💡 Using a Limit Order Only Trading Strategy to Maximise Profits 📈

Summary

TLDRThis video explores a limit order-only trading strategy, ideal for traders unable to monitor the market constantly. It discusses the pros and cons of this approach, including the inability to adjust on the fly due to market volatility. The presenter suggests using daily charts to hypothesize future price action, structuring trades around expected outcomes, and employing time-based exit strategies to manage risk effectively. The strategy encourages traders to think critically about market patterns and trade duration without the need for constant screen time.

Takeaways

- 📈 Limit Order Strategy: The video discusses a trading strategy that relies solely on limit orders to enter trades without the need to be constantly in front of the screen.

- 🕒 Time Efficiency: One of the pros of using limit orders is that they allow traders to capitalize on trade ideas without being actively monitoring the market all day.

- 🔄 Risk of Fill: A downside of limit orders is that they will be filled at the specified price regardless of market conditions, which can be a risk if the price moves through the limit due to sudden news or events.

- 🛠 Strategy Adaptability: The video suggests that traders who are struggling with market timing might benefit from experimenting with a limit order strategy to see if it aligns better with their trading style.

- 📊 Hypothesis Formation: The strategy involves forming a hypothesis about what the market might do on a daily chart and then structuring trades based on that expectation.

- 🔄 Types of Limit Orders: The script explains two types of limit orders: stop entry orders for getting into the market at a certain level and standard limit orders for exiting or entering trades at specific prices.

- 📝 Trade Planning: It's important to plan trades based on expected price action, including setting entry points with limit orders and managing risk with stop-loss orders.

- ⏰ Time-Based Exits: The video emphasizes the importance of having a time-based exit strategy in addition to price-based targets to manage how long a trade is held open.

- 📉 Handling Breakouts: The script provides an example of how to structure trades during breakouts and failures, suggesting specific strategies for entering and exiting trades in these scenarios.

- 📝 Daily Chart Analysis: Traders are encouraged to analyze the daily chart to visualize potential price movements and structure limit orders that align with these expectations.

- 📲 Alerts and Timers: For traders not in front of the screen, setting alerts on a phone and using timers can help manage trades effectively, ensuring that entries and exits are executed according to the strategy.

Q & A

What is a limit order only trading strategy?

-A limit order only trading strategy is a method where traders place orders to buy or sell at a specific price, without the need to constantly monitor the market. It is based on the idea that the trader can set their desired entry and exit points in advance and let the market meet those prices to execute the trade.

Why might a trader choose to use a limit order only strategy?

-A trader might choose to use a limit order only strategy due to time constraints or the inability to be in front of the screen all day. It allows them to capitalize on trade ideas without needing to actively monitor the market for execution.

What are the pros and cons of using a limit order strategy?

-Pros include not needing to be in front of the screen constantly and having the potential to execute trades based on predetermined prices. Cons include the risk of being filled at the limit price regardless of market conditions, which could be unfavorable if the price hits the limit due to sudden news or market movements.

What are the two types of limit orders mentioned in the script?

-The two types of limit orders mentioned are stop entry orders, which are used to enter a trade when the price reaches a certain level, and standard limit orders, which are placed to buy or sell at a specific price and are executed only if the market price meets the limit price.

How can a trader use the previous day's price action to inform their limit order strategy?

-A trader can analyze the previous day's price action, including patterns and trends, to form a hypothesis about what the next day's price action might look like. This can help in deciding where to place limit orders for entry and exit based on expected market behavior.

What is an 'inside day' in the context of trading?

-An 'inside day' refers to a trading day where the price action is contained within the range of the previous day's price action. It suggests a period of consolidation and can be used to inform a trader's expectations for the next day's market movement.

How can a trader manage their risk when using a limit order strategy?

-A trader can manage risk by setting stop-loss orders to limit potential losses if the trade goes against them. Additionally, they can use time-based exit strategies, such as setting alerts or timers to close the trade after a certain period if the market does not move as expected.

What is a 'breakout and fail' scenario in trading?

-A 'breakout and fail' scenario occurs when the price breaks above or below a significant level (like a resistance or support level) but then fails to sustain the move and reverts back to the previous range. This can be a signal for potential reversals and can inform a limit order strategy.

How can a trader determine the duration of a trade when using a limit order strategy?

