BITCOIN CONFIRMA SUPORTE E DISPARA PROS 110K 🚀

Summary

TLDRIn this video, the host discusses recent developments in the cryptocurrency market, particularly Bitcoin, and its interactions with major companies like Microsoft. The rejection of Bitcoin by Microsoft is contrasted with MicroStrategy's continued investment in Bitcoin, which has helped the company grow. The video analyzes Bitcoin's price movements, comparing current trends to previous cycles, and predicts a possible strong altcoin season. The host also touches on economic and political developments, including Argentina's potential adoption of Bitcoin and a shift towards a libertarian approach under President Milei, promoting free-market competition and lower taxes.

Takeaways

- 😀 The price of Bitcoin is currently holding above the 21-day EMA, despite recent market fluctuations, suggesting a strong support level.

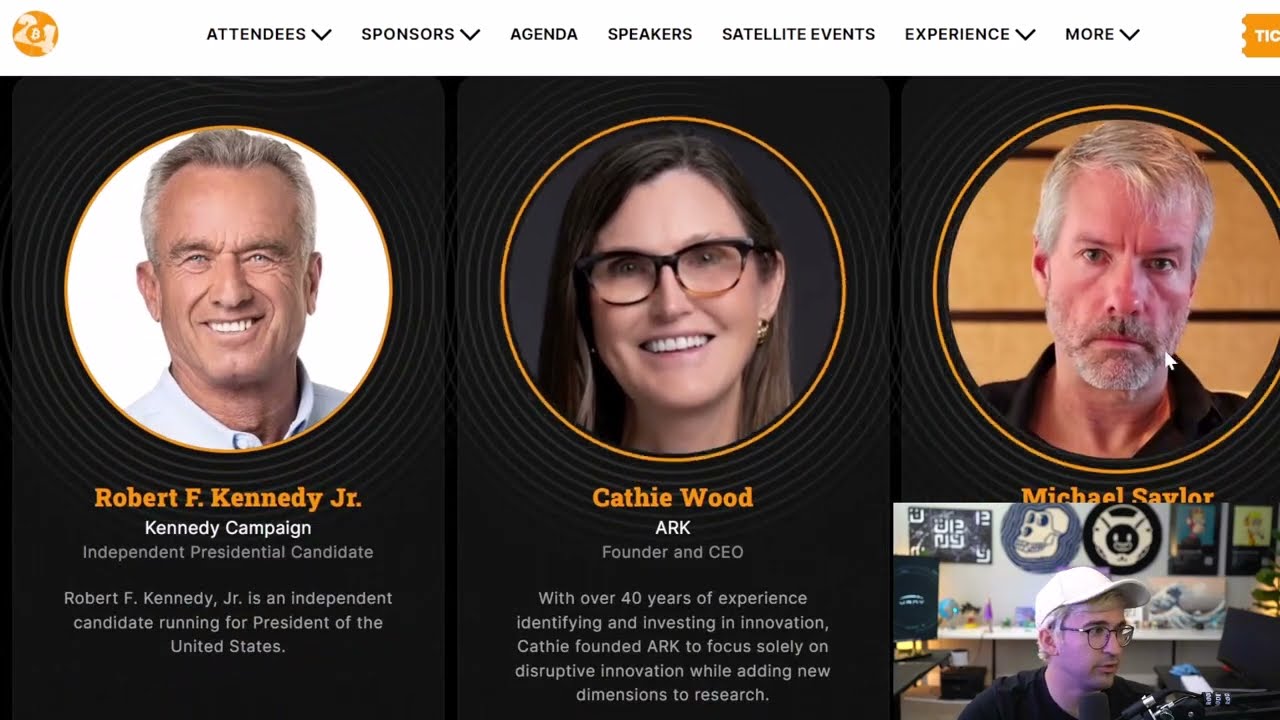

- 😀 Microsoft rejected a proposal to invest in Bitcoin, which could negatively impact the company's future growth, as it has previously missed out on emerging technologies.

- 😀 MicroStrategy, the company with the largest Bitcoin holdings in the world, is benefiting from its strategy and has recently entered the Nasdaq-100 index, which will inject $2.1 billion into Bitcoin-related ETFs.

- 😀 The price of Bitcoin recently broke out of a triangle formation, which indicates a potential strong upward movement, with a target price range of $130,000 to $140,000.

- 😀 A historical comparison to 2020 shows a similar chart pattern, where Bitcoin's price experienced a breakout and substantial increase after confirming a triangle formation.

- 😀 The Bitcoin dominance chart shows a pattern similar to 2020, where Bitcoin's dominance peaked and then fell, followed by a consolidation period that eventually led to an altcoin season.

- 😀 Altcoins are expected to see significant growth in the coming months, mirroring the cycle seen in late 2020 when altcoins increased by 45%, followed by a 30% correction.

- 😀 Bitcoin's strong position in the market is reinforcing the likelihood of a major altcoin season, with altcoins poised for significant value increases after their current correction.

