What is an IRS 1040 Form? - TurboTax Tax Tip Video

Summary

TLDRThe Form 1040 is the primary document for personal federal income tax returns in the U.S., detailing filing status, personal and tax identification information for individuals and their families. It is structured into sections that calculate income, deductions, and ultimately, the tax owed or refund due. While supplementary forms may be necessary for complete reporting, Form 1040-SR offers a simplified version for seniors over 65 with a larger font and standard deduction table. Formerly available simplified forms like 1040A and 1040EZ are now obsolete. For further tax guidance, TurboTax is recommended.

Takeaways

- 📄 Form 1040 is the primary document for filing personal federal income tax returns in the United States.

- 👤 It requires you to provide your filing status, personal information, and tax identification numbers for yourself, your spouse, and dependents.

- 📈 The form is divided into sections that help you report your income and deductions, which are essential for calculating your tax liability or potential refund.

- 🔍 In certain cases, you might need to file additional forms and schedules alongside Form 1040 to accurately report your income and claim deductions and credits.

- 👵 Form 1040-SR is a variant designed for individuals aged 65 and over, featuring larger font and a standard deduction table.

- 📚 The script mentions that there were once different versions of Form 1040, such as 1040A and 1040EZ, but these are no longer in use.

- 💡 The script suggests visiting turbotax.com for more tax tips and support, indicating a resource for further guidance on tax matters.

- 🏦 Form 1040 is crucial for determining the amount of tax owed to the IRS or the refund you might be eligible for.

- 🔑 Tax identification numbers are a key component in the tax filing process, ensuring accurate identification for tax purposes.

- 📚 The script emphasizes the importance of using the correct form and potentially additional forms for a comprehensive tax filing experience.

Q & A

What is Form 1040 used for?

-Form 1040 is used for personal federal income tax returns, allowing individuals to report their filing status, personal information, and tax identification numbers to the IRS.

What information is included in Form 1040?

-Form 1040 includes sections for reporting income, deductions, and determining the amount of tax owed or refund expected.

Are there any additional forms that might be required along with Form 1040?

-Yes, in some situations, taxpayers may be required to file other forms and schedules in conjunction with Form 1040 to accurately report income and claim deductions and credits.

What is Form 1040-SR and who is it designed for?

-Form 1040-SR is designed for people aged 65 and over. It is similar to Form 1040 but includes a larger font and a standard deduction table for ease of use.

What were the 1040A and 1040EZ, and why are they no longer in use?

-The 1040A and 1040EZ were simplified versions of the 1040 Form for certain taxpayers. They are no longer in use, likely due to the simplification of the main Form 1040 and the introduction of Form 1040-SR.

How does Form 1040 help determine the tax refund or amount owed?

-Form 1040 helps determine the tax refund or amount owed by calculating the difference between the total income and the total deductions and credits claimed.

What is the purpose of the standard deduction table in Form 1040-SR?

-The standard deduction table in Form 1040-SR provides a quick reference for the standard deductions applicable to taxpayers aged 65 and over, simplifying the tax filing process.

What is the significance of the larger font in Form 1040-SR?

-The larger font in Form 1040-SR is designed to make it easier for older taxpayers to read and fill out the form, enhancing accessibility.

Can Form 1040 be filed electronically?

-While the script does not specify, Form 1040 can typically be filed electronically, which is often more convenient and efficient than paper filing.

What resources are available for tax tips and support as mentioned in the script?

-For tax tips and support, the script suggests visiting turbotax.com, which likely offers tools, advice, and assistance for tax filing.

What is the importance of accurately reporting income and deductions on Form 1040?

-Accurately reporting income and deductions on Form 1040 is crucial for determining the correct amount of tax owed or refund due, ensuring compliance with IRS regulations.

Outlines

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantMindmap

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantKeywords

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantHighlights

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantTranscripts

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantVoir Plus de Vidéos Connexes

ITR Filing Online 2024-25 | Income Tax Return ( ITR 1) filing online 2024-25 (FY 2023-24) | Guide

Tutorial Pengisian SPT 1770 S Melalui e-Filing

Mail & Social Media Account Can Accessed by Government | Income Tax का नया नियम लंका लगा देगा!

BIR Form No. 1701 Step-by-Step Filing Guide

The only TAX SYSTEM VIDEO you will ever need. | INDIAN TAX SYSTEM EXPLAINED | Aaditya Iyengar

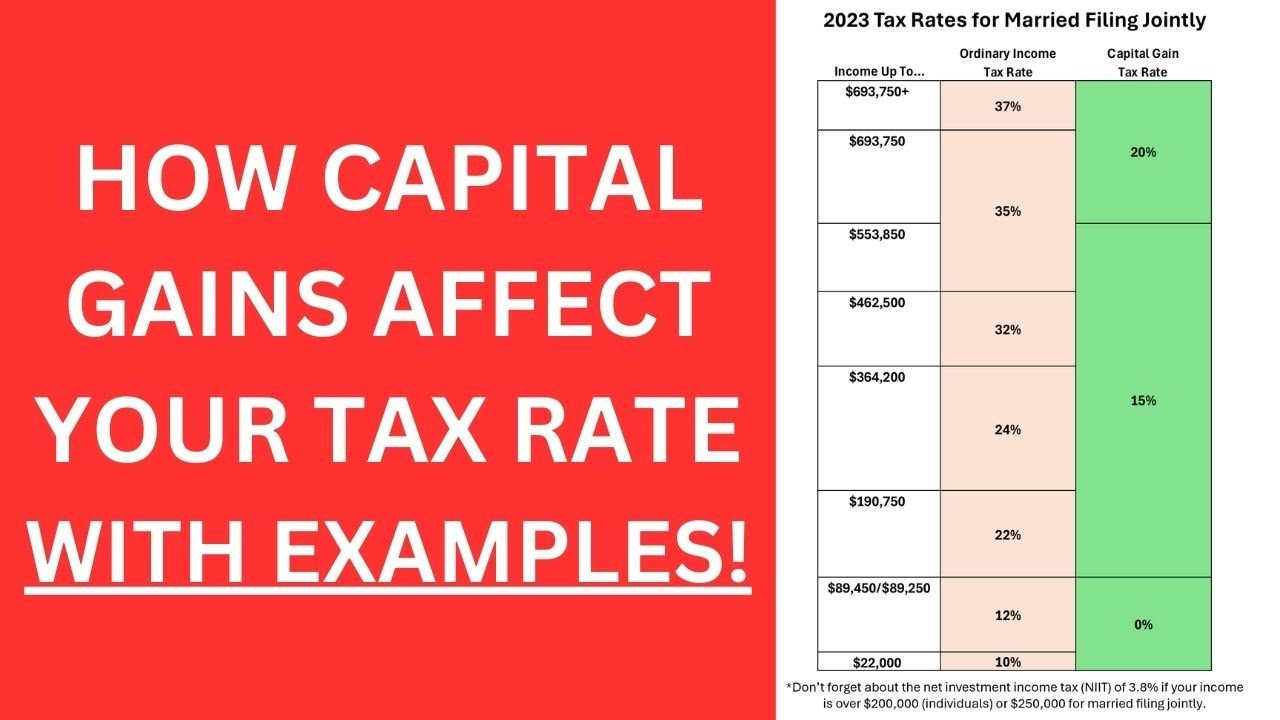

NEW! - Can Capital Gains Push Me Into a Higher Tax Bracket?

5.0 / 5 (0 votes)