-A trader can determine the duration of a trade by setting time-based exit strategies, such as setting a timer for when they expect the trade to complete based on market conditions or by using alerts that trigger when certain price levels are reached.

What is the importance of having a clear hypothesis about the market when using a limit order strategy?

-Having a clear hypothesis about the market is important because it helps the trader to make informed decisions about where to place their limit orders. It allows them to anticipate market movements and structure their trades accordingly, increasing the likelihood of successful trades.

Can you provide an example of how a trader might structure a limit order based on their market hypothesis?

-An example could be if a trader expects a heavy down day based on the previous day's price action. They might place a sell limit order just below the prior day's low, anticipating a test of that level. They would also set a stop-loss order to manage risk and potentially a time-based exit strategy to close the trade after a set period if the market does not behave as expected.

Outlines

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードMindmap

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードKeywords

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードHighlights

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードTranscripts

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレード関連動画をさらに表示

Mastering Order Flow To Make Money Trading (2023)

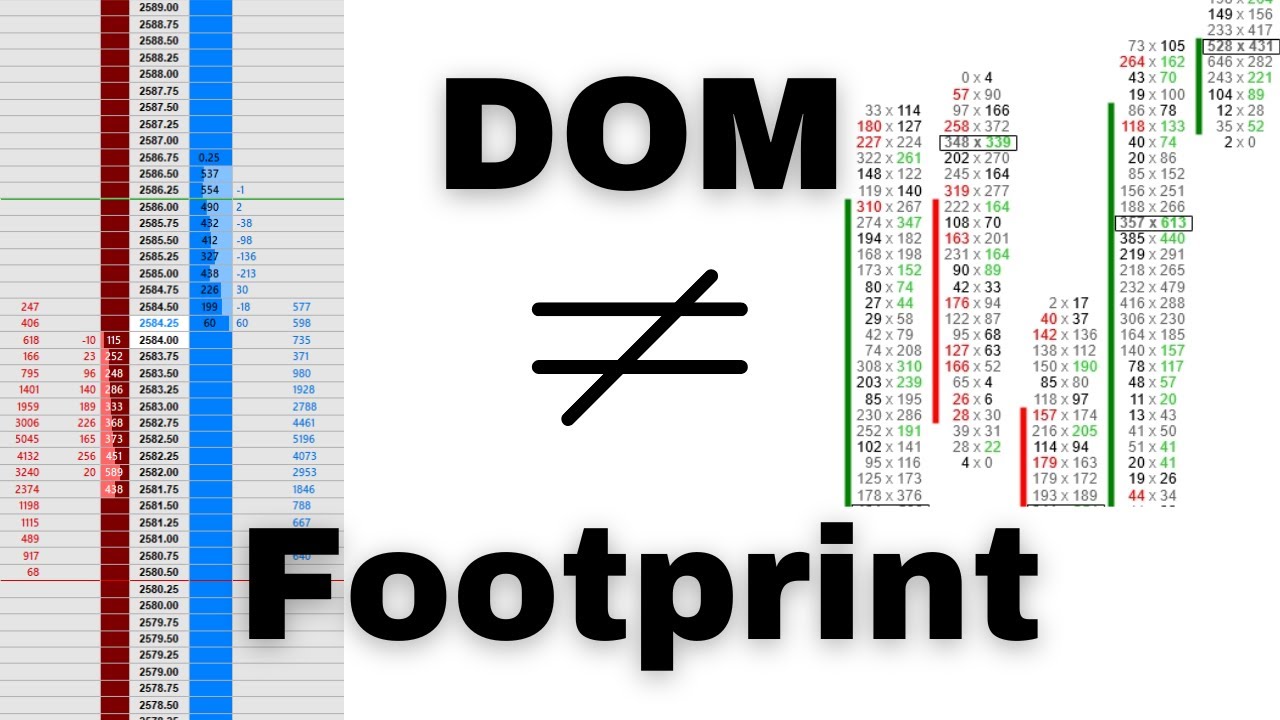

Understanding The Differences Between a DOM and Footprint Chart

Why Valid Order Blocks Fail in Forex Trading, Exploring the Order Flow Trading Strategy

Make $100 PER DAY - The Ultimate Order Block Trading Strategy

Cara Baku Menentukan Supply & Demand Seperti Profesional || Strategi 4 EMA Supply & Demand || SMC

2022 ICT Mentorship Episode 9

5.0 / 5 (0 votes)