CONTABILIDADE PÚBLICA PARA CONCURSOS - AULA 02 - PARTE 01/03 - NOÇÕES DE PCASP

Summary

TLDRIn this video, Professor Jaime Soares Júnior introduces a course on public sector accounting, specifically focusing on the Public Sector Accounting Plan (PCAP). The lesson outlines the importance of standardized accounting practices across federal, state, and municipal governments in Brazil. It emphasizes how this uniformity facilitates the generation of accurate reports and financial statements, enhancing transparency and control over public finances. The professor highlights the plan's objectives, including supporting efficient decision-making, ensuring fiscal accountability, and contributing to the consolidation of public accounts. Throughout, the video connects theoretical knowledge to practical applications in public administration and accounting.

Takeaways

- 😀 The Public Sector Chart of Accounts (P.C.A.P.S.) standardizes accounting practices across all levels of government in Brazil, ensuring consistency and comparability in financial data.

- 😀 P.C.A.P.S. is designed to ensure transparency in public administration, enabling more accurate financial reporting and improved accountability.

- 😀 The main objective of P.C.A.P.S. is to systematize public sector accounting, facilitating the generation of uniform reports and financial statements.

- 😀 P.C.A.P.S. uses standardized classifications and codes for various types of public sector expenditures, such as fuel for healthcare-related services, ensuring consistency across municipalities, states, and the federal government.

- 😀 The implementation of P.C.A.P.S. enables the creation of national-level reports, such as the General Balance Sheet of the Union (Balanço Geral da União), to support fiscal transparency and responsibility.

- 😀 The system includes over 8,000 accounts, although not all are used by every governmental entity, ensuring flexibility while maintaining a standardized framework.

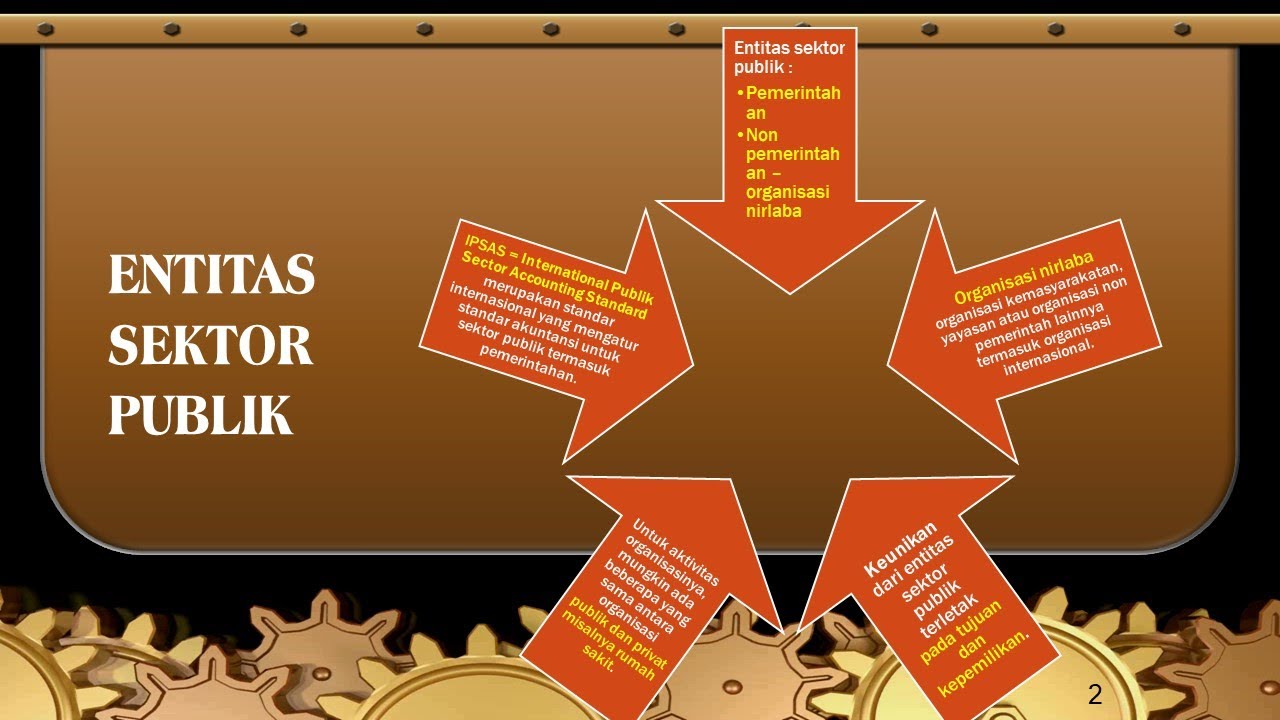

- 😀 The P.C.A.P.S. aligns with international accounting standards, such as the IPSAS (International Public Sector Accounting Standards), helping Brazil meet global financial reporting expectations.

