Basic Financial Statements

Summary

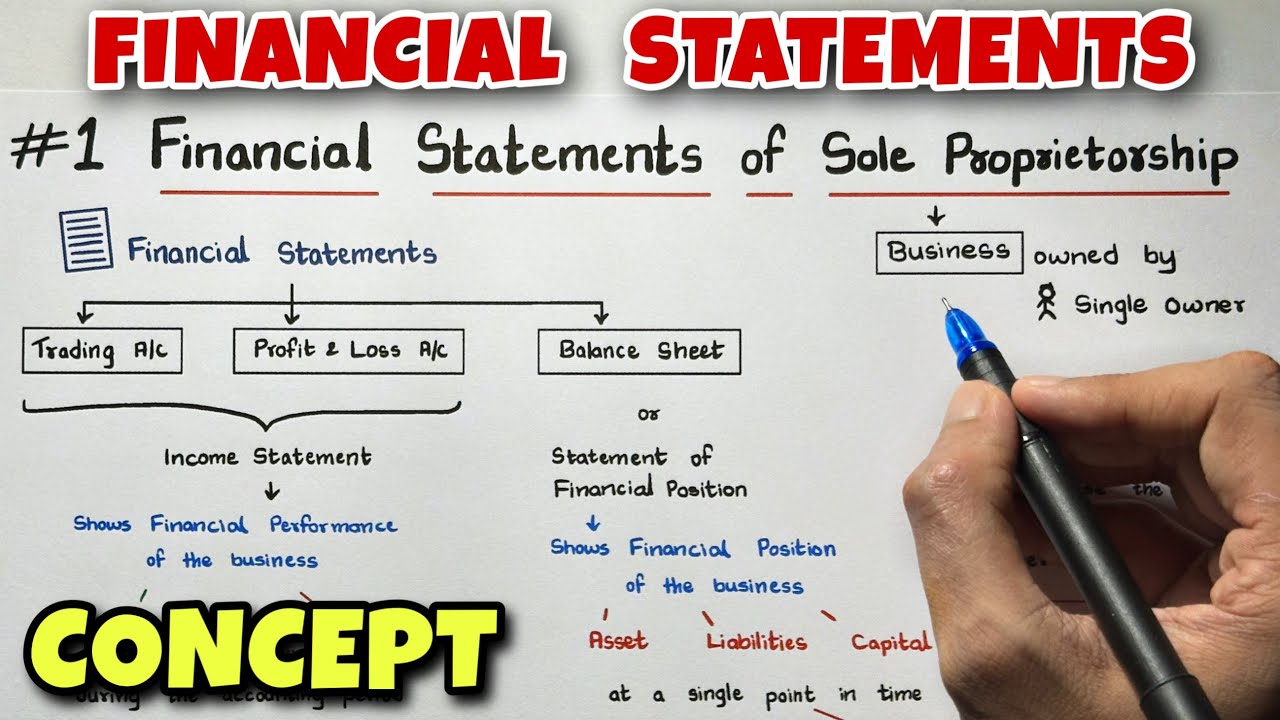

TLDRIn this tutorial, Brandy introduces the basics of financial statements for a sole proprietor business. She explains the process of creating three key statements: the income statement, the statement of owner's equity, and the balance sheet. Using an example of 'Sarah's Bookkeeping,' Brandy demonstrates how to record revenues, expenses, and calculate net income. She then guides viewers through the statement of owner's equity, showing how to track changes in capital, and concludes with preparing a balance sheet, ensuring the accounting equation is balanced. The video is a foundational step for beginners learning financial accounting.

Takeaways

- 😀 Financial statements are key in financial accounting, and there are four main types: income statement, statement of owner's equity, balance sheet, and cash flow statement.

- 😀 In this tutorial, the focus is on the first three financial statements: income statement, statement of owner's equity, and balance sheet.

- 😀 The process of creating financial statements always begins with the income statement, followed by the statement of owner's equity, and then the balance sheet.

- 😀 The income statement shows revenues and expenses, and the result is net income, which is crucial for the next financial statement.

- 😀 Revenues on the income statement include money earned through services or sales, while expenses are the costs incurred to run the business.

- 😀 For Sarah's bookkeeping, the income statement example shows $10,000 in service revenue and $3,000 in expenses, resulting in a net income of $7,000.

- 😀 The statement of owner's equity shows the opening balance, any investments by the owner, net income or loss, withdrawals by the owner, and the closing balance of the capital account.

- 😀 The closing capital balance from the statement of owner's equity is used on the balance sheet, making it an important figure to track.

- 😀 The balance sheet is divided into three categories: assets, liabilities, and owner's equity, with assets always equal to the sum of liabilities and owner's equity.

- 😀 On the balance sheet, assets represent future benefits (like cash and equipment), liabilities show debts owed to outsiders, and owner's equity reflects the capital invested by the owner.

- 😀 The balance sheet ensures that the accounting equation (Assets = Liabilities + Owner's Equity) balances, confirming the accuracy of financial reporting.

Q & A

What are the four main financial statements in financial accounting?

-The four main financial statements are the income statement, the statement of owner's equity, the balance sheet, and the cash flow statement.

Which financial statements are covered in this tutorial?

-In this tutorial, the focus is on the income statement, the statement of owner's equity, and the balance sheet.

In what order are the financial statements typically prepared?

-The income statement is prepared first, followed by the statement of owner's equity, and finally, the balance sheet.

What is the primary purpose of the income statement?

-The income statement shows a company's revenues and expenses over a period of time and calculates the net income, which is a measure of profitability.

What type of revenue is shown in the income statement for Sarah's Bookkeeping?

-For Sarah's Bookkeeping, the revenue shown is service revenue, which amounts to $10,000.

How do expenses affect the income statement?

-Expenses are subtracted from revenues to calculate the net income. In this case, Sarah's Bookkeeping has $3,000 in expenses, which reduces the net income.

What is the key calculation in the income statement?

-The key calculation in the income statement is subtracting expenses from revenues to determine net income. In the example, the net income is $7,000.

What is the purpose of the statement of owner's equity?

-The statement of owner's equity tracks the changes in the owner’s equity over a period of time, including the opening balance, investments by the owner, net income, and withdrawals.

What components are included in the statement of owner's equity?

-The components of the statement of owner's equity are the opening balance, investment by the owner, net income or loss, withdrawals by the owner, and the closing balance of the capital account.

Why is the closing balance of the owner's equity important?

-The closing balance of the owner's equity is important because it is carried forward to the balance sheet, reflecting the owner's stake in the company at the end of the period.

What is the accounting equation shown in the balance sheet?

-The accounting equation shown in the balance sheet is Assets = Liabilities + Owner’s Equity.

How does the balance sheet differ from the income statement in terms of time period?

-The balance sheet is a snapshot of a company’s financial position at a specific point in time, while the income statement covers a period of time, showing revenues and expenses over that duration.

What does it mean if the balance sheet balances?

-If the balance sheet balances, it means that the total assets are equal to the sum of liabilities and owner’s equity, confirming that the accounting equation is correct.

Outlines

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードMindmap

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードKeywords

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードHighlights

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードTranscripts

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレード5.0 / 5 (0 votes)