Basic Alchemist bahasa indonesia || Alchemist strategy

Summary

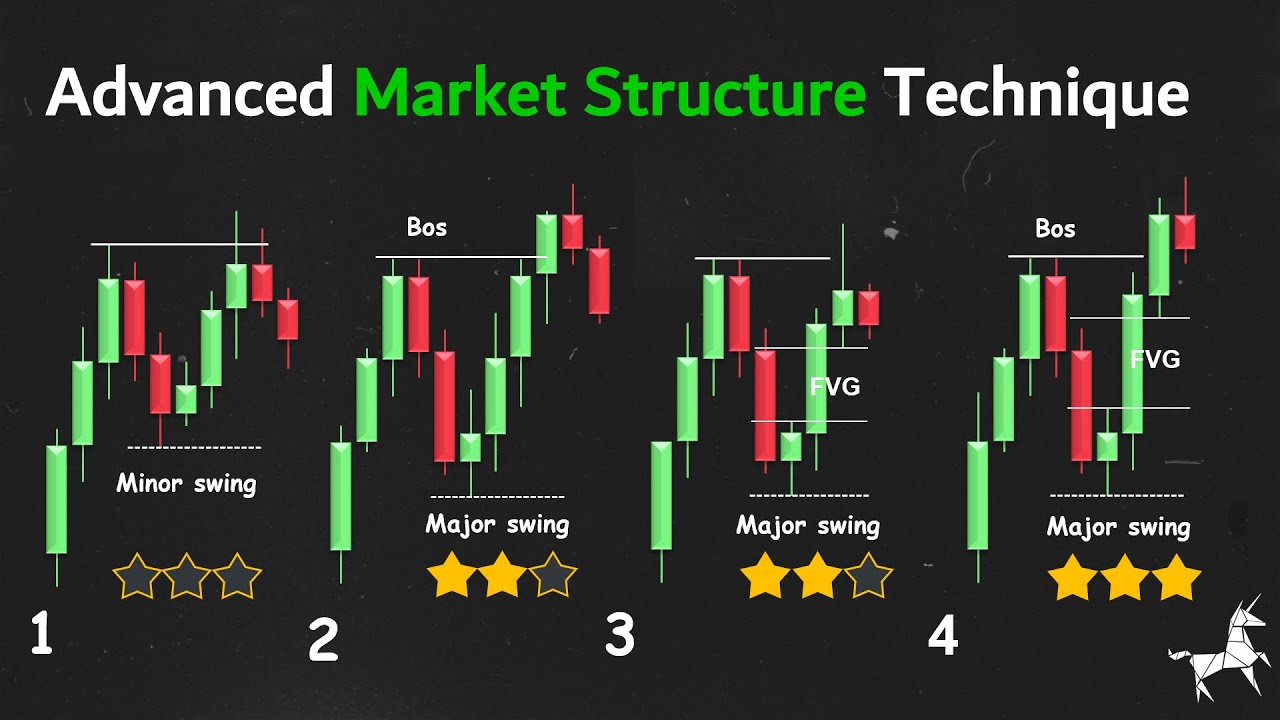

TLDRIn this video, the speaker delves into the Alsemis trading method, emphasizing the importance of recognizing strong high and low market structures, liquidity grabs, and key entry points. The video covers fundamental concepts like order blocks, break of structure, and the significance of different market sessions, including the Asia, London, and New York Kill Zones. The speaker stresses the need for top-down analysis and understanding the market's direction to identify valid points of interest (POIs) and execute trades effectively. Viewers are encouraged to watch a longer video for deeper understanding and examples.

Takeaways

- 😀 Strong high and strong low are essential structures in market analysis for predicting trend reversals.

- 😀 Understanding the market structure requires identifying 'breaks' in price action, such as strong highs or lows.

- 😀 Always verify market setups using higher time frames (e.g., H1, H4, Daily) to confirm the validity of patterns found in lower time frames.

- 😀 The key zones to focus on in trading include POI (Point of Interest) areas, order blocks, rejection blocks, and apex areas.

- 😀 It's important to wait for a body close, not just a wick, for valid breakouts or liquidity grabs in the market.

- 😀 The Asian session often involves ranging markets, and price action can be used to identify liquidity grabs and trend setups.

- 😀 A strong low or high can form during the Asia session, which should then be checked for order blocks or rejection blocks on higher time frames for validation.

- 😀 Trading with clear market structure in mind, such as recognizing liquidity grabs and break of structure, can help in setting effective trade entries.

- 😀 Use the London Kill Zone and New York Kill Zone as prime entry points for trades, especially during volatile news periods.

- 😀 Key to successful trading is following a top-down analysis approach, understanding both bullish and bearish market directions based on structural patterns and liquidity levels.

Q & A

What is the main topic of the video?

-The main topic of the video is about explaining the Alsemis trading strategy, focusing on key concepts like market structure, strong highs and lows, liquidity, and how to use these principles to make trading decisions.

What does the speaker recommend before watching this video?

-The speaker recommends watching a previous 3-hour video on Alsemis to understand the basics of the strategy before diving into this video. This ensures viewers won’t feel lost while following the concepts discussed.

What are strong highs and strong lows in Alsemis trading?

-In Alsemis trading, strong highs and strong lows represent key points in market structure where a reversal or trend change is likely. A strong high is when the market breaks a previous high and a strong low is when it breaks a previous low, signaling potential trend shifts.

What is the significance of liquidity in the Alsemis strategy?

-Liquidity is crucial in the Alsemis strategy because the market often targets liquidity areas to grab orders. The concept of liquidity grab involves the market moving toward areas of high liquidity, which may result in price reversals or trend changes.

What is the importance of time frames in Alsemis trading?

-Time frames are important because the strategy requires analyzing market structures on different time frames. For example, low time frames help identify market structure changes, while higher time frames (like H1, H4, or daily) validate the setup and help confirm the direction of the trend.

How does the Asia session affect trading in Alsemis?

-In the Alsemis strategy, the Asia session is characterized by a lack of significant market movement, often resulting in ranging or consolidation. Traders observe the low and high points during this session to predict future price movements.

What role do the London and New York Kill Zones play in this strategy?

-The London and New York Kill Zones are crucial for entering trades, as these sessions tend to have higher volatility. The strategy relies on these times to enter trades after identifying key market structures and liquidity areas.

What is the role of a 'Break of Market Structure' (BMS) in this strategy?

-A Break of Market Structure (BMS) occurs when the market breaks a previous high or low, signaling a potential reversal or continuation of the trend. This is a key event that traders use to enter trades in Alsemis.

What are Order Blocks and Rejection Blocks?

-Order Blocks are areas where institutions have placed significant buy or sell orders, which can act as support or resistance. Rejection Blocks are areas where the market has previously rejected price movement, often signaling strong resistance or support for future trades.

How can traders confirm their entries in Alsemis?

-Traders can confirm their entries by using smaller time frames to observe price action. For example, they may look for confirmation of strong lows or highs on the M15 time frame, ensuring that the setup is valid before entering the trade.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Advanced Market Structure Simplified | ICT

I Discovered Best Market Structure Analysis (Premium Video)

#1 ORDER BLOCK Trading Strategy: FOR PROS

Master SMC/ ICT Market Structure The Correct Way (very easy)

My Secret High Probability Liquidity Sweep Strategy [Full In-Depth Guide]

Why You Don't Understand ICT Liquidity | Strategy + Entry Model

5.0 / 5 (0 votes)