Guide to Singapore GST (Part 1)

Summary

TLDRThe video provides an in-depth guide on GST registration, payment, and filing processes in Singapore. It covers key topics such as import duties, excise duties, and how taxes apply to various goods and services. Viewers are informed about the compulsory and voluntary registration processes, requirements for small businesses, and tips for GST compliance. The video emphasizes the importance of maintaining records for government audits and includes a simplified explanation of GST schemes. Repeated calls to subscribe to the channel are also made throughout the video.

Takeaways

- 💼 The script discusses a comprehensive guide on GST and company registration processes in Singapore.

- 📄 It highlights the requirements for compulsory registration of companies for GST and explains forms and quarterly returns.

- 💰 The video explains different types of duties like import, excise, and duties charged on petroleum products in Singapore.

- 📊 The importance of filing GST on a quarterly basis and paying duties to the government is emphasized.

- 📦 Companies involved in import and export must understand different tax rates applicable for goods and services in Singapore.

- 🏢 Voluntary GST registration is discussed, along with the conditions under which a business might choose to register.

- 💻 Businesses using accounting software can easily manage GST records, especially for small businesses.

- 📈 The script details various tax categories, including corporate taxes, road tax, and duties related to manufacturing.

- 🇸🇬 Singapore-specific tax rates, especially on import and excisable goods, are highlighted for business owners.

- 🔔 Repeatedly, the video encourages viewers to subscribe, like, and share the content for future updates and guides.

Q & A

What is GST, and how does it apply in Singapore?

-GST, or Goods and Services Tax, is a consumption tax levied on the import of goods and supply of goods and services in Singapore. Businesses are required to register for GST if their annual taxable turnover exceeds a certain threshold.

What are the registration requirements for GST in Singapore?

-Businesses must register for GST if their annual taxable turnover exceeds SGD 1 million. Voluntary registration is also possible for businesses under this threshold, but they must remain registered for at least two years.

What types of duties are imposed on goods in Singapore?

-In Singapore, import duty, excise duty, and other specific duties apply to certain products like intoxicating liquor, tobacco, petroleum, and motor vehicles. These are charged based on the customs tariff rates.

How does GST affect the sale and purchase of products within Singapore?

-GST is charged on the sale of products and services within Singapore. Businesses collect this tax from customers and remit it to the government through quarterly returns.

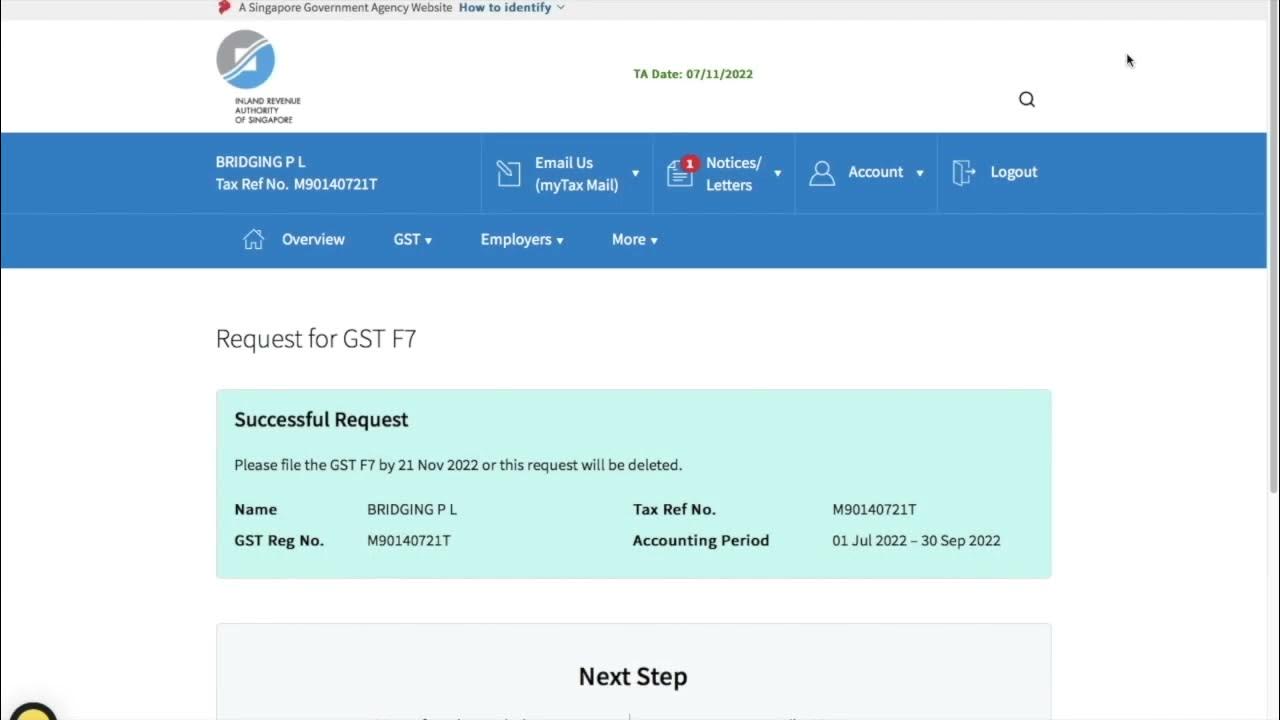

What is the process for filing GST returns in Singapore?

-GST returns must be filed on a quarterly basis. Businesses report their total sales and purchases, the amount of GST collected, and any GST they paid on their purchases (input tax). The net GST amount is then paid to the authorities or refunded if applicable.

Are there specific sectors or products exempt from GST in Singapore?

-Yes, financial services, the sale and lease of residential properties, and the import and local supply of investment-grade gold, silver, and platinum are some examples of GST-exempt sectors in Singapore.

How is voluntary GST registration different from compulsory registration?

-Voluntary registration allows businesses below the threshold to register for GST, but they must remain compliant for at least two years. Compulsory registration applies when a business's taxable turnover exceeds SGD 1 million.

What are the consequences of not registering for GST when required?

-Failing to register for GST when required can lead to penalties and fines. The authorities may also backdate the GST registration, requiring the business to pay any outstanding taxes from the date they should have been registered.

How are GST rates determined for different products in Singapore?

-GST rates are set by the Singapore government and apply uniformly to most goods and services. However, certain goods, such as luxury products or tobacco, may be subject to additional duties beyond GST.

What record-keeping requirements exist for GST-registered businesses?

-GST-registered businesses must maintain records of all sales, purchases, and tax invoices for at least five years. These records must be detailed and accurate to ensure compliance during audits by the tax authorities.

Outlines

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифMindmap

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифKeywords

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифHighlights

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифTranscripts

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифПосмотреть больше похожих видео

Important 😯 GST Changes May 2025 |GSTR-1 New Additions |GSTR-3B locking|GST Refund|GST Registration

GST Amnesty Scheme under Section 128A – No Interest & Penalty for FYs 2017-20 || CA (Adv) Bimal Jain

How to File GSTR-3B Return | 5 min me easily | GSTology

GST Cancellation Process | How to Cancel GST Registration | How to Close Surrender GST Number

Filing of GST Return (Video Guide)

CA Inter GST amendments for May 25 Quick Recap | CA Ramesh soni

5.0 / 5 (0 votes)