish or bearish trends for the next trading day.

- 📊 The presenter demonstrates various trading examples using TradingView to illustrate the practical application of the model.

- 🔍 Inside bars and swing points are key elements in analyzing price action and making trade decisions.

- 🌍 The fractal nature of the model means it can be applied across multiple time frames for broader trading strategies.

- 💡 Entries should be strategically timed with consideration of stop-loss placements and profit targets.

- 📉 Recognizing patterns of expansion and consolidation aids in predicting market behavior and potential reversals.

- 📚 Additional resources, such as a PDF and Discord group, are available for those wanting to learn more about the model.

Q & A

What is the primary focus of the video?

-The video focuses on using previous candle data to predict the movement of the next candle, emphasizing methods for identifying reversals and continuations.

How does the video define a reversal in price action?

-A reversal is defined as when price takes out the previous candle's high or low and then closes back inside the range, indicating a potential change in trend.

What indicates a continuation in price action?

-A continuation occurs when the price closes outside the previous candle's high or low, suggesting the existing trend will persist.

Why is it important to observe multiple candles before making a trading decision?

-Observing multiple candles helps confirm price action signals and reduces the risk of acting on false indicators, especially when facing conflicting signals.

What role does range closure play in trading strategy?

-Range closure helps traders anticipate whether to expect a bullish or bearish trend on the following day based on whether the price closes inside or outside of established ranges.

How can traders utilize the fractal nature of the candle models?

-Traders can apply the principles of candle models across different time frames, allowing them to analyze and make trading decisions on daily, hourly, or even lower time frames.

What is a propulsion block and how is it used in trading?

-A propulsion block is a significant price level that indicates a change in price direction. Traders use it as a reference point for placing trades and managing risk.

What does it mean when price action shows expansion followed by consolidation?

-This pattern typically suggests a phase transition, where an initial strong movement is followed by a period of indecision, often leading to further expansion or a retracement.

What advice does the presenter give regarding volatility in trading?

-The presenter emphasizes the importance of waiting for higher time frame candle closures to determine market direction, especially in volatile conditions.

How does the video recommend managing trades when facing conflicting signals?

-When encountering conflicting signals, the presenter advises waiting for additional candle confirmations to clarify the direction before entering a trade.

Outlines

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифMindmap

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифKeywords

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифHighlights

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифTranscripts

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифПосмотреть больше похожих видео

Trading one candle is easy, actually | Determine Market Direction and Daily bias

Best Bank Nifty Scalping Strategy || Golden 10% Q&A

How to trade Turtle Soups (Liquidity Sweeps)

Candle Range Theory Explained and Simplified | Easily Predict the Next Candle

AULA 1: OS SEGREDOS QUE TODO MUNDO DEVERIA SABER SOBRE A VELA DE COMANDO E A VELA DE TAXA ÚNICA.

XRP DAILY ANALYSIS - RIPPLE XRP PRICE PREDICTION - RIPPLE XRP 2024 - RIPPLE ANALYSIS

5.0 / 5 (0 votes)