Compound Amount Formula with Unknown Interest Rate and Time

Summary

TLDRThis video script teaches the derivation of the compound interest rate formula and its application. It explains how to find the nominal rate 'j', compounded quarterly, using the formula j = i * m, where 'i' is the interest rate per period and 'm' is the number of compounding periods per year. The script also demonstrates solving for time 't' in compounding periods 'n' using logarithms. Practical examples are given, such as calculating the time for an investment to double with a 6% semi-annual interest rate.

Takeaways

- 🧮 The compound amount formula helps solve for present and future values of loans or investments.

- 📈 This video focuses on deriving formulas for the interest rate (i) per compounding period and the number of compounding periods (n).

- 💰 Example problem: A loan of 40,000 pesos accumulates to 100,000 pesos in 10 years with quarterly compounding; the task is to find the nominal interest rate (j).

- 📊 To find the number of compounding periods, use the formula n = m * t, where m is the number of periods per year (4 in this case) and t is the time in years.

- 🔢 The nominal rate (j) is related to the interest rate (i) by the equation j = i * m, where m is the number of compounding periods per year.

- ⚖️ The formula for the interest rate (i) per compounding period is derived as i = (nth root of (F/P)) - 1, where F is the future value and P is the present value.

- 🧮 In the example, substituting values gives an interest rate (i) of 0.0232 (or 2.32%) per compounding period.

- 📉 The nominal rate (j) is found by multiplying the interest rate per period by the number of periods per year: j = 2.32% * 4 = 9.28%.

- 🕰️ For time-related problems, such as finding the duration required for a principal of 60,000 pesos to reach 85,000 pesos with a 6% interest rate compounded semi-annually, the formula for n is used.

- 🔐 To solve for n (the number of periods), logarithms are applied to the compound amount formula, giving n = log(F/P) / log(1 + i). Then, time (t) is calculated as t = n/m.

Q & A

What is the purpose of the compound amount formula?

-The compound amount formula is used to find the present value and future value of loans or investments over time.

What unknowns does the video focus on solving within the compound amount formula?

-The video focuses on deriving formulas for the interest rate per compounding period (i) and the number of compounding periods (n).

In the example provided, what are the given values to solve for the nominal interest rate (j)?

-The given values are a present value of 40,000, a future value of 100,000, and a period of 10 years with quarterly compounding, meaning m = 4.

How is the number of compounding periods (n) calculated in the problem?

-n is calculated as the product of the number of compounding periods per year (m) and the time in years (t), which in this case is n = 4 * 10 = 40 quarters.

What is the relationship between the nominal rate (j) and the interest rate per period (i)?

-The nominal rate (j) is equal to the interest rate per period (i) multiplied by the number of compounding periods per year (m), i.e., j = i * m.

How is the interest rate per period (i) derived from the compound amount formula?

-The interest rate per period (i) is derived by rearranging the formula for the future value (F = P * (1 + i)^n). After dividing both sides by P, taking the nth root, and subtracting 1, the formula becomes i = (nth root of F/P) - 1.

How is the nominal rate (j) calculated once the interest rate per period (i) is found?

-The nominal rate (j) is found by multiplying the interest rate per period (i) by the number of compounding periods per year (m). In the example, j = 2.32% * 4 = 9.28%.

How can a scientific calculator or smartphone be used to solve for i when calculating roots with large indices like 40?

-On scientific calculators, you can directly input the formula. On smartphones, which may not support high index roots, you can convert the root to a fractional exponent. For example, instead of taking the 40th root, you can raise the fraction to the power of 1/40.

What is another common unknown in the compound amount formula, as shown in the second example?

-Another common unknown is time (t), which is related to the number of compounding periods (n). The second example demonstrates how to solve for time.

How is time (t) derived from the number of compounding periods (n) in the second example?

-Time (t) is calculated by dividing the number of compounding periods (n) by the number of compounding periods per year (m). In the second example, t = 11.78 / 2 = 5.89 years.

Outlines

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифMindmap

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифKeywords

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифHighlights

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифTranscripts

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифПосмотреть больше похожих видео

บทที่ 3 ดอกเบี้ยและมูลค่าของเงิน ep.3

Aptitude Preparation for Campus Placements #10 | Simple Interest | Quantitative Aptitude

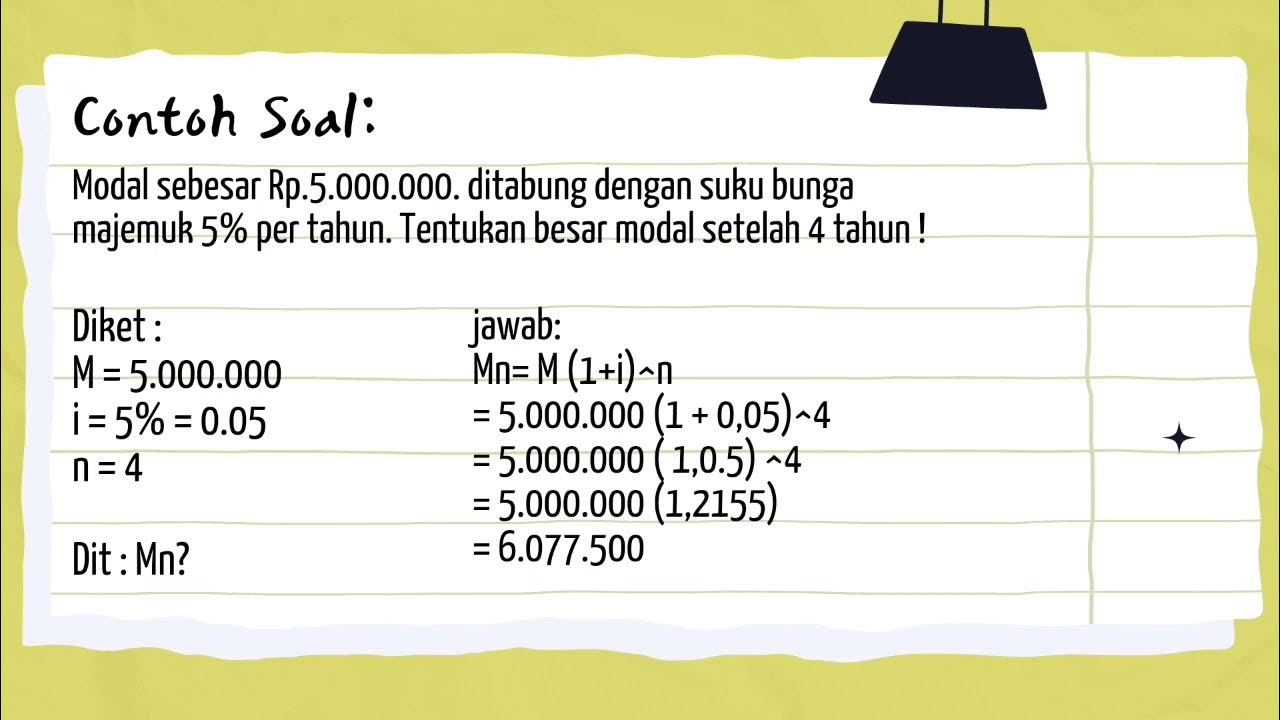

Bunga Majemuk || Materi Mtk wajib kelas 11 ( kurikulum merdeka)

บทที่ 3 ดอกเบี้ยและมูลค่าของเงิน ep.1

Compound Interest (Higher & Foundation) | GCSE Maths Revision | GCSE Maths Tutor

LESSON 5: Compound Interest (Finding for the Principal, Future Value, and Time)

5.0 / 5 (0 votes)