Why we make bad financial choices -- even when we know better | Your Money and Your Mind

Summary

TLDRThe video script debunks the 'G.I. Joe fallacy', highlighting that knowledge alone doesn't change behavior. It emphasizes the struggle to save and spend wisely despite financial literacy. The speaker, a behavioral scientist, shares her own experience and proposes that behavior change is more environmental than educational. She offers to guide viewers through reshaping their environment to better manage finances, promising practical tips for immediate action.

Takeaways

- 🧴 Knowing what to do, like wearing sunscreen or saving money, doesn’t always lead to action.

- 📊 The 'G.I. Joe fallacy' refers to the mistaken belief that knowing is half the battle; in reality, information alone rarely changes behavior.

- 💸 Financial literacy programs have minimal impact on behavior, accounting for only 0.1% of the variance in financial decisions.

- 📚 Even though 20 states in the US require financial literacy education in schools, it has little effect on future financial outcomes unless well-implemented.

- 🧠 A better predictor of financial success is a person's general ability to do math, rather than their financial knowledge.

- 💡 Behavior change is more about adjusting your environment than simply learning more information.

- 🛍️ The modern environment is filled with smarter, more personalized, and efficient cues to spend money, making it harder to save.

- 🔄 Reshaping your environment can help regain control over your finances.

- 💬 Through this series, the speaker will provide step-by-step guidance on how to change your environment to better manage finances.

- 📅 Each episode will end with practical, research-based tips that you can apply immediately to start saving more and spending less.

Q & A

What is the 'G.I. Joe fallacy' mentioned in the transcript?

-The 'G.I. Joe fallacy' is a term coined by two Yale professors to describe the mistaken belief that knowing something is sufficient to put it into practice, implying that awareness alone can lead to behavior change.

Why do people struggle to save money or manage their debt despite taking financial literacy classes?

-People struggle because simply knowing what to do is not enough to change behavior. Information doesn't always translate into action, and the ability to save and manage finances is often more complex than just having knowledge.

What is the speaker's personal example of knowing what to do but struggling to act on it?

-The speaker mentions a magazine subscription they knew they should cancel but took two years to do so, despite never reading the magazine and seeing the expense in their budget every month.

How much does the US spend annually on financial education programs, and what has been found about their effectiveness?

-The US spends nearly 700 million dollars every year on financial education programs. However, researchers found that these programs only explained 0.1 percent of the variance in financial behaviors.

What is the role of math ability in managing finances according to the transcript?

-The transcript suggests that a person's general ability to do math is a more significant predictor of how well they manage their finances than financial literacy education.

What does the speaker propose as the key to changing financial behavior?

-The speaker suggests that behavior change is more of an environmental pursuit than an educational one, implying that altering one's environment and how they interact with it is crucial for financial behavior change.

How are targeted ads and corporate content influencing financial behavior according to the transcript?

-Targeted ads are becoming more personalized and corporate content more engaging, which are cues to spend money that have become smarter, faster, and more efficient.

What is the main message the speaker wants to convey about financial security?

-The speaker wants to convey that financial security is not just a problem that can be solved through education alone, but it requires reshaping one's environment to facilitate better financial decisions.

What practical tips does the speaker promise to share at the end of each episode?

-The speaker promises to share practical tips based on research on how to spend less and save more today, with the aim of helping viewers regain control of their finances.

What is the intended outcome for the audience after following the series mentioned in the transcript?

-The intended outcome is for the audience to change their environment and regain control of their finances, leading to improved financial management and savings.

Why does the speaker emphasize that the tips are for 'today' and not 'tomorrow'?

-The speaker emphasizes 'today' to encourage immediate action and change, recognizing that procrastination is a common barrier to implementing financial advice.

Outlines

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифMindmap

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифKeywords

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифHighlights

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифTranscripts

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифПосмотреть больше похожих видео

Evaluating composite functions | Mathematics III | High School Math | Khan Academy

Function Operations

You CAN manifest ANYTHING in 3 days ( even your SP )

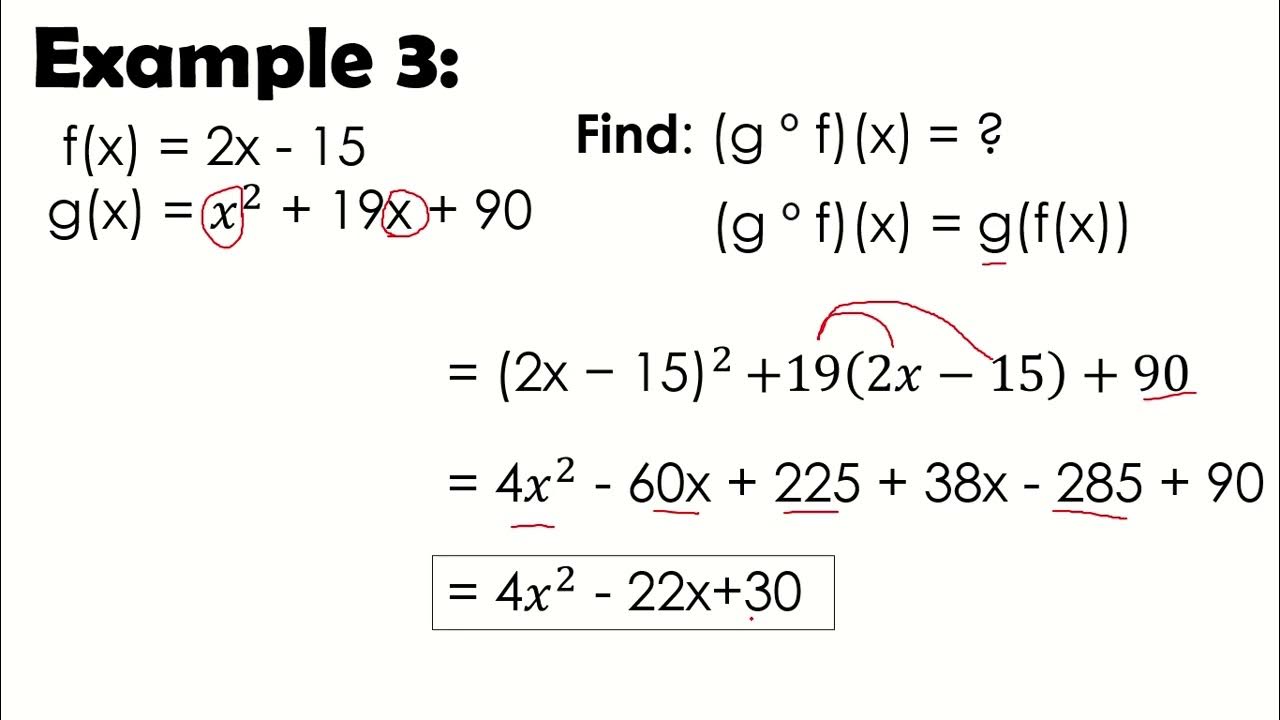

Composition of Functions - Grade 11 - General Mathematics

Weather update as of 6:10 AM (August 27, 2024) | Unang Hirit

G-Spot Stimulation Mastery: 7 Moves That Will Make Her Scream!

Composition of Function by Ma'am Ella Barrun

5.0 / 5 (0 votes)