Foreign call centre raided over alleged links to scam tricking Australians out of super | 7.30

Summary

TLDRAustralian cybercrime investigator Ken Gamble travels to the Philippines to expose a call center involved in an elaborate scam targeting Australians with bogus investments. The operation, disguised as legitimate financial advice, has defrauded many, including Rob Wade, who lost a significant portion of his retirement savings. Gamble's team conducts surveillance and a raid, uncovering evidence of the scam and implicating key players. Victims like Anna Longford, who had her superannuation funds fraudulently rolled out, struggle to recover their stolen money, raising questions about the responsibility of financial institutions in such scams.

Takeaways

- 🕵️♂️ Australian cyber crime investigator Ken Gamble is in the Philippines to uncover a call center linked to a scam targeting Australians.

- 🇵🇭 The call center is located in Metro Manila, Philippines, and is suspected of scamming Australians with bogus investments.

- 📞 The scam begins with a phone call from the call center, claiming to be from Australia and conducting surveys to gauge interest in investments.

- 🎓 The scammers have detailed knowledge of self-managed super funds and use this to appear legitimate to potential victims.

- 🤑 Victims like Rob Wade and Aldi's lost significant amounts of retirement savings to the scam, with some transferring hundreds of thousands of dollars.

- 📞 Victims were contacted by another group posing as financial planners after the initial call, furthering the scam.

- 📊 The scammers used a fraudulent company, Australian Securities Administration Limited (Asal), to promote a Morgan Stanley product without authorization.

- 🏢 The scammers created a professional-looking website and provided an app to make the scam appear more credible.

- 🚨 The scam was eventually discovered, with victims like Anna Longford managing to get their money back after fraud was detected.

