Advanced Market Structure Simplified | ICT

Summary

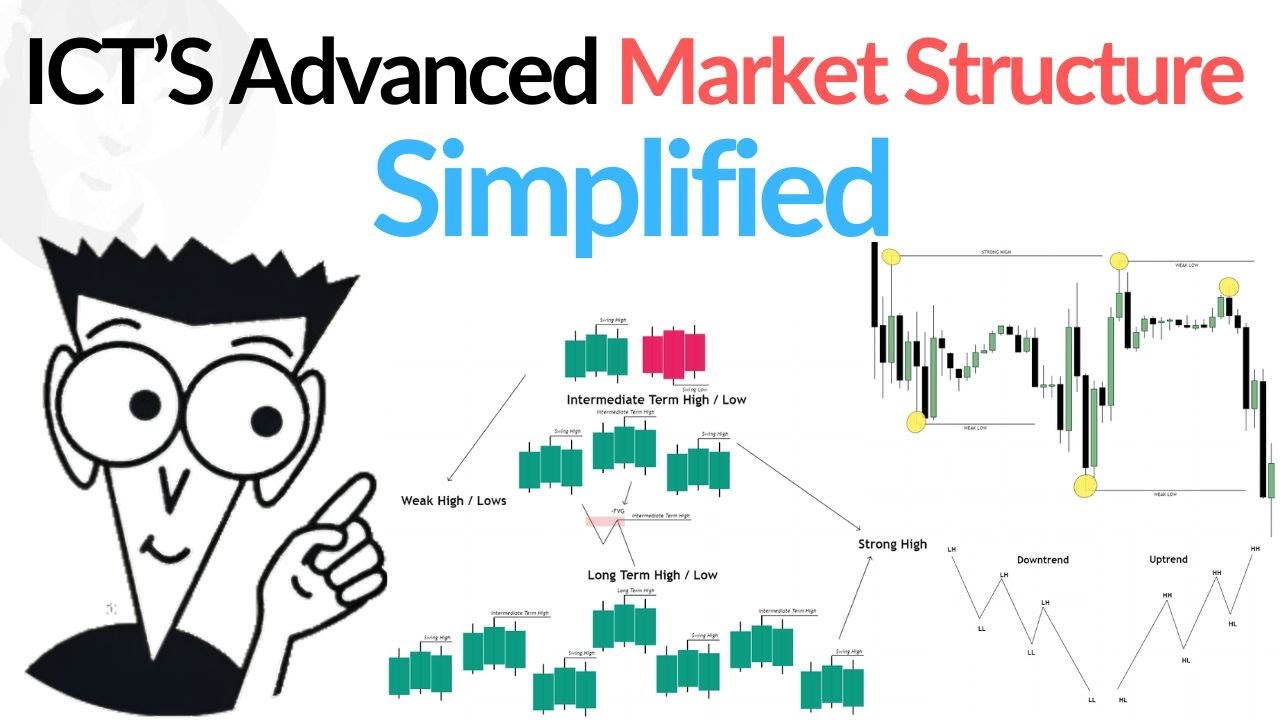

TLDRThis video dives deep into advanced market structure concepts, emphasizing the importance of swing points over simple high-low analysis. It covers the identification of long-term, intermediate-term, and short-term points, explaining how the market hunts liquidity and fills gaps. Key strategies for recognizing significant market movements and proper entry points are discussed, with a focus on daily and lower time frames. The video also highlights the importance of liquidity sweeps and their role in defining market trends, ensuring a thorough understanding of market structure for traders aiming to enhance their trading techniques.

Takeaways

- 😀 Advanced market structure goes beyond simple highs and lows, incorporating swing points to better understand price action.

- 😀 Swing points are identified through three-candle formations, with swing highs having the highest upper wick and swing lows having a lower middle wick.

- 😀 There are three types of swing points: long-term, intermediate-term, and short-term, each serving a different purpose in market analysis.

- 😀 Long-term swing points are identified on daily timeframes, acting as support or resistance levels and are significant for liquidity hunting.

- 😀 Intermediate-term swing points are formed when price rebalances an imbalance (such as a fair value gap) or creates a higher swing point between two others.

- 😀 Short-term swing points are simpler formations and typically broken by the market, often used to define intermediate points rather than as trade entry points.

- 😀 Liquidity hunting and gap filling are the two key drivers behind market movements, often seen as the market seeks high liquidity areas and fills untraded zones.

- 😀 A liquidity gap is a price range where few trades have occurred, often due to rapid price movements, and the market typically returns to fill these gaps.