- 😀 The standardized accounting system simplifies the preparation of financial reports by making it easier to compare data across different levels of government and public entities.

- 😀 P.C.A.P.S. ensures that the classification of public sector accounts distinguishes between patrimonial, budgetary, and control aspects, which are key to managing government finances accurately.

- 😀 The use of P.C.A.P.S. is mandatory for all direct and indirect public administration entities, with exceptions for independent state-owned companies, which apply the system voluntarily.

Q & A

What is the Plano de Contas Aplicado ao Setor Público (PCASP)?

-The PCASP is the public sector chart of accounts used in Brazil, providing a standardized framework for public entities at the federal, state, and municipal levels to record and report financial transactions. It aims to ensure uniformity and transparency in public sector accounting.

Why is standardization important in the PCASP?

-Standardization ensures that public entities across Brazil use a uniform system to classify financial transactions, enabling consistency in financial reporting. This allows for more accurate and reliable financial data collection, which supports transparency and better decision-making.

How does PCASP contribute to the transparency of public sector finances?

-PCASP enhances transparency by ensuring that all public entities use the same classification system for financial records. This makes it easier to consolidate financial data across different levels of government and provides clear reports for public scrutiny and oversight.

What is the primary objective of the PCASP?

-The primary objective of PCASP is to provide a standardized and systematized framework for recording public sector financial transactions, which facilitates the preparation of accurate and consistent financial reports and statements across all government entities.

How does the PCASP align with international public sector accounting standards?

-The PCASP aligns with international standards, such as the IPSAS (International Public Sector Accounting Standards), ensuring that Brazil's public sector accounting practices are in harmony with global best practices. This alignment facilitates cross-country comparisons and supports international financial transparency.

What types of entities are required to use the PCASP?

-The PCASP must be used by all public entities within Brazil, including the federal, state, and municipal governments, as well as their funds, autarchies, foundations, and dependent state-owned enterprises. The usage is mandatory, except for independent state-owned companies.

What is the role of the Ministry of Finance (Tesouro Nacional) in relation to the PCASP?

-The Tesouro Nacional is responsible for maintaining the official PCASP guidelines, providing access to the updated chart of accounts, and ensuring the proper implementation of the standards. The Ministry publishes the PCASP and related documents on its website for public consultation.

What are some specific objectives of the PCASP beyond standardization?

-Beyond standardization, the PCASP aims to contribute to better financial decision-making, improve the rationalization of public sector costs, ensure adequate fiscal management, enhance public financial reporting, and facilitate the development of consolidated financial statements for the national government.

What is the difference between the general and extended versions of the PCASP?

-The general version of the PCASP has up to five levels of classification, while the extended version includes up to seven levels. The extended version offers more detailed categorization of accounts to accommodate the specific needs of different public sector entities.

How does the PCASP support public sector accountability?

-By providing a structured and uniform accounting framework, the PCASP helps ensure that public funds are managed transparently and responsibly. This system allows for detailed financial tracking, which supports accountability, oversight, and the proper use of taxpayer money.

Outlines

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードMindmap

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードKeywords

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードHighlights

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードTranscripts

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレード関連動画をさらに表示

CONTABILIDADE PÚBLICA PARA CONCURSOS - AULA 02 - PARTE 02/03 - NOÇÕES DE PCASP

D-III AKUNTANSI_SEKTOR PUBLIK Pertemuan 1(Konsep Dasar Dan Karakteristik Lingkungan Sektor Publik)

[MEET 10-1] AKUNTANSI SEKTOR PUBLIK - AKUNTANSI ASET & KEWAJIBAN

RESUMÃO CONTABILIDADE PÚBLICA: TUDO O QUE VOCÊ PRECISA SABER

PENGANTAR AKUNTANSI SEKTOR PUBLIK

KELOMPOK 4_KARAKTERISTIK DAN TUJUAN SEKTOR PUBLIK_UTS AKUNTANSI SEKTOR PUBLIK

5.0 / 5 (0 votes)