Open High Low Close - Understanding Candlesticks

Summary

TLDRThis video covers the essential concepts of candle charts used in trading, explaining how to read candles based on their open, high, low, and close prices. It distinguishes between bullish and bearish candles and discusses three key types: directional candles, reversal candles, and indecision candles. The video emphasizes the importance of analyzing the body and wicks of candles to identify price trends and reversals. Real chart examples are used to demonstrate how different candle types behave on various time frames, aiding viewers in making informed trading decisions.

Takeaways

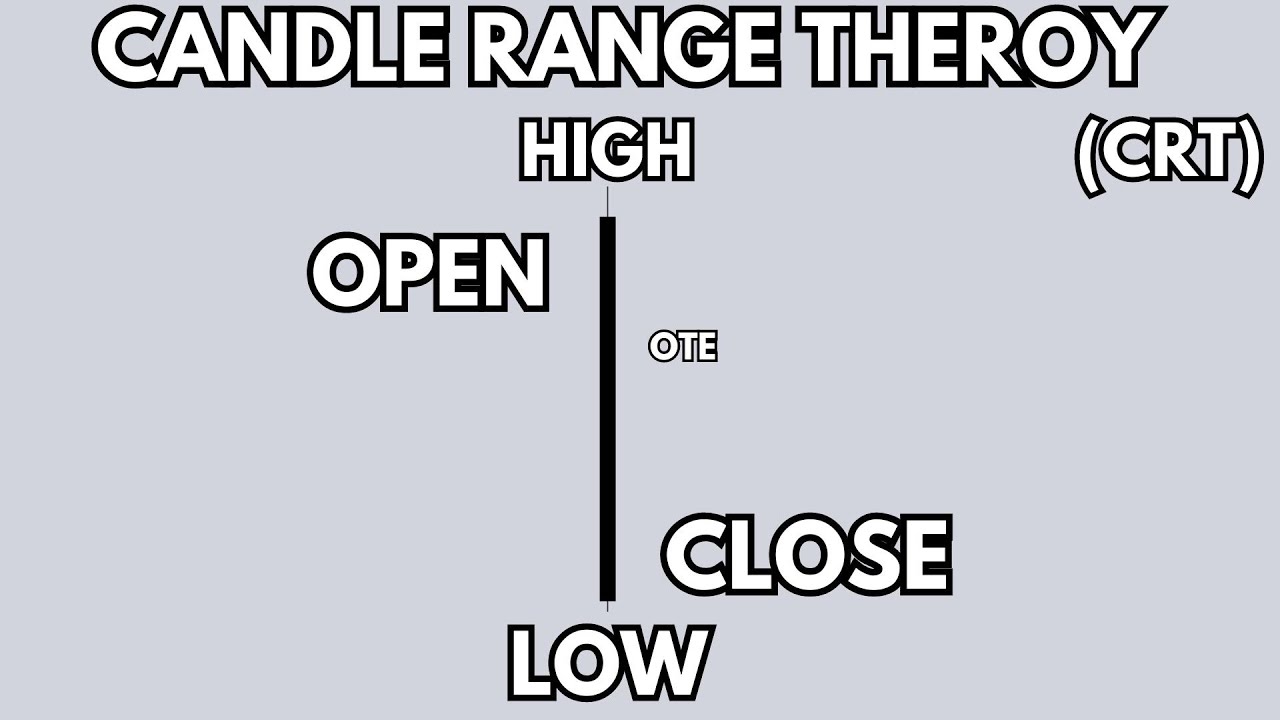

- 📊 Every candle in trading has an open, high, low, and close, which are essential to understanding price movements.

- 📉 A bearish candle forms when the close is below the open, indicating downward price movement.

- 📈 A bullish candle occurs when the close is above the open, showing upward price movement.

- 🔍 The three main candle types are directional, reversal, and indecision candles, each reflecting different market behavior.

- 📉 A bearish directional candle moves in one direction for most of the period, often having a small wick compared to the body.

- 📈 A bullish directional candle trends upward for most of the period, with a relatively smaller wick compared to the body.

- 🔄 Reversal candles show a change in direction, where the wick is larger than the body, indicating that price reversed during the time period.

- ⚖️ Indecision candles have small bodies with longer wicks, indicating that price fluctuated but closed near the opening price, reflecting market uncertainty.

- 🔁 Understanding how candles form on different timeframes (e.g., daily or 15-minute) can provide deeper insights into price action.

- 🔎 Recognizing patterns like directional moves or reversals over consecutive days helps traders anticipate market behavior and adjust their strategies accordingly.

Q & A

What are the four key components of a candle in trading?

-The four key components of a candle are the open, high, low, and close. These represent the opening price, the highest price, the lowest price, and the closing price within a specific time period.

How can you identify a bearish candle?

-A bearish candle occurs when the closing price is below the opening price, indicating that the price moved downward during the time period.

How is a bullish candle defined?

-A bullish candle is defined by the closing price being higher than the opening price, indicating that the price moved upward during the time period.

What is a directional candle and how can it be recognized?

-A directional candle shows movement primarily in one direction throughout the time period. For a bearish directional candle, price opens, makes a high, and then moves lower to close. For a bullish directional candle, price opens, makes a low, and then moves higher to close.

What characteristics distinguish a reversal candle from other types?

-A reversal candle has a large wick relative to its body. It shows a price reversal during the time period, meaning that the price moves in one direction and then reverses to close in the opposite direction.

What can a small wick relative to the body of a candle indicate?

-A small wick relative to the body often indicates a directional candle where price movement is more stable and trends in one direction during the time period.

How do lower time frames relate to higher time frame candles?

-Lower time frames contribute to the formation of higher time frame candles. For example, a daily candle might consist of smaller 15-minute candles showing the detailed movement of price throughout the day.

What is an indecision candle, and what does it signify?

-An indecision candle occurs when the opening and closing prices are close to each other, with long wicks on both sides. It indicates a lack of clear direction in the market during that time period.

How does understanding open, high, low, and close (OHLC) improve trading?

-Understanding OHLC helps traders interpret market behavior, identify trends, and make better decisions based on whether the price is moving upward, downward, or staying neutral within a time period.

What patterns might you expect after several directional candles in a row?

-After several directional candles, such as three days of expansion, it’s common to see a reversal or consolidation, where price movement may shift direction or pause for a period of indecision.

Outlines

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифMindmap

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифKeywords

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифHighlights

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифTranscripts

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифПосмотреть больше похожих видео

You're Trading The PO3 WRONG - ICT Concepts

Trading Academy Day 2: Charting & Intro To Candlesticks

ICT Mentorship Core Content - Month 03 - The Next Setup - Anticipatory Skill Development

Trading The 4 Hour Power Of Three - OHLC / OLHC

Candle Range Theory | CRT | The NEW Silver Bullet For Struggling Traders

Morning Star Candlestick Pattern | Basic Price Action Roadmap | Part 3

5.0 / 5 (0 votes)