Petty Cash 101: Penjelasan Lengkap Tentang Kas Kecil

Summary

TLDRThis video provides a comprehensive guide to managing petty cash in businesses. It explains the importance of separating small expenses from larger ones and introduces the concept of petty cash, used for minor expenditures. The video covers key aspects such as how to record, report, and control petty cash, including practical examples. It also emphasizes the need for effective control measures due to the high risk of fraud associated with small transactions. Tips for managing petty cash effectively are also shared, such as setting limits, requiring signatures for approvals, and monitoring unusual expenditures.

Takeaways

- 😀 Kas kecil (petty cash) is a cash fund used for minor business expenses like office supplies and operational costs.

- 😀 The size of petty cash transactions depends on the company's scale, with limits typically set around 500,000 IDR per expense.

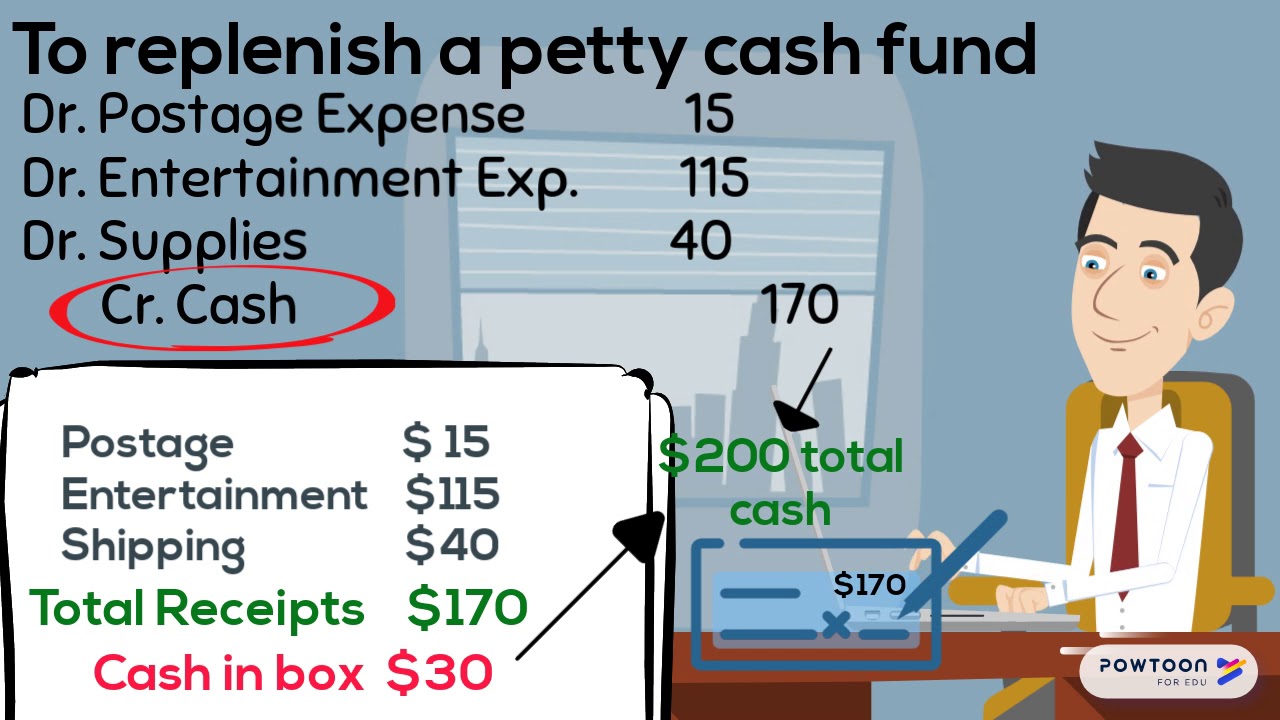

- 😀 Petty cash is replenished based on the imprest system, where the fund is topped up to a set maximum amount after it’s used.

