FAQ EKONOMI SYARIAH #1: Ciri, Prinsip & Larangannya

Summary

TLDRThe video script discusses the terminology and principles of Islamic Economics (Ekonomi Islam) and Sharia Economics (Ekonomi Syariah) in Indonesia. It explains that while both terms refer to the same system based on the Qur'an and Sunnah, 'Syariah' is preferred in Indonesia due to historical sensitivities. The script highlights key Islamic economic principles: avoiding riba (interest), gharar (uncertainty), and dzolim (injustice). It differentiates between muamalah (human interactions) and ibadah (worship), emphasizing that in muamalah, all is permissible unless explicitly prohibited.

Takeaways

- 📊 The term 'Islamic Economics' is used globally, whereas 'Sharia Economics' is more commonly used in Indonesia.

- 📖 Islamic Economics is a system based on the Qur'an and the Sunnah of the Prophet Muhammad (SAW).

- 🔄 Although the terminology differs, Islamic Economics and Sharia Economics are essentially the same.

- 🌍 Globally recognized terms include Islamic Banking, Islamic Capital Market, and Islamic Mutual Fund.

- 🇮🇩 In Indonesia, the term 'Sharia' is preferred due to historical sensitivities around the word 'Islam'.

- 📚 Some Indonesian institutions, like the University of Indonesia, are starting to use the term 'Islamic Economics'.

- 🔄 Islamic Economics covers broader aspects like faith (akidah), ethics (akhlaq), and law (sharia).

- 📜 In Islamic muamalah (transactions), all activities are permitted except those explicitly forbidden.

- 💵 Riba (interest), gharar (uncertainty), and dzolim (injustice) are prohibited in Islamic transactions.

- ❌ Riba is the predetermined addition in a loan agreement, gharar involves uncertain transactions, and dzolim includes fraud and bribery.

Q & A

What is the primary difference between 'Islamic Economics' and 'Shariah Economics' as discussed in the transcript?

-The terms 'Islamic Economics' and 'Shariah Economics' essentially refer to the same system of economics based on the Quran and Sunnah. The difference lies in terminology, with 'Islamic Economics' being more commonly used globally, while 'Shariah Economics' is often used in Indonesia due to sensitivities around the word 'Islam'.

Why is the term 'Shariah Economics' preferred in Indonesia?

-In Indonesia, the term 'Shariah Economics' is preferred because 'Islamic Economics' was initially perceived as exclusive to Muslims. The use of 'Shariah' was seen as more inclusive, reflecting the Islamic law aspect without emphasizing religious exclusivity.

What are some common elements mentioned in the transcript that are prohibited in Islamic economic transactions?

-The transcript mentions three key prohibitions in Islamic economic transactions: riba (interest), gharar (uncertainty), and dzolim (injustice or wrongdoing).

How does the concept of 'riba' differ from conventional interest in financial transactions?

-Riba refers to any guaranteed interest or profit on loans or investments that is predetermined, which is considered exploitative. Unlike conventional interest, which is a standard aspect of many financial systems, riba is prohibited in Islamic finance.

Can you explain the term 'gharar' and provide an example?

-Gharar refers to uncertainty or ambiguity in the terms of a contract, which can lead to exploitation. An example of gharar is selling crops that are not yet grown, where the outcome and quality are uncertain.

What is 'maysir', and why is it prohibited in Islamic economics?

-'Maysir' refers to gambling or any form of zero-sum game where one party's gain is another's loss. It is prohibited because it involves excessive uncertainty and can lead to harm and financial loss for one of the parties involved.

How does the concept of 'muamalah' differ from 'ibadah' in Islamic teachings?

-'Muamalah' involves dealings and transactions between people, covering all economic and social interactions. 'Ibadah', on the other hand, refers to worship and the relationship between individuals and God, with specific rules and rituals.

Why might the term 'Islamic Economics' be considered more comprehensive than 'Shariah Economics'?

-'Islamic Economics' is seen as more comprehensive because it encompasses not only the legal aspects of Shariah but also includes elements of faith (aqidah) and ethics (akhlak).

What is the primary goal of Islamic Economics according to the transcript?

