ICT Power Of 3 - AMD

Summary

TLDRThis video explains the Power of Three trading strategy, which focuses on identifying Accumulation, Manipulation, and Distribution phases in the market. The strategy is built on the concept of recognizing price consolidations (accumulation), false breakouts (manipulation), and trend continuation (distribution). By using higher timeframes to understand market structure, traders can predict price movements on lower timeframes. The video walks through various examples, showing how to spot these phases and make entry decisions, with insights into using open-high-low-close patterns and liquidity analysis for better trading outcomes.

Takeaways

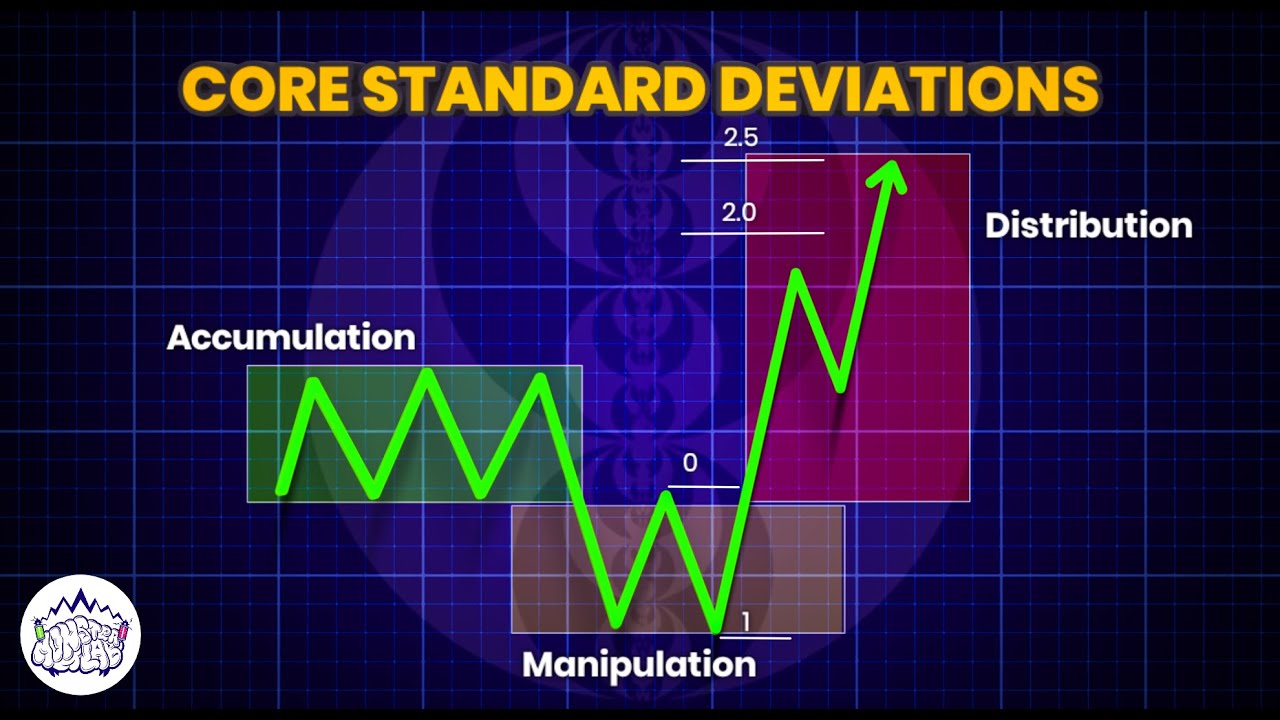

- 😀 Accumulation, Manipulation, and Distribution (AMD) is a trading strategy that involves three key phases: consolidating price action, false breakouts, and final price movement in the direction of the trend.

- 😀 Open High Low Close (OHLC) and Open Low High Close (OLHC) are key terms used to describe the high, low, open, and close values of higher timeframe candles, which are critical to identifying AMD patterns in intraday price action.

- 😀 Accumulation refers to a consolidation phase where liquidity builds up above old highs and below old lows, setting up potential trade setups for future breakouts.

