Statement of comprehensive income calculation

Summary

TLDRIn this video, the process of completing a statement of financial income is explained step-by-step. Key elements include calculating sales revenue, which combines cash and credit sales, and determining the cost of sales by factoring in opening inventories, purchases, and closing inventories. The gross profit is then calculated, and expenses such as rent, wages, depreciation, and other costs are deducted to determine the final profit or loss for the year. The video provides useful insights and tips for exams, emphasizing accuracy and awareness of distractor figures to ensure the correct completion of financial statements.

Takeaways

- 😀 Understanding the structure of a statement of financial income is essential for accurate reporting.

- 😀 Revenue includes both cash sales and sales on credit, which should be combined to calculate total income.

- 😀 The cost of sales is calculated by adding opening inventories to purchases and subtracting closing inventories.

- 😀 The gross profit is the difference between total revenue and the cost of sales.

- 😀 Expenses are indirect costs that the business incurs and must be subtracted from gross profit to determine net profit.

- 😀 Common expenses include rent, wages, depreciation, and liabilities.

- 😀 Depreciation represents the loss of value of assets over time, such as equipment or vehicles.

- 😀 A business’s profitability is determined by subtracting total expenses from gross profit.

- 😀 The final profit or loss for the year is calculated after deducting all expenses from the gross profit.

- 😀 In exams, be prepared for distractor items, which may test your understanding of the relevant financial concepts.

- 😀 Always double-check calculations with a calculator to ensure accuracy in preparing the statement.

Q & A

What is the first step in completing a statement of financial income?

-The first step is to determine the total sales revenue. This includes cash sales and sales on credit. Both figures are added together to calculate the total income.

How is the cost of sales calculated?

-The cost of sales is calculated by adding the opening inventories to purchases during the year and then subtracting the closing inventories from this sum.

Why is depreciation considered in the statement of financial income?

-Depreciation reflects the reduction in value of an asset over time due to factors like wear and tear. It is an expense that reduces the overall profit of the business.

What does the gross profit represent?

-Gross profit represents the difference between the total sales revenue and the cost of sales. It shows how much the business earns after accounting for the costs directly related to the production of goods or services.

What types of expenses are included in the statement of financial income?

-Expenses include rent, wages, depreciation, and utilities. These are indirect costs associated with running the business and are subtracted from the gross profit to calculate net profit or loss.

How do you calculate net profit from the statement of financial income?

-Net profit is calculated by subtracting total expenses from the gross profit. If the expenses exceed the gross profit, the result will be a net loss.

What role does a calculator play when completing the statement of financial income?

-A calculator is essential for accurately adding and subtracting figures, especially when dealing with tricky numbers. It's important to use it to ensure the calculations are precise.

What are 'distractors' in the context of the exam question?

-Distractors are elements or figures that do not belong in the statement of financial income. They are included to test your understanding and ability to discern what should and should not be included.

What does the term 'indirect costs' mean in the statement of financial income?

-Indirect costs, or expenses, are costs that are not directly tied to the production of goods or services but are necessary for running the business, such as rent, wages, and utilities.

Why is it important to understand the principles behind the statement of financial income?

-Understanding the principles behind the statement of financial income is crucial because it allows you to accurately complete the financial statement, ensuring correct calculations of revenue, costs, and profit or loss.

Outlines

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードMindmap

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードKeywords

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードHighlights

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードTranscripts

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレード関連動画をさらに表示

The INCOME STATEMENT for BEGINNERS

Basic Financial Statements

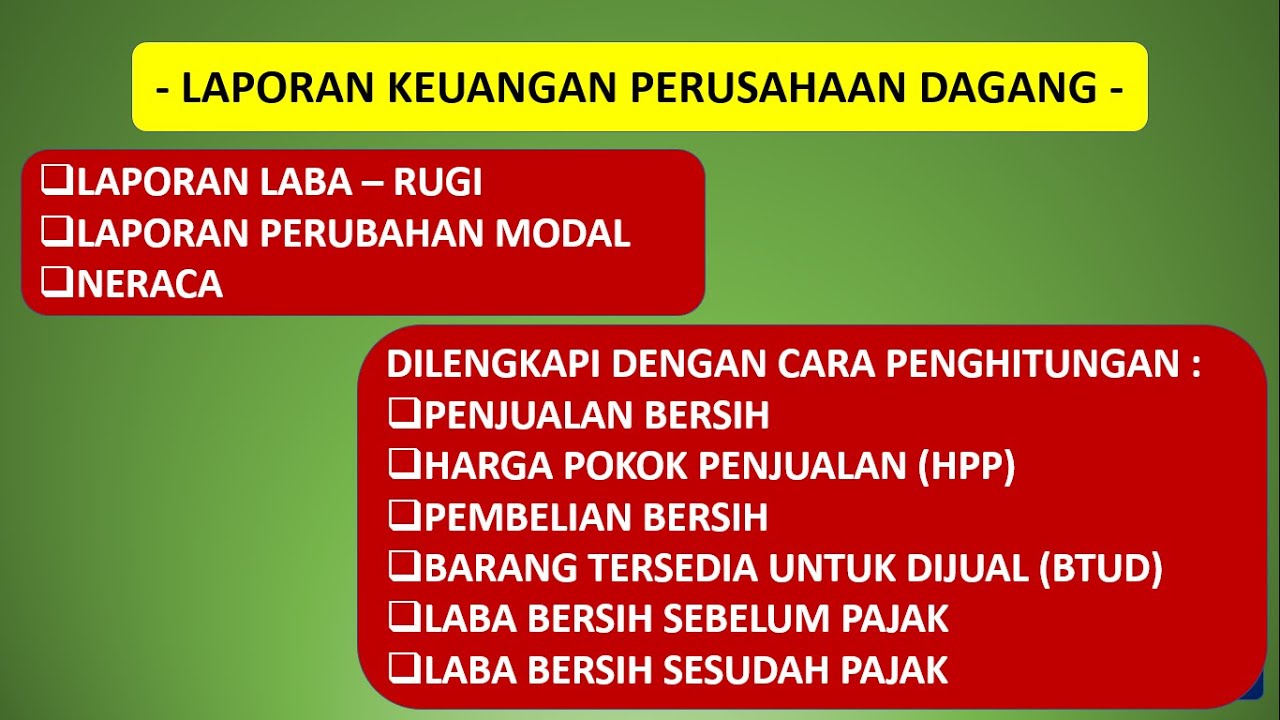

LAPORAN KEUANGAN PERUSAHAAN DAGANG

Tutorial Efiling 2022: Cara Lapor Pajak SPT Tahunan Secara Online Penghasilan Dibawah Rp 60 Juta

Menghitung Pajak Penghasilan Pasal 21 || Materi Ekonomi Kelas XI

Myob : UD. Buana || Memorial Evidence & Financial Statements || Parts. 6

5.0 / 5 (0 votes)