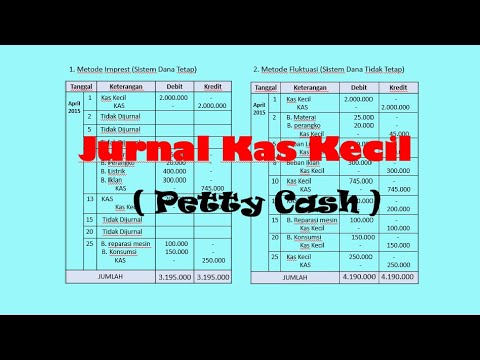

- 😀 Recording transactions is vital: each petty cash transaction should be documented with proper journal entries to track funds accurately.

- 😀 Petty cash is commonly replenished weekly, biweekly, or monthly, depending on company policies.

- 😀 Internal reporting for petty cash involves submitting detailed records of expenses after each replenishment to company management.

- 😀 External reporting involves listing petty cash balances in the current assets section of the balance sheet, as it’s considered liquid.

- 😀 Proper controls are essential to avoid fraud, with practices like requiring receipts for expenses and limiting transaction amounts.

- 😀 Managers or department heads must approve significant petty cash transactions to prevent misuse and ensure accountability.

- 😀 Common fraud risks with petty cash include the ease of misappropriating cash and the lack of approval for small, frequent purchases.

- 😀 Tips for effective management include regularly reviewing transactions, limiting the types of expenses that can be paid with petty cash, and ensuring all receipts are signed and approved.

Q & A

What is Petty Cash (Kas Kecil) in business?

-Petty Cash (Kas Kecil) refers to a small amount of cash set aside to handle minor, everyday business expenses, such as office supplies, transportation, or minor repairs. It helps to avoid the hassle of writing checks or using bank transfers for small expenditures.

Why is it important to separate small expenses from larger ones?

-Separating small expenses from larger ones allows managers to focus more effectively on critical areas like increasing profits or business growth, while ensuring that smaller, routine expenditures are tracked and managed separately.

What is the typical limit for Petty Cash in most companies?

-While there is no fixed standard, many companies set the limit for Petty Cash at around IDR 500,000 for small businesses. However, for larger businesses, this limit can vary, and some companies may set it higher based on internal policies.

How is Petty Cash managed and replenished?

-Petty Cash is managed through three main activities: recording, reporting, and controlling. It is replenished periodically, often on a weekly, bi-weekly, or monthly basis, depending on the company's policies. When the cash in the fund is low, a request for replenishment is made.

What is the Imprest Fund System in managing Petty Cash?

-The Imprest Fund System involves maintaining a fixed balance in the Petty Cash fund. When the fund is used, it is replenished back to the original amount. This system ensures there is always enough cash to cover small expenses without running into a deficit.

What should be done when Petty Cash is used for expenses?

-Whenever Petty Cash is used, the transaction should be recorded in the Petty Cash Book with appropriate journal entries. For example, a debit entry is made for the expense (such as fuel or office supplies), and a credit entry is made to reduce the cash balance.

What is the role of a manager in controlling Petty Cash?

-A manager or department head is typically responsible for approving the use of Petty Cash for specific expenses. Their role is to ensure that only authorized expenditures are made and that the cash is used within the set limits and guidelines.

How are Petty Cash reports presented to management?

-Petty Cash reports are typically submitted as part of a periodic review, such as weekly or monthly. The report includes a detailed list of all transactions, along with receipts or invoices, and is attached to the request for replenishment of the fund.

What are the risks associated with managing Petty Cash?

-The primary risks associated with managing Petty Cash include fraud and misuse. Since the fund consists of cash, it is easy to divert or misuse for unauthorized purposes. To mitigate this, companies implement strict controls, such as requiring approval for expenditures and maintaining proper documentation.

What are some tips for effectively managing and controlling Petty Cash?

-Some tips for controlling Petty Cash include: requiring receipts for all expenses, limiting the amount of cash that can be spent, ensuring that transactions are signed off by the appropriate managers, and periodically reviewing the Petty Cash records to ensure everything is accurate and within policy.

Outlines

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードMindmap

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードKeywords

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードHighlights

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードTranscripts

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレード5.0 / 5 (0 votes)