- 😀 Manipulation occurs when price breaks out of the range during accumulation, triggering false breakouts and stop-outs, while also inducing breakout traders to enter the market.

- 😀 Distribution follows manipulation, as price moves in the direction of the established trend, completing the 'Power of Three' cycle and potentially providing profitable trade opportunities.

- 😀 Key to identifying AMD patterns is having a higher timeframe order flow or liquidity draw, as trading solely based on patterns without context can be ineffective.

- 😀 In terms of entries, traders can look for reversals during the manipulation phase or continuation patterns in the distribution phase, based on how the price action behaves.

- 😀 The Power of Three concept can be applied to both lower and higher timeframes, with the same principles of accumulation, manipulation, and distribution occurring across different timeframes.

- 😀 Fractal patterns are central to the strategy, where similar structures of consolidation and breakout can be found across various timeframes, whether intraday or daily.

- 😀 In the examples provided, the strategy is shown to work on both intraday charts (such as 5-minute or 1-minute) and daily charts, where manipulations form the wicks and distributions make up the body of daily candles.

Q & A

What is the main concept discussed in the video?

-The main concept is the 'Power of Three' or AMD, which refers to Accumulation, Manipulation, and Distribution in trading. It explains how to identify these phases on charts and how they relate to market movements and liquidity.

What is meant by 'open high low close' and 'open low high close'?

-'Open high low close' (OHL) and 'open low high close' (OLH) refer to the open, high, low, and close of a higher time frame candle, such as a daily candle. These patterns help traders understand the price action dynamics in relation to intraday movements.

What is the purpose of identifying accumulation, manipulation, and distribution phases?

-Identifying these phases helps traders understand market behavior, detect price manipulation, and plan entries based on the market's direction—whether it's reversing or continuing a trend.

How does the concept of 'manipulation' play a role in trading strategy?

-Manipulation refers to a false breakout outside of a consolidation range, which stops out early longs and induces breakout sellers. It is crucial for triggering a reversal or a move that leads to distribution, helping traders anticipate price moves.

What are the two entry strategies mentioned in the video for trading the Power of Three?

-The two entry strategies are: 1) Entering within the manipulation phase by looking for reversal patterns, and 2) Entering in the distribution phase by looking for continuation patterns.

How is the 'Power of Three' fractal in nature?

-The Power of Three can be applied to both higher and lower time frames. The same accumulation, manipulation, and distribution concepts work on different time scales, allowing traders to use them in intraday trading as well as longer-term market analysis.

What role does liquidity play in identifying the accumulation phase?

-Liquidity in the accumulation phase is built above old highs and below old lows, which creates potential buy and sell stops. Recognizing these liquidity levels helps traders identify where manipulation might occur.

What does 'distribution' refer to in the context of the Power of Three?

-Distribution refers to the final phase where the price moves in the expected direction after manipulation, either up or down, based on the market conditions. It completes the cycle of the Power of Three, either confirming the trend or reversing it.

How can the 'Box Setup' help in identifying entries?

-The Box Setup involves looking for price action that deviates from a range and then returns within it. Traders use this setup to identify potential reversal points or entries after a manipulation phase, usually by placing stops outside the range and targeting key price levels.

What is the significance of 'New York Open' in the examples provided in the video?

-The New York Open is important because it often marks a shift in market behavior, with price manipulation during the London session setting up opportunities for distribution during the New York session. The video highlights how this transition can influence price movements.

Outlines

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードMindmap

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードKeywords

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードHighlights

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードTranscripts

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレード関連動画をさらに表示

ICT Forex - Accumulation - Manipulation - Distribution

Episode 7: Identifying Power Of 3 & SMT - ICT Concepts

4HR PO3 | MMXM | Standard Deviations | ICT Concepts

You can trade only 1 hour a day using this model! M2 Model

Voici Comment Identifier Facilement des Orders Blocks en Trading (Guide 2024)

Core Standard Deviations + PO3 | ICT Concepts | DexterLab

5.0 / 5 (0 votes)