Konsep, Pengertian dan Klasifikasi Biaya

Summary

TLDRThis video script explains the concepts of cost estimation, cost classification, and the different types of costs in business accounting. It highlights the difference between costs and expenses, the classification of costs based on various factors such as object, function, relationship to activities, and time span. Key cost categories discussed include direct and indirect costs, variable and fixed costs, as well as capital and revenue expenditures. The script also provides examples of how costs behave in different scenarios, offering a deeper understanding of cost management for decision-making in business operations.

Takeaways

- 😀 Costs vary based on their intended purpose and the decisions made within an organization.

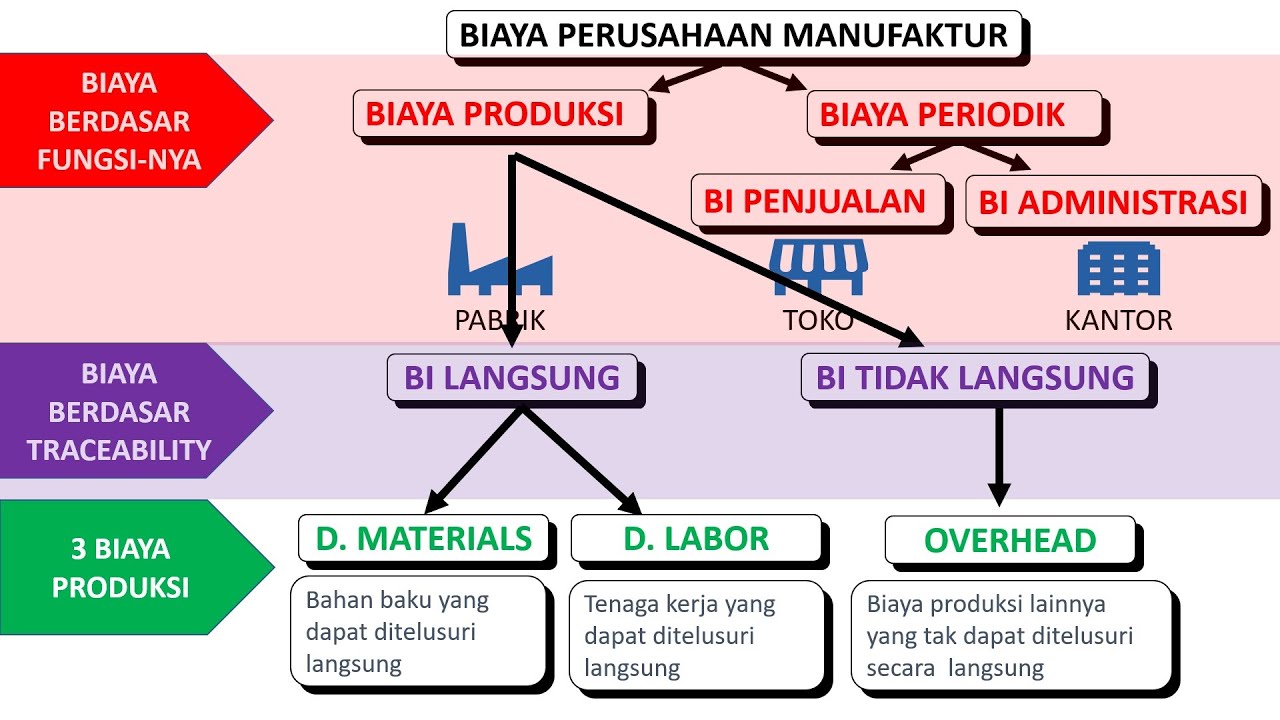

- 😀 Costs can be classified based on their object (e.g., fuel, salaries), function (e.g., production, marketing, administration), and their relationship to the volume of activities.

- 😀 A cost is an economic sacrifice measured in money, incurred for a specific purpose, either in the past or future.

- 😀 The difference between 'cost' and 'expense' is crucial. Costs often involve investment for multiple accounting periods, whereas expenses are typically incurred within a single accounting period.

- 😀 Direct costs are directly tied to the production of a product (e.g., materials), while indirect costs are not directly traceable (e.g., overhead costs).

- 😀 Manufacturing companies classify their costs into three primary categories: production costs, marketing and sales costs, and administrative and general costs.

- 😀 Production costs include direct materials, direct labor, and factory overhead, which together are known as conversion costs.

- 😀 Marketing and sales costs focus on obtaining and fulfilling customer orders, including advertising, shipping, and sales commissions.

- 😀 Administrative and general costs refer to expenses related to organizing and managing business operations, such as executive salaries and office overhead.

- 😀 Costs can be classified based on their behavior: variable costs change with activity volume, semi-variable costs change but not proportionally, and fixed costs remain constant regardless of activity volume.

- 😀 Capital expenditures are long-term costs that provide benefits beyond one accounting period, like purchasing machinery, while revenue expenditures provide benefits within the current accounting period, like operational expenses.

Q & A

What is the definition of cost as per the script?

-Cost is defined as the sacrifice of economic resources, measured in monetary units, that has already occurred or is likely to occur for a specific purpose.

What is the difference between 'cost' and 'expense'?

-'Cost' refers to expenditures for acquiring resources, often as an investment, that can be used across multiple accounting periods. 'Expense' refers to expenditures that are incurred for obtaining returns or income within a single accounting period.

What are the main classifications of costs?

-Costs are classified based on several factors: the object of the expenditure, the main functions within a company, the relationship between the cost and the item being financed, the relationship between the cost and the volume of activities, and the time frame of benefits (short-term or long-term).

What is the meaning of direct and indirect costs?

-Direct costs are those that can be directly attributed to the production of goods or services, like materials used in a product. Indirect costs cannot be directly linked to a specific product and are often categorized as overhead.

How are costs classified based on the main functions in a manufacturing company?

-In a manufacturing company, costs are classified into three main categories: production costs (for transforming raw materials into finished products), marketing and sales costs (for obtaining and fulfilling customer orders), and administrative and general costs (for managing and organizing production and marketing activities).

What is meant by fixed costs and variable costs?

-Fixed costs remain constant regardless of the production volume, such as salaries of permanent employees. Variable costs change in direct proportion to the volume of production, such as raw materials used.

What are semi-variable costs?

-Semi-variable costs are those that change, but not in direct proportion to the volume of activity. They contain elements of both fixed and variable costs. For example, utility bills that increase with production volume but not on a 1:1 ratio.

What is the difference between capital expenditure and revenue expenditure?

-Capital expenditure refers to costs incurred for acquiring or improving long-term assets that provide benefits over several accounting periods, such as purchasing machinery. Revenue expenditure refers to costs that provide benefits within a single accounting period, such as operational expenses.

How do electricity costs relate to the production process in terms of cost behavior?

-Electricity costs for operating machines are considered variable costs because they increase as production volume increases.

Can you explain the classification of costs based on their relationship to volume changes?

-Costs can be classified into four categories based on their response to volume changes: variable costs (which increase proportionally with activity), semi-variable costs (which change but not proportionally), stepped costs (which remain constant within specific ranges of activity), and fixed costs (which remain unchanged regardless of activity volume).

Outlines

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードMindmap

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードKeywords

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードHighlights

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードTranscripts

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレード5.0 / 5 (0 votes)