Contoh Cara Menghitung Analisis Vertikal / Horizontal Laporan Keuangan

Summary

TLDRThis video script offers a comprehensive tutorial on financial statement analysis, focusing on both vertical and horizontal analysis. It guides viewers on how to use a stock calculator from analis.co.id for these analyses. Vertical analysis is explained as comparing parts of a single financial statement, exemplified by calculating the cash ratio. Horizontal analysis is detailed as comparing financial statements across different periods, using data from at least two periods. The script also highlights the benefits of using the provided calculator for ease and accuracy in analysis.

Takeaways

- 📈 The video discusses financial analysis techniques, specifically vertical and horizontal analysis of financial statements.

- 🔢 Vertical analysis involves comparing different parts of a single financial statement to understand the proportionate relationships between them.

- 💹 An example of vertical analysis is calculating the quick ratio by dividing the quick assets by short-term liabilities.

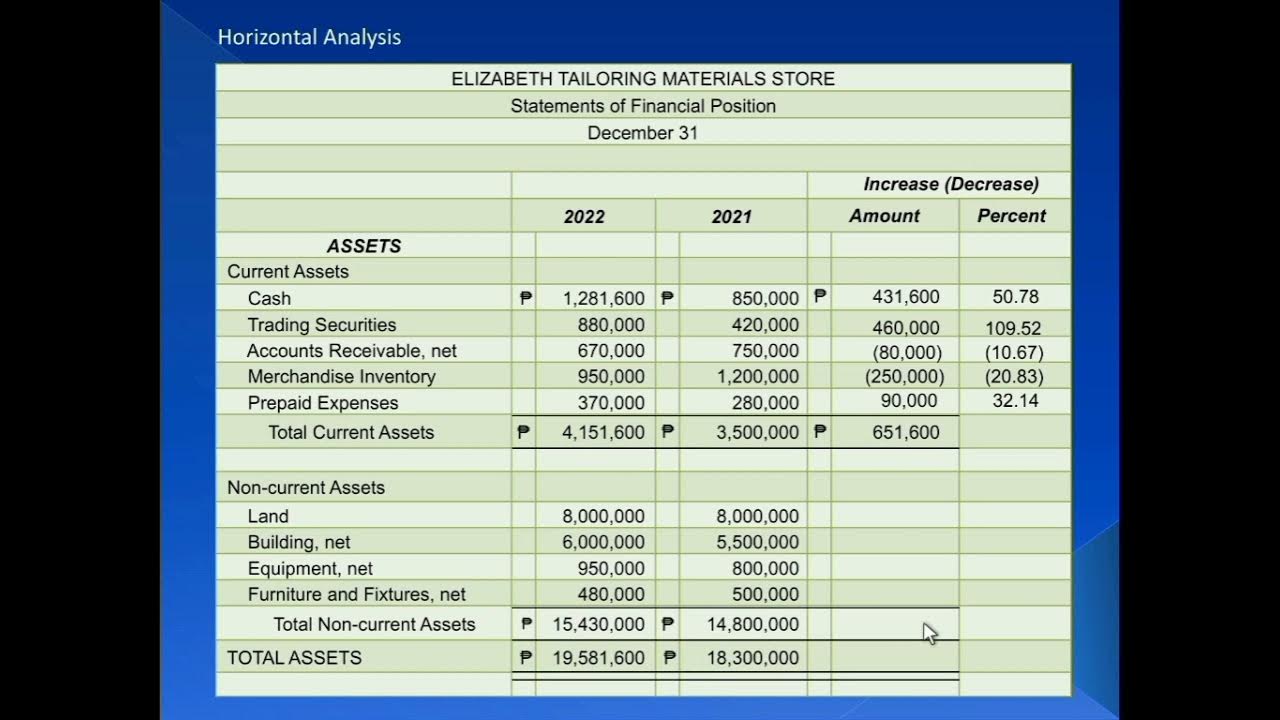

- 📊 Horizontal analysis compares a financial statement with another over different periods, such as comparing the financial data of 2017 with that of 2016.

- 📚 The video introduces a stock calculator tool from analis.co.id to facilitate these analyses without manual calculations.

- 💼 The tool automatically presents the results of horizontal analysis in percentage form, making it easier to understand changes over time.

- 📊 Horizontal analysis can also be performed by comparing the same ratio across different years, such as comparing the return on equity (ROE) over multiple years.

- 💡 The video emphasizes the importance of both vertical and horizontal analyses for a comprehensive understanding of a company's financial health.

- 📝 The presenter provides a detailed explanation of how to use the stock calculator tool and where to find it on the website.

- 🔑 Key financial ratios such as liquidity, profitability, activity, solvency, and market evaluation ratios are mentioned as part of vertical analysis.

- 🌐 The video concludes with a reminder to subscribe and visit the analis.co.id blog for more information and tools.

Q & A

What are the two types of financial analysis discussed in the script?

-The script discusses vertical analysis and horizontal analysis of financial statements.

What does vertical analysis of financial statements involve?

-Vertical analysis involves comparing each part of a financial statement to another part within the same statement, such as comparing assets to liabilities or equity.

Can you provide an example of a vertical analysis calculation mentioned in the script?

-Yes, an example given is calculating the quick ratio by dividing cash and cash equivalents by short-term liabilities.

What is horizontal analysis of financial statements?

-Horizontal analysis involves comparing one financial statement with another over different periods, typically year over year.

How do you perform a horizontal analysis according to the script?

-To perform a horizontal analysis, you need data from at least two different financial statements and compare the data from one period to another.

What is the purpose of using the 'kalkulator saham' from analis.co.id as mentioned in the script?

-The 'kalkulator saham' is used to perform financial analysis without the need for manual calculations, as it automatically computes the results in percentage form.

What is the significance of Return on Equity (ROE) in vertical analysis as discussed in the script?

-Return on Equity (ROE) is significant in vertical analysis because it compares net profit to total equity, providing insight into how efficiently a company is using its equity to generate profit.

What are some of the financial ratios that can be calculated using vertical analysis according to the script?

-Financial ratios that can be calculated using vertical analysis include liquidity ratios, profitability ratios, activity ratios, solvency ratios, and market evaluation ratios.

What is the main difference between vertical and horizontal analysis as presented in the script?

-The main difference is that vertical analysis compares parts of the same financial statement, while horizontal analysis compares the same parts of different financial statements over time.

Why is it recommended to perform both vertical and horizontal analyses as suggested in the script?

-Performing both analyses provides a more comprehensive understanding of a company's financial health by evaluating changes over time and the internal structure of financial statements.

How can one access the 'kalkulator saham' mentioned in the script?

-One can access the 'kalkulator saham' by visiting analis.co.id, navigating to the 'tools' section, and then clicking on 'kalkulator saham'.

Outlines

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифMindmap

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифKeywords

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифHighlights

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифTranscripts

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифПосмотреть больше похожих видео

ANALISIS LAPORAN KEUANGAN UNTUK SMK KELAS XII SEMESTER GENAP

Types of Financial Analysis

07- Análisis Horizontal y Vertical dentro de los Estados Financieros

Part 1: Financial Statements Analysis (Intro, Horizontal Analysis and Vertical Analysis)

Análisis Vertical Estado Resultados - Interpretar y Como reducir Costos y Gastos

Graphing Rational Functions Step-by-Step (Complete Guide 3 Examples)

5.0 / 5 (0 votes)