- 😀 Argentina's new president, Javier Milei, is adopting libertarian economic policies and may potentially move toward adopting Bitcoin as legal tender, following El Salvador's lead.

- 😀 The Argentine government's recent decision to reduce taxes and promote competition between provinces could lead to a more effective and efficient economic environment, offering lessons for other countries.

Q & A

What does the presenter say about the price of Bitcoin in relation to the 21-day moving average?

-The presenter notes that the price of Bitcoin has been holding above the 21-day moving average, even after experiencing a sharp drop due to Microsoft's rejection of a Bitcoin investment proposal. This moving average has historically acted as a strong support level, helping to maintain the price within a certain range.

What was the impact of Microsoft's rejection of Bitcoin on the market?

-The presenter suggests that the rejection of Microsoft's Bitcoin investment proposal initially caused a market shock, causing Bitcoin's price to dip to around $94,000. However, the price failed to close below the key 21-day moving average, which provided support and limited the damage.

How does the presenter compare Microsoft's rejection of Bitcoin to past decisions?

-The presenter draws parallels between Microsoft's rejection of Bitcoin and past mistakes made by the company, such as rejecting new technologies like web browsers, smartphones, and social networks. The presenter believes this rejection will lead to Microsoft being overtaken by Bitcoin in the future, similar to how past mistakes harmed Microsoft's relevance.

What is MicroStrategy's role in the Bitcoin market?

-MicroStrategy is presented as the company holding the largest amount of Bitcoin in the world. The presenter highlights that MicroStrategy's decision to adopt Bitcoin as a treasury asset has significantly increased its value and relevance, and the company is now part of the Nasdaq 100, potentially attracting billions of dollars in ETF investments.

What is the significance of MicroStrategy's inclusion in the Nasdaq 100 index?

-MicroStrategy's inclusion in the Nasdaq 100 is seen as a key event because it leads to an automatic investment from various ETFs and funds, which will inject $2.1 billion into MicroStrategy. This, in turn, benefits Bitcoin, as MicroStrategy holds large amounts of it in its treasury.

What does the presenter predict about Bitcoin's price movement?

-The presenter predicts that Bitcoin's price will likely rise further after confirming the breakout of a triangle pattern on the price chart. They suggest that the price could reach $110,000, with strong support at the 21-day moving average acting as a key indicator for buying opportunities.

How does the presenter explain the current market behavior in relation to the 2020 cycle?

-The presenter draws a comparison between the current market behavior and the 2020 Bitcoin cycle. They point out similar patterns, such as a breakout from a triangle pattern, two touches on the 21-day moving average, and a strong price movement after the breakout. This suggests that Bitcoin could experience significant price increases, similar to what happened in 2020.

What is the relevance of Bitcoin dominance and how is it expected to evolve?

-The presenter explains that Bitcoin dominance has recently peaked above 60%, followed by a drop. This phase of consolidation is expected to continue, potentially leading to a significant altcoin season, where altcoins could experience explosive price movements after Bitcoin's dominance falls further.

What does the presenter mean by 'altcoin season' and how does it relate to the current market?

-Altcoin season refers to a period where altcoins experience significant price growth, often after Bitcoin's dominance decreases. The presenter notes that current market patterns closely resemble the 2020 cycle, where altcoins saw a dramatic increase in value after a correction. This could happen again, leading to a strong altcoin rally.

What are the key political developments in Argentina mentioned in the video?

-The presenter discusses the political changes in Argentina, specifically the new president, Javier Milei, who is aligning with El Salvador's Bitcoin-friendly policies. The presenter highlights Milei's proposed tax reforms, including a 90% reduction in national taxes, and his commitment to creating a competitive fiscal environment that could attract investments.

How does the presenter view the relationship between Bitcoin adoption and political decisions in Argentina?

-The presenter suggests that Milei's support for Bitcoin and his libertarian approach to governance could lead to significant changes in Argentina's economy. They speculate that Argentina could eventually adopt Bitcoin as an official currency, following in the footsteps of El Salvador, which could have a large impact on the global cryptocurrency market.

Outlines

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードMindmap

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードKeywords

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードHighlights

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードTranscripts

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレード関連動画をさらに表示

ACHTUNG BITCOIN & ALTCOIN HALTER: RIESEN KATALYSATOR IN 48 STUNDEN!

THIS WEEK IS HUGE FOR CRYPTO

⚠️ RECORD de VENTAS en BITCOIN pero AGUANTA los 56K | Noticias y Actualidad Criptomonedas y Economia

DAS ÄNDERT ALLES FÜR BITCOIN, XRP, ETH, SOL, HBAR & DEN GESAMTEN KRYPTOMARKT [RIESEN NEWS…]

Creptos explodiram! Rompemos topo Historico! BTC Para onde vai!!???

Bitcoin: TRUMP plant etwas GEWALTIGES!🤯

5.0 / 5 (0 votes)