Want to be RICH with Salary? | STOP 50:30:20 | Start Kakeibo in 2024 | Financial Freedom| Rahul Jain

Summary

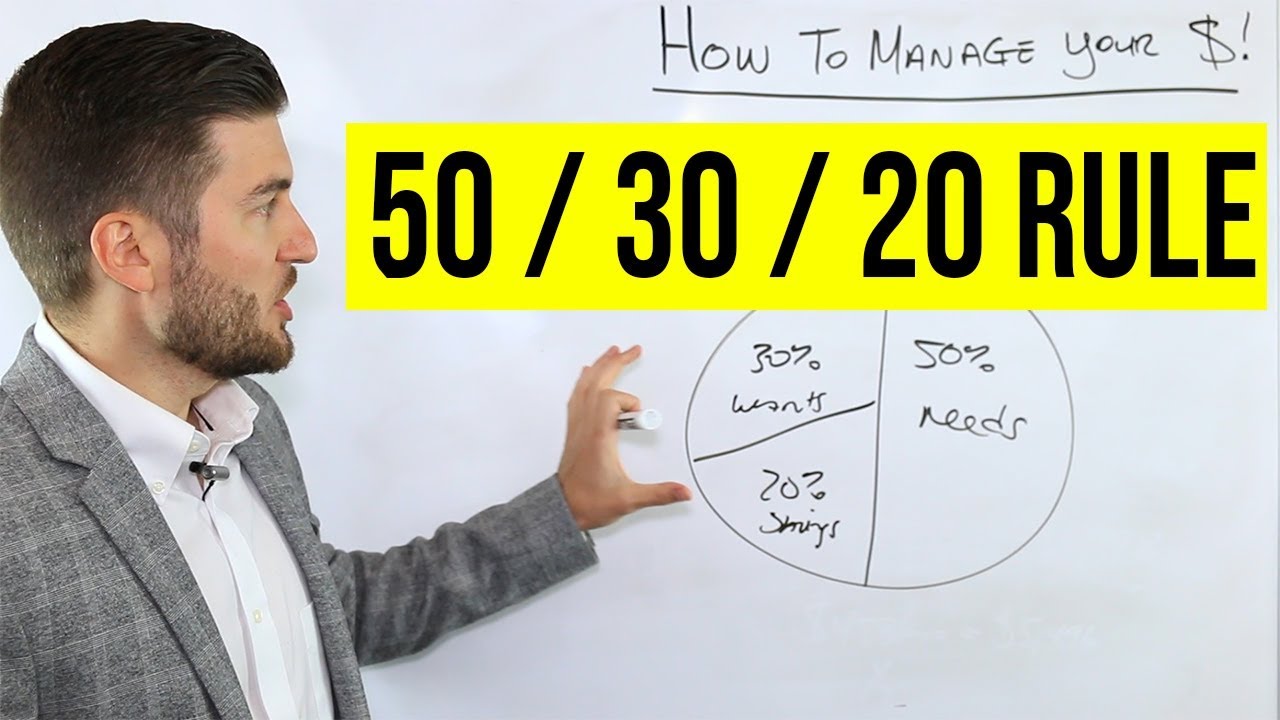

TLDRThe video script critiques the 50/30/20 financial rule, arguing it's unsuitable for Indians due to high education costs. It introduces the Japanese KBO money management technique and the 50/25/25 rule, emphasizing prioritizing expenses and investing wisely for short-term and long-term goals. The speaker also stresses the importance of having health insurance.

Takeaways

- 😀 The 50/30/20 rule, popular in the US, may not be suitable for Indians due to different financial circumstances.

- 🏫 In the US, education from kindergarten to 12th grade is free, allowing Americans to spend more on wants, unlike in India where private education is expensive.

- 💼 The speaker suggests that Indians should not follow the 50/30/20 rule blindly and instead consider their unique financial needs.

- 🇨🇳 The Chinese 10:1 rule, where you spend 10% of your income, is mentioned as a more practical approach for many in India.

- 📚 The Japanese money management technique called 'KBO' is introduced, emphasizing the importance of categorizing expenses into needs, wants, cultural spend, and unexpected spend.

- 💡 The speaker recommends using the KBO method to track and manage expenses, which can help in understanding where money is being spent.

- 💰 A new financial rule of 50/25/25 is proposed, where 50% of after-tax income is spent, 25% is saved for short-term goals, and 25% is invested for long-term goals.

- 🚦 The IT project management concept of RAG (Red, Amber, Green) is introduced to help prioritize spending within the 50% of income allocated for spending.

- 🏦 The speaker advises having an emergency fund before starting any investments and emphasizes the importance of health insurance.

- 🌐 The video concludes with an invitation for viewers to request more information on investment strategies for short-term and long-term goals in a potential follow-up video.

Q & A

What is the 50/30/20 rule mentioned in the video?

-The 50/30/20 rule is a financial guideline proposed by US Senator Elizabeth Warren. It suggests that 50% of your after-tax income should be spent on needs (like housing, food, and insurance), 30% on wants (like hobbies, vacations, and gadgets), and 20% should be saved and invested.

Why might the 50/30/20 rule not be suitable for Indians according to the video?

-The video suggests that the 50/30/20 rule may not be suitable for Indians because it was designed for the US context. In India, education costs are significantly higher, and many families have to spend a large portion of their income on private school fees, which is not accounted for in the rule.

What is the significance of the 10:1 rule in China?

-The 10:1 rule in China is a financial management technique where you spend only 10% of your income. This is more applicable to those with very high incomes, as living on 10% of your income is challenging for most people.

What is the Japanese money management technique called KBO mentioned in the video?

-KBO is a Japanese money management technique where all income is given to the wife, who then categorizes every expense into four broad buckets: needs, wants, cultural spend, and unexpected spend. This helps in tracking and managing expenses effectively.

What are the four main categories of expenses in the KBO method?

-The four main categories of expenses in the KBO method are needs, wants, cultural spend, and unexpected spend.

What is the financial rule of 50/25/25 proposed in the video?

-The financial rule of 50/25/25 suggests that 50% of your after-tax income should be spent on needs, wants, cultural spend, and unexpected expenses. The remaining 50% should be split into 25% for short-term goals and 25% for long-term goals.

What is the RAG method mentioned in the video?

-The RAG method is a project management technique where expenses are categorized as Red (not important), Amber (somewhat important), and Green (very important). This helps in prioritizing spending and managing the budget effectively.

What is the importance of having an emergency fund according to the video?

-Having an emergency fund is crucial as it provides a financial safety net. Without it, any financial plan could be wiped out by a single large expense, such as a hospital bill.

What are short-term goals in the context of the video?

-Short-term goals are those that you aim to achieve within the next five years, such as buying a house, getting married, going on a honeymoon, or taking a holiday abroad.

What are long-term goals in the context of the video?

-Long-term goals are those that extend beyond five years, such as planning for retirement, saving for children's higher education, saving for their weddings, or leaving an inheritance.

Outlines

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantMindmap

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantKeywords

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantHighlights

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantTranscripts

Cette section est réservée aux utilisateurs payants. Améliorez votre compte pour accéder à cette section.

Améliorer maintenantVoir Plus de Vidéos Connexes

7 Steps on How to Create a Budget

Cash Course: What Is A Budget? | Kids Shows

Konsep Keuangan 50/30/20 SALAH TOTAL?!😱

My unfiltered advice to someone who wants financial freedom

How To Manage Your Money (50/30/20 Rule)

QUANTO VOCÊ DEVE INVESTIR TODO MÊS? (Métodos para Dividir seu Salário - Vídeo para quem É POBRE)

5.0 / 5 (0 votes)