-The primary goal of Islamic Economics is to regulate human interactions, especially in economic activities, based on the principles of fairness, transparency, and prohibition of exploitative practices like riba, gharar, and maysir.

Is conventional economics entirely incompatible with Shariah principles?

-The transcript suggests that not all conventional economic practices are incompatible with Shariah principles. However, practices involving riba, gharar, and dzolim are not permissible under Shariah.

Outlines

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードMindmap

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードKeywords

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードHighlights

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードTranscripts

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレード関連動画をさらに表示

Bab 4 Asuransi, Bank, dan Koperasi Syariah | Bagian Ketiga Koperasi Syari'ah | Kurikulum Merdeka

PART#2 EKONOMI DAN ISLAM.

PRINSIP, TUJUAN & KARAKTERISTIK EKONOMI SYARI'AH || EKONOMI ISLAM

Tugas Perbankan Syariah

APA ITU EKONOMI SYARIAH?? - Dr. M. Syafii Antonio, M.Ec.

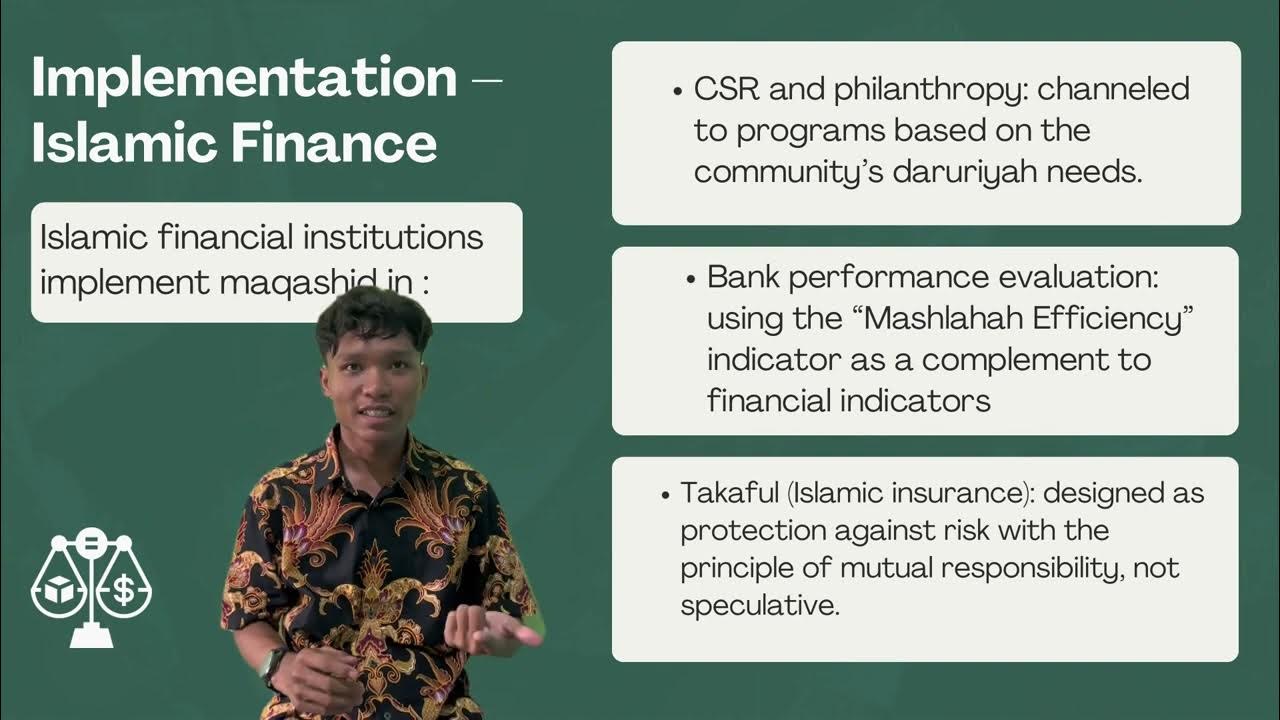

Maqashid Sharia As The Goals of Islamic Economics

5.0 / 5 (0 votes)