Impact of demonetization on India’s real estate

Summary

TLDRIn this real estate show, host Narayan discusses the significant impact of India's demonetization on the real estate industry since 2016. He highlights the challenges faced due to the cessation of cash transactions, including the decline in rental yields and the stagnation of the secondary market. The primary market remains largely unaffected, while the luxury housing segment has experienced a sharp decline due to the withdrawal of unaccounted cash. Narayan predicts a slow recovery for the secondary and luxury markets in the coming years.

Takeaways

- 📅 The demonetization in India occurred on November 8, 2016, and had a significant impact on the real estate industry.

- 💡 The real estate sector was heavily reliant on cash transactions, which led to substantial disruptions post-demonetization.

- 💸 It was expected that the elimination of unaccounted cash would bring transparency to the real estate market, but this did not materialize as anticipated.

- 🏗 The cessation of cash transactions affected the flow of funds to laborers, suppliers, and other stakeholders in the industry.

- 🏠 The hope was that property prices would decrease as cash was redeposited into banks, leading to lower interest rates on home loans, but this did not happen.

- 📉 The rental yield in India has been negatively impacted, with India having one of the lowest rental yields compared to other countries.

- 🏘️ The primary market, involving new projects and ready-to-move-in houses, was less affected by demonetization as it relies more on bank loans and legal financial instruments.

- 📉 The secondary market, involving resale of properties, was severely impacted due to the prevalence of cash transactions, leading to a drop in prices and a halt in transactions.

- 🏡 The luxury housing segment, which caters to a significant portion of the market, especially in large metros, experienced a sharp decline in rates due to the drying up of unaccounted cash.

- 🔮 The speaker predicts that the secondary market may not see improvement for another two to three years.

- 📢 The video encourages viewers to engage by liking, sharing, and commenting on the content, and to follow the channel for updates.

Q & A

What was the main topic of the real estate show with architect Narayan?

-The main topic was the impact of demonetization on the real estate industry, particularly in India, since its implementation on November 8, 2016.

Which sector had the largest number of cash transactions prior to demonetization?

-The real estate sector had the largest number of cash transactions before demonetization.

What was the initial expectation regarding the elimination of unaccounted cash in the real estate sector?

-The initial expectation was that the elimination of unaccounted cash would bring transparency and a positive change to the real estate sector.

How did the sudden stop of cash transactions affect the real estate industry?

-The sudden stop of cash transactions led to significant problems in the industry, as it was accustomed to a lot of unaccounted cash transactions that were no longer possible.

What was the anticipated effect of cash redepositing into banks on the home loan sector?

-It was anticipated that the influx of redeposited cash into banks would lead to a reduction in interest rates for secured home loans, but this did not happen.

What has been the current state of home loan interest rates since demonetization?

-Home loan interest rates have remained high, typically between 8% to 10%, without significant reduction due to the lack of cash inflow into the banks.

How has demonetization impacted the rental yield in the real estate market?

-Demonetization has led to a decrease in property prices and rental values, resulting in a low rental yield, which is currently the lowest compared to other countries.

What is the difference in rental yield between India and other Eastern countries?

-India has the lowest rental yield, typically between 1.5% to 2%, compared to other Eastern countries.

How did demonetization affect the primary market in real estate?

-The primary market, which involves ready-to-move-in houses and new projects, was not significantly affected by demonetization as it primarily relies on banking and legal financial aids rather than cash transactions.

What has been the impact of demonetization on the secondary market for real estate?

-The secondary market, which involves resale of properties, has been hugely affected by demonetization due to the drying up of cash transactions, leading to a drop in prices and a stagnation in the market.

How did the luxury housing segment fare after demonetization?

-The luxury housing segment, catering to a significant portion of the overall housing market, was heavily impacted by demonetization, with a sharp decline in rates due to the curbing of unaccounted cash transactions.

Outlines

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantMindmap

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantKeywords

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantHighlights

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantTranscripts

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantVoir Plus de Vidéos Connexes

Tech-Savvy Entrepreneur : Narayan Ner's Journey | Realty Business Show

Proptech: The Future of Real Estate or a Crash Waiting to Happen?

How Much Gold & Silver You'll Need To Buy A House In The Crash - Important 2025 Update!

Real Estate Expert: ''Bitcoin Will BREAK The $300T Property Market.''

The Demographics of Real Estate Investments

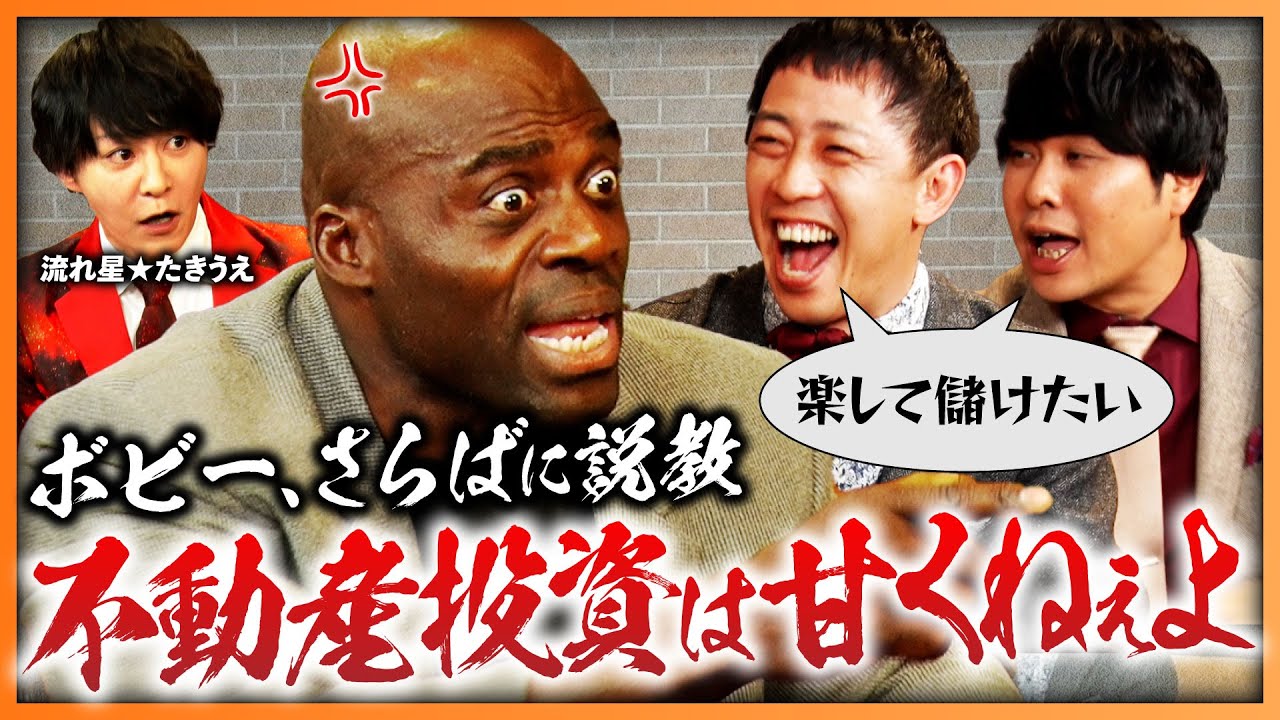

【放送事故】金儲けしか考えていない森田・東ブクロに、ボビーがブチ切れて…《さらば青春の光 不動産王への道#6》

5.0 / 5 (0 votes)