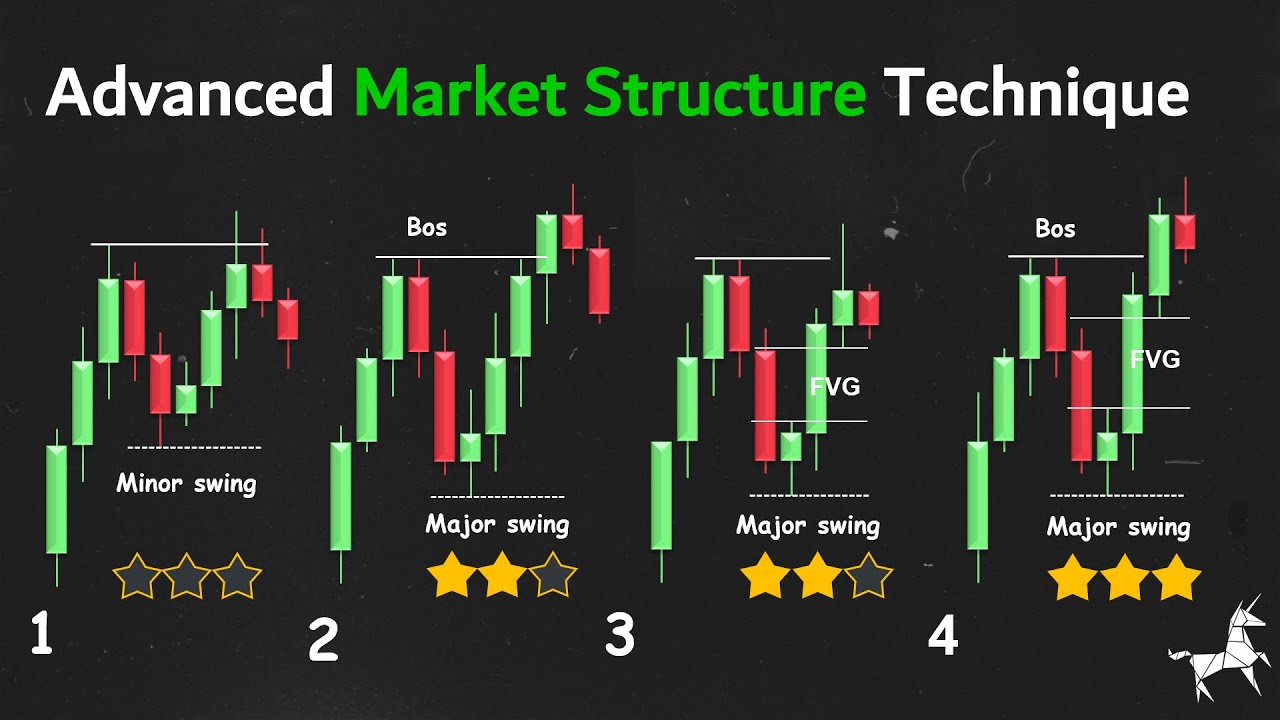

- 😀 To enter a trade effectively, identify where liquidity has been swept, ensuring that the price moves in the right direction and that the market structure break is confirmed.

- 😀 Understanding market structure involves identifying swing points, predicting market direction, and finding valid trade entries, supported by analyzing price movements at multiple timeframes.

Q & A

What is the primary focus when analyzing advanced market structure?

-The primary focus is on identifying swing points, which are three-candle formations that help define key market levels. These swing points help in understanding market direction, liquidity hunting, and entry points for trades.

How are swing points identified in advanced market structure?

-Swing points are identified by observing the relationships between three candles: the middle candle in a swing high has the highest upper wick, and in a swing low, the bottom wick of the first and third candles is higher than the bottom wick of the middle candle.

What are the three types of swing points in advanced market structure?

-The three types are long-term points (identified on daily time frames), intermediate term points (identified through price rebalancing or new higher swing points), and short-term points (simpler three-candle swings that are more transient and often broken).

What role does liquidity play in market structure analysis?

-Liquidity plays a crucial role in market structure analysis, as the market hunts for areas with high liquidity, typically around support and resistance levels. Liquidity gaps, such as fair value gaps, often form when prices move rapidly, leaving untraded zones, which the market eventually returns to fill.

How does a market structure break impact market trends?

-A market structure break occurs when the price moves against the established trend and breaks through long-term points, potentially leading to a reversal on higher time frames.

What is the difference between short-term and intermediate term points?

-Short-term points are simple swing highs and lows, often broken by the market, and are not significant for trading. In contrast, intermediate term points represent more important swings that the market reacts to, and gaps or order blocks formed around them can be potential entry points.

What is the significance of fair value gaps in market structure?

-Fair value gaps represent price ranges where few trades have occurred, typically due to rapid price movements. These gaps are considered important because the market often returns to fill them, restoring liquidity and balance, making them potential areas for entering trades.

Why is it important to identify the direction of the market when entering a trade?

-Identifying the market direction is critical because entering a trade without understanding whether the market has swept liquidity and is moving in a specific direction could lead to poor trade decisions. Traders should ensure that liquidity has been swept and the market is heading in the desired direction before entering a trade.

What should traders look for in lower time frames to confirm a trade entry?

-Traders should look for price gaps or order blocks formed after intermediate term points in lower time frames. These areas are more likely to impact market movement and serve as potential entry points.

How can traders effectively test their understanding of market structure?

-Traders can effectively test their understanding of market structure by analyzing different charts and identifying swing points. This practice helps develop a deeper understanding of how the market behaves and enhances their ability to spot valid trading opportunities.

Outlines

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードMindmap

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードKeywords

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードHighlights

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードTranscripts

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレード関連動画をさらに表示

ICT Advanced Market Structure Made EASY

ICT Advanced Market Structure | The ONLY Video You Will ever Need

Market Profile: Course Introduction

How To Understand Market Structure | FOREX | SMC (Part 1)

Basic Alchemist bahasa indonesia || Alchemist strategy

I Discovered Best Market Structure Analysis (Premium Video)

5.0 / 5 (0 votes)