Cuma 3 Langkah Menentukan Support dan Resistance (Strategi Price Action)

Summary

TLDRThis video explains the correct way to identify and draw support and resistance areas for trading. It covers four key criteria: swing highs and lows, multiple price rejections, sharp reversals, and the most recent price levels. The video emphasizes the importance of cleaning the chart before placing lines and suggests merging lines into areas for better clarity. Additionally, it provides insights on using indicators like 'Abah Invest' and applying multi-time frame analysis. The video also discusses three trading strategies: Breakout, Breakout with Retest, and Bouncing, to enhance accuracy and profitability in trading.

Takeaways

- 📈 Correctly identifying support and resistance is crucial for improving trading success.

- 🎯 Support and resistance can be identified through four key criteria: swing highs/lows, multiple bounces, sharp reversals, and proximity to current price.

- 💡 Swing highs and swing lows represent recent peaks and valleys in the market and can be used to determine resistance and support areas.

- ↔️ Areas with multiple price bounces, whether in support or resistance, strengthen the significance of the level.

- 📉 Sharp reversals indicate strong changes in market direction and can be used to mark critical support and resistance levels.

- ⏳ Focus on new and nearby levels of support and resistance for more accurate trading decisions.

- 🔧 Clean your chart from indicators and use candle bodies to draw support and resistance lines based on the discussed criteria.

- 📊 For added precision, connect nearby levels to create clear support and resistance areas instead of single lines.

- 🛠️ Use tools like indicators (e.g., Abah Invest) to quickly identify support and resistance levels and adjust settings for greater detail or multiple time frames.

- 💼 Three main trading strategies using support and resistance are breakout, breakout with retest, and bouncing, with each requiring careful attention to price action and candlestick patterns.

Q & A

What are the four criteria for identifying valid support and resistance (SNR) areas?

-The four criteria for identifying valid SNR areas are: 1) High and low (swing high and swing low), 2) Multiple bounces (prices bouncing off the same area), 3) Sharp reversals (drastic changes in price direction), and 4) New areas (focusing on the nearest recent price levels).

How do you identify swing highs and swing lows for SNR?

-Swing highs are identified when the price rises and then falls after reaching a peak, forming a resistance area. Swing lows occur when the price falls and then rises after hitting a low point, forming a support area.

What is the importance of 'multiple bounces' in determining SNR levels?

-Multiple bounces are important because they indicate strong SNR areas where the price has repeatedly reacted, either as support or resistance. This shows that the level holds significance in the market.

How does 'drastic reversal' help in determining SNR levels?

-A drastic reversal occurs when the price sharply changes direction. Such areas often represent strong SNR zones where there was a decisive battle between buyers and sellers.

What is meant by focusing on 'new' areas when drawing SNR levels?

-Focusing on 'new' areas means prioritizing the most recent price levels that meet the SNR criteria, especially those closest to the current price, to ensure that the analysis is relevant to current market conditions.

What are the steps for drawing SNR areas manually on a chart?

-The steps are: 1) Clean your chart of all indicators to avoid confusion, 2) Place lines at the body of the candles that meet the SNR criteria (e.g., swing highs, multiple bounces, etc.), 3) Connect these lines to form areas for clarity, 4) Focus on relevant levels near the current price to avoid over-complicating the analysis.

How can you ensure clarity when multiple SNR levels are close together?

-To ensure clarity, draw lines on the candle bodies near the same level and then connect them to form a single SNR area. This way, overlapping levels can be simplified into a unified zone.

What is the 'Abah Invest' indicator, and how can it help in drawing SNR areas?

-The 'Abah Invest' indicator is a tool available on TradingView that helps identify support and resistance areas automatically. Traders can input parameters like pivot levels and multi-timeframe options to customize the detail of the SNR areas shown on their chart.

What are the three types of trading strategies using SNR areas?

-The three types of trading strategies using SNR areas are: 1) Breakout, where you enter a trade after the price breaks through an SNR area, 2) Breakout plus retest, where you wait for the price to break through and then retest the SNR area, and 3) Bouncing, where you enter a trade when the price bounces off the SNR area.