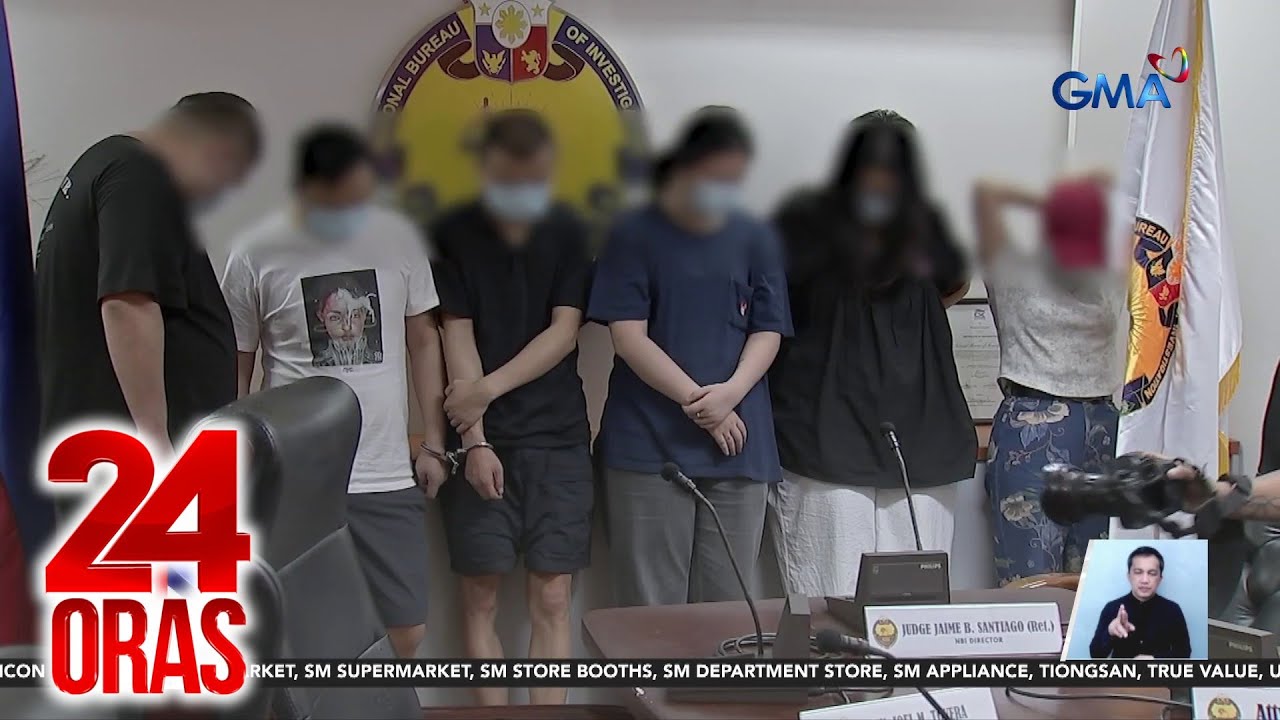

- 👮♂️ A raid was conducted on the suspected call center, with local police leading the operation and Gamble's team providing support.

- 💻 Evidence was seized during the raid, including computers that contained victim information, potentially implicating the call center in the frauds.

Q & A

What is the purpose of Ken Gamble's visit to the Philippines?

-Ken Gamble, an Australian cyber crime investigator, traveled to the Philippines to uncover a call center he believes is linked to an elaborate scam targeting Australians.

What is the nature of the scam being investigated?

-The scam involves obtaining sensitive information from Australians under the guise of investment surveys, followed by fake financial planners contacting the victims to scam them out of their money through bogus investments.

How do the scammers make their fraudulent activities appear legitimate?

-The scammers use intricate knowledge of self-managed super funds, create websites that closely resemble legitimate businesses, and provide apps to victims that show fake investment activities to make the scam appear credible.

What was Rob Wade's experience with the scam?

-Rob Wade lost a large chunk of his retirement savings after being convinced to invest in a Morgan Stanley product through a self-managed super fund, which turned out to be a scam.

How did the scammers gain the trust of their victims?

-The scammers used a slick pitch, claimed to be from Australian Securities Administration Limited (ASAL), and provided victims with an app that showed fake investment activities to gain their trust.

What was the role of ANZ bank in the scam as mentioned by the victims?

-The victims were instructed to transfer money into an ANZ bank account, which they believed to be Australian. Some victims believe the bank owes them an explanation and compensation.

What action did ANZ bank take after becoming aware of the ASAL scam?

-ANZ bank reported the matter to Victoria Police but has not provided further comment or taken on-camera interviews regarding the scam.

What was the outcome of Anna Longford's complaint about her super fund being fraudulently rolled out?

-After making a complaint, Anna Longford was able to get her money back, as the rollout form was fraudulently signed and stamped by someone else.

What was the result of the raid conducted by Metro Manila Philippines police on the call center?

-The raid resulted in the seizure of computers and the discovery of victims' names and contact details in the database, but no charges have been laid against the British man or 30 others as the investigation continues.

What are the potential consequences for the individuals involved in the scam if charged with cyber fraud?

-If charged with cyber fraud-related offenses, the individuals could face between six to 12 years in prison with a minimum of six years.

What is Rob Wade's hope regarding the outcome of the investigation?

-Rob Wade is desperate to get his money back and hopes that the investigation will lead to charges against the scammers and potentially a refund for the victims.

Outlines

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantMindmap

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantKeywords

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantHighlights

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantTranscripts

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantVoir Plus de Vidéos Connexes

Spying on the Scammers [Part 1/5]

How cyber-crime has become organised warfare | Four Corners

BPNL New Vacancy 2025 | BPNL Recruitment 2025 Syllabus | BPNL Recruitment 2025 fake or real

prepaid task scam telegram| Online job scam| मेरे साथ ऑनलाइन जॉब फ्रॉड कैसे हुआ😮😥(1.35Lakh rupees)

6 Chinese nationals, huling nagsasagawa ng cybercrime activities | 24 Oras

How To Protect Yourself From Online Fraud? | Who Can Digitally Arrest You? | Akash Banerjee & Rishi

5.0 / 5 (0 votes)