The Perfect 0% Tax Structure for Online Businesses

Summary

TLDRThe Wealthy Expat discusses strategies for legally lowering taxes on online business income, focusing on the use of payment processors like Stripe and PayPal. The video outlines a two-entity structure involving a UAE company and a US LLC to facilitate payments and minimize tax liabilities. It details the process of setting up an LLC, obtaining a bank account with Mercury, and transferring funds to a UAE company, all while addressing client concerns about making payments to foreign entities. The presenter also emphasizes the importance of using professional services to establish this tax-efficient structure.

Takeaways

- 💼 The video discusses strategies for legally lowering taxes, particularly for those with online businesses.

- 🌐 It addresses the challenge of clients' reluctance to pay to accounts in certain jurisdictions, like the UAE, due to perceived risks or stigma.

- 🏢 The speaker proposes a two-entity structure involving a UAE company and an intermediary company elsewhere to manage payments and taxes.

- 📑 The UAE company can be a free zone company, which allows for zero percent tax on profits.

- 🇺🇸 For U.S. citizens not residing in the U.S., an LLC in the U.S. can act as an intermediary, facilitating payments to the UAE company.

- 💻 Online businesses can use payment processors like Stripe and PayPal to receive payments, which are then transferred to the U.S. LLC and subsequently to the UAE company.

- 🏦 The video mentions Mercury as a bank option for opening accounts for U.S. LLCs, even for non-residents.

- 📈 The speaker shares personal experience, showing documents and transactions that demonstrate the effectiveness of this structure.

- 🔒 It emphasizes the importance of using professional services to set up this structure correctly to avoid legal and tax complications.

- ⚠️ A cautionary note is given regarding the choice of service providers, as not all are equipped to handle the complexities of setting up such an international business structure.

Q & A

What is the primary focus of the Wealthy Expat channel?

-The primary focus of the Wealthy Expat channel is to discuss legal ways to lower taxes, thereby allowing individuals to keep more of their wealth and money.

How does the speaker suggest reducing capital gains taxes for online business owners?

-The speaker suggests establishing a company in a tax-friendly location like Dubai, UAE, to reduce capital gains taxes to zero percent.

What is the concern some clients have when paying to a UAE bank account?

-Some clients are concerned that paying to a UAE bank account might indicate the business owner is engaging in shady activities, due to stigma and prejudice associated with certain jurisdictions.

What is the recommended structure for a business owner to legally pay zero percent tax?

-The recommended structure involves having two entities: a UAE company and a company in another country to handle payment processors. The second company sends money to the UAE company, which pays zero percent tax.

Why does the speaker recommend setting up a US LLC for non-US citizens?

-The speaker recommends a US LLC for non-US citizens because it can act as an intermediary between clients and the UAE company, and it can also be owned 100% by the UAE company, facilitating tax-free transfers.

What is the role of an online bank account in this structure?

-An online bank account, such as one from Mercury, is used to receive payments from clients through Stripe or PayPal, and then to send those funds to the UAE company.

Why is it important for the speaker to emphasize the use of professionals when setting up this structure?

-The speaker emphasizes the use of professionals because setting up this structure requires specific knowledge and expertise, which services like LegalZoom may not provide, potentially leading to incorrect setup and legal issues.

What is the significance of the Free Zone Company (FZCO) in the UAE?

-The Free Zone Company (FZCO) in the UAE is significant because it can own a US LLC and receive payments tax-free, making it a crucial part of the tax-reduction strategy.

How does the speaker propose dealing with clients who are uncomfortable paying to a Dubai account?

-The speaker proposes using a US LLC as an intermediary to receive payments from clients, which then transfers the funds to the Dubai company, making the transaction appear more legitimate to the clients.

What is the potential tax implication for US citizens using this structure?

-For US citizens, using this structure might still result in a maximum tax of 10.5% due to the 'guilty tax', unless they follow specific rules and strategies outlined in other videos by the speaker.

Outlines

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードMindmap

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードKeywords

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードHighlights

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードTranscripts

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレード関連動画をさらに表示

How to Start a Blog in 2025 for FREE (Cheapest Setup)

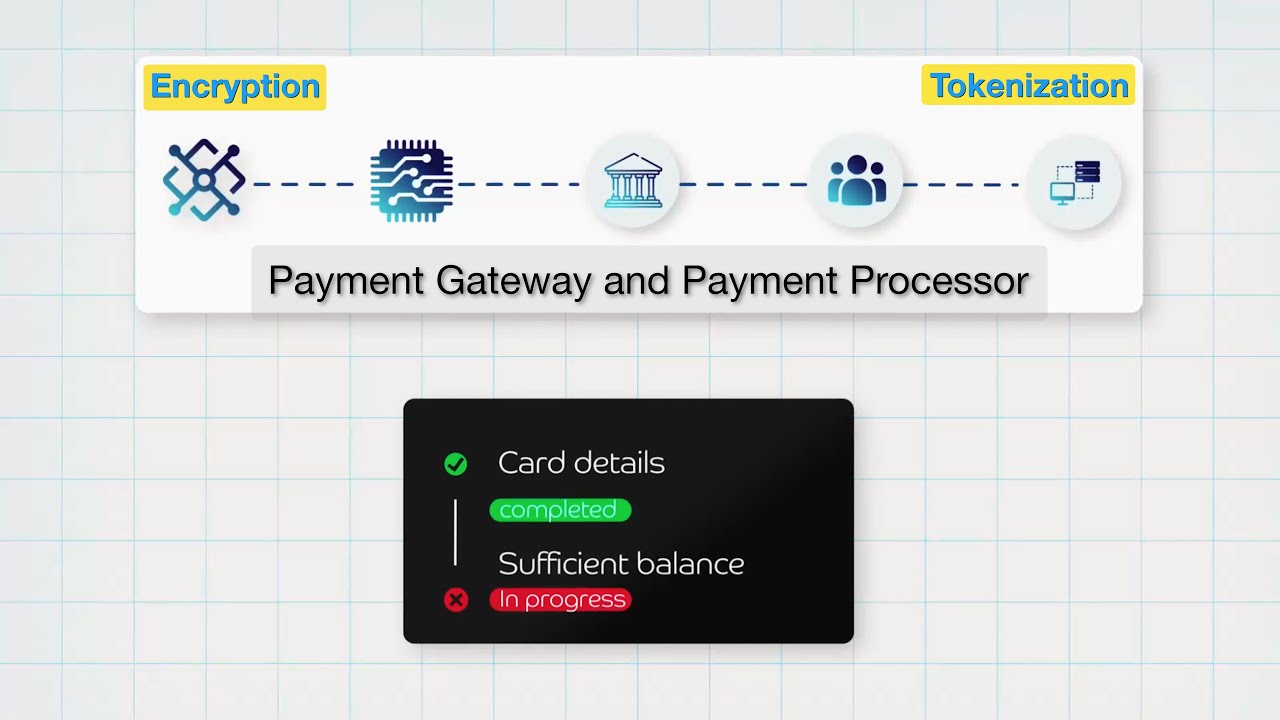

Payment Gateway, Payment Processor and Payment Security Explained

🇬🇧 If I Were a UK Entrepreneur, Here’s EXACTLY What I’d Do 🔥

I read 300 money books to learn these 4 lessons...

The Ultra Rich Playbook [Legal & Tax-Free]

بوابات دفع شغالة من غير وايز او سترايب في الدروبشيبينج!

5.0 / 5 (0 votes)