How can you improve your risk-to-reward ratio when trading using SNR levels?

-You can improve your risk-to-reward ratio by using multi-timeframe analysis. First, identify SNR levels on a higher timeframe, then switch to a lower timeframe to refine entry points. This allows for smaller stop losses and greater potential for profit as the trade aligns with larger market trends.

Outlines

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードMindmap

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードKeywords

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードHighlights

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードTranscripts

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレード関連動画をさらに表示

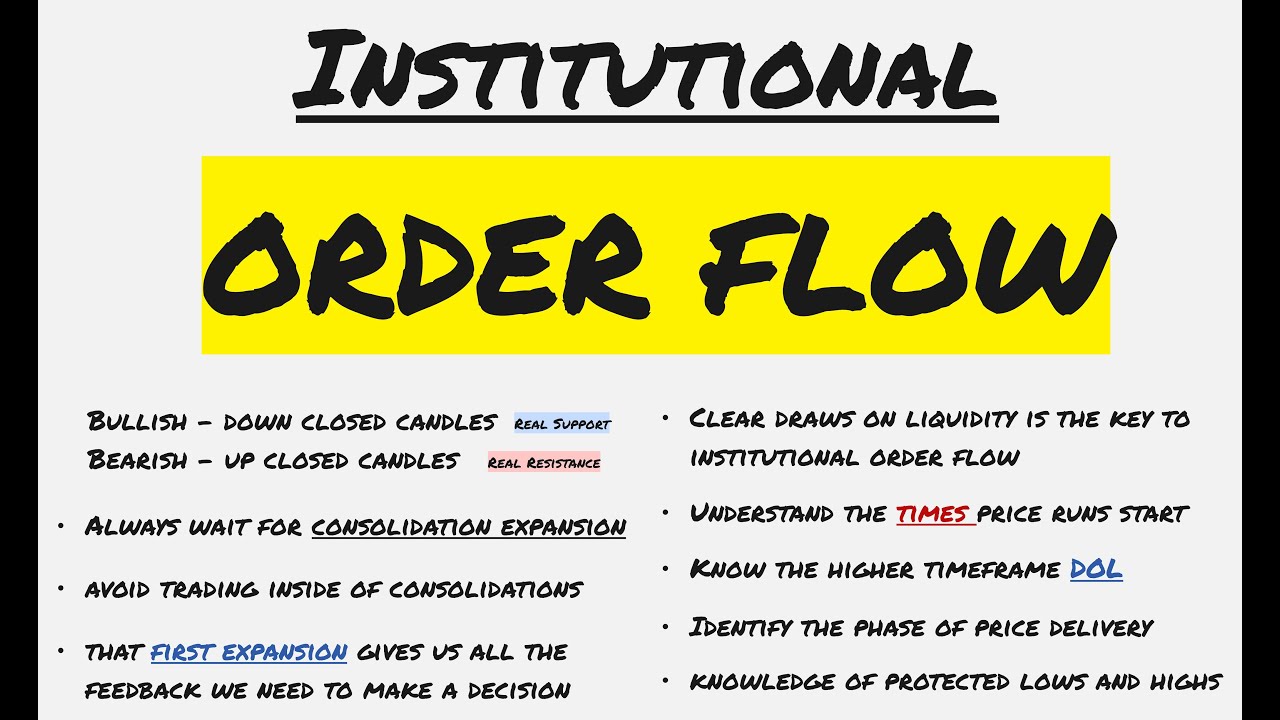

Real ICT Institutional Order Flow Explained

MALAYSIAN SNR FULL STRATEGY NO BS 2024

Cara Menentukan Support Resistance Part 1 | Kelas Trading Si Koko Saham Hari Ke-8

You Are Using Discount and Premium Wrong! - EQ For Expansions

🔥 "TERLARANG?! Indikator Gratis Ini Bisa Bikin Profit RATUSAN PIPS! 😱🔥"

My Secret To Having A Strong Bias - Inverse FVG's

5.0 / 5